Investment success contributor: taxation

Are negative gearing and capital gains tax discounts sustaining your investment success? An investment success contributor for many ‘ordinary’ Australians,

Are negative gearing and capital gains tax discounts sustaining your investment success? An investment success contributor for many ‘ordinary’ Australians,

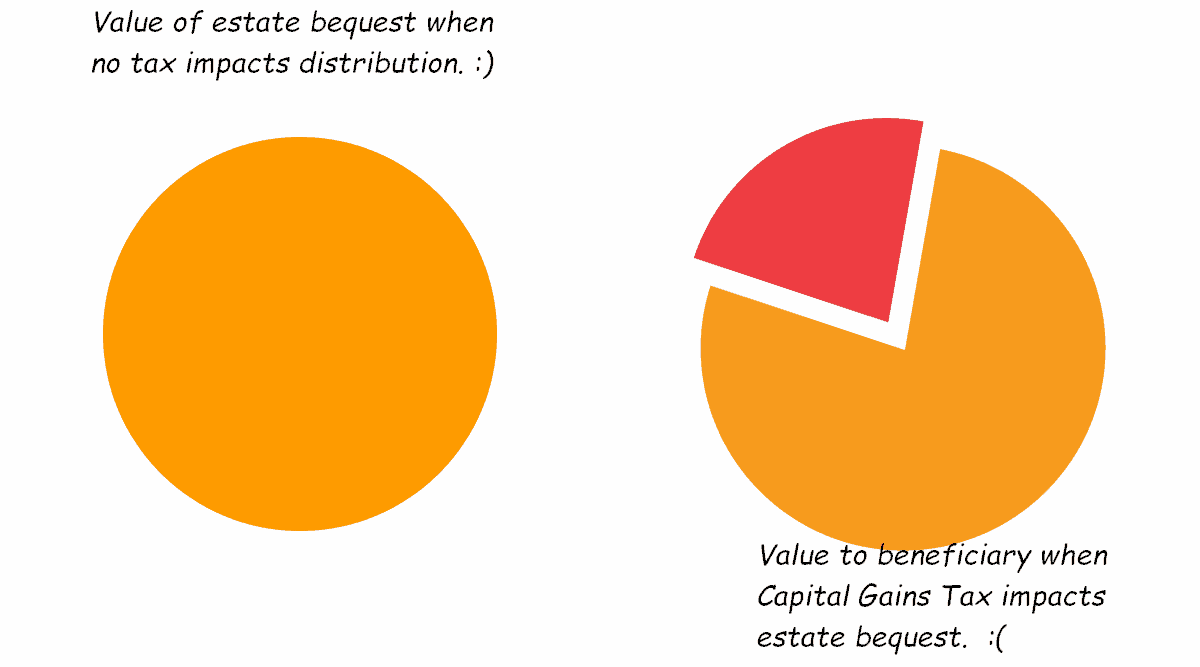

Intergenerational wealth transfer is about to move significant asset values from the accumulators to the next generation. How will they

Why do Australian investors love property so intensely? That Australian investors love property as an asset class is not a

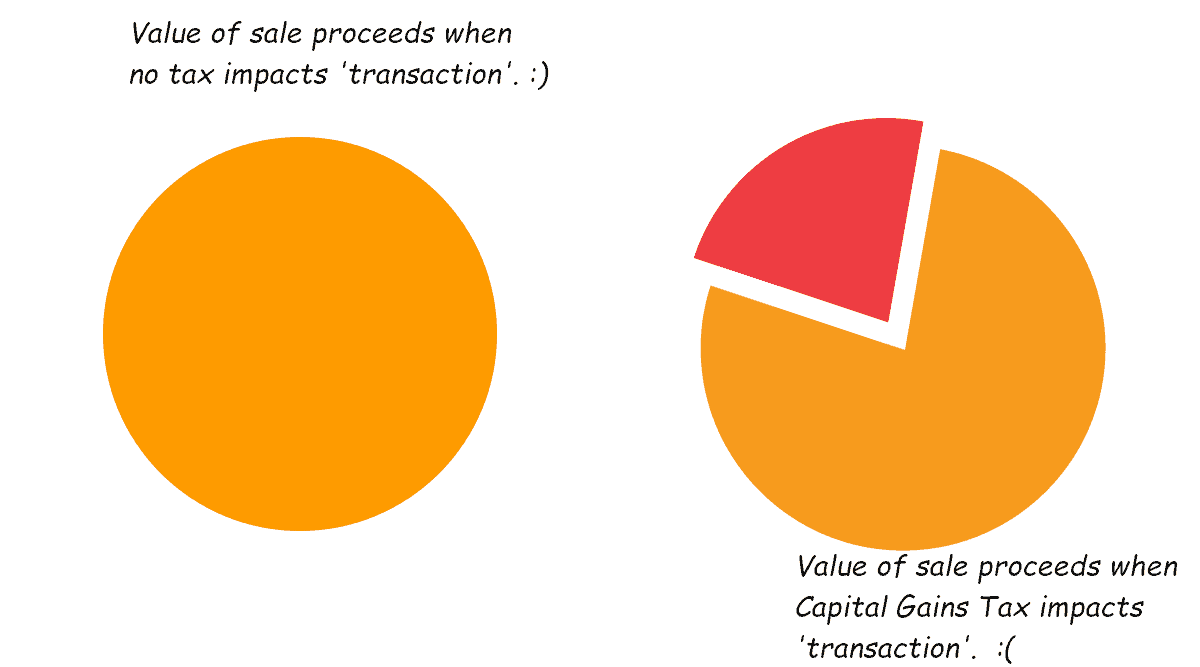

Have you had a Capital Gains Tax (CGT) event during the year? Managing Capital Gains Tax events to minimise the

Estate planning and company-owned assets require particular attention because of the legal implications of each environment (entity). Not all assets

Estate planning and family loans: what could go wrong?! Loans between members of the family, particularly between the testator and

What is the Capital Gains Tax impact on estate bequests? When undertaking your estate planning, be aware that there may

What are Investment Bonds? Investment bonds are financial securities provided in a specific form by life insurance companies and friendly societies. Although

What are listed investments? Listed investments are investments quoted on an exchange established for trading investment-class assets. In Australia, equities

What is negative gearing? Negative gearing occurs when the expenses associated with an investment, including interest on the money borrowed,