Superannuation contribution eligibility

Superannuation contribution eligibility and regulatory ‘caps’ determine the rate at which you can accumulate funds for your retirement. Over time,

Superannuation contribution eligibility and regulatory ‘caps’ determine the rate at which you can accumulate funds for your retirement. Over time,

The superannuation co-contribution that the government makes to the superannuation accounts of eligible contributors attracts a lot of attention and publicity towards

What is superannuation investing? Superannuation investing entails two elements of investment concept. It is important to recognise that superannuation is

Superannuation co-contribution eligibility 2012 The following Table and associated information is provided for use in relation to the period specified

– for whom Superannuation co-contribution benefits your wealth accumulation, but your contribution circumstances need to be ‘eligible’. The government has

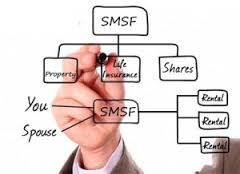

Why are superannuation structures so misunderstood? A question that is frequently asked of investment advisers and financial planners is: ‘Why would you invest

Self managed superannuation funds (SMSFs) are private superannuation funds that are managed and controlled by the members. These funds are sometimes

From time to time employers offer (or are committed to) redundancy payments for unscheduled termination of employment arrangements: there are

Estate Planning and Superannuation Assets are important considerations in Australia, where compulsory superannuation is now held by almost every adult

The value in estate planning for a self-managed super fund trustee is in the certainty it provides in the event

Level 1

2042 Logan Road

Upper Mt Gravatt QLD 4122

07 3421 3456

Paul Ashton & Associates – CPAs

2 Alice Street

Warwick QLD 4370

07 3421 3456