Superannuation investment benefits

The retirement savings vehicle that was so proudly introduced by a former Labor government as a compulsory system by which

The retirement savings vehicle that was so proudly introduced by a former Labor government as a compulsory system by which

The Budget Highlights 2013 presented below, were extracted from the 2013 Budget announcements by the Federal Treasurer, as likely to

Superannuation contribution eligibility and regulatory ‘caps’ determine the rate at which you can accumulate funds for your retirement. Over time,

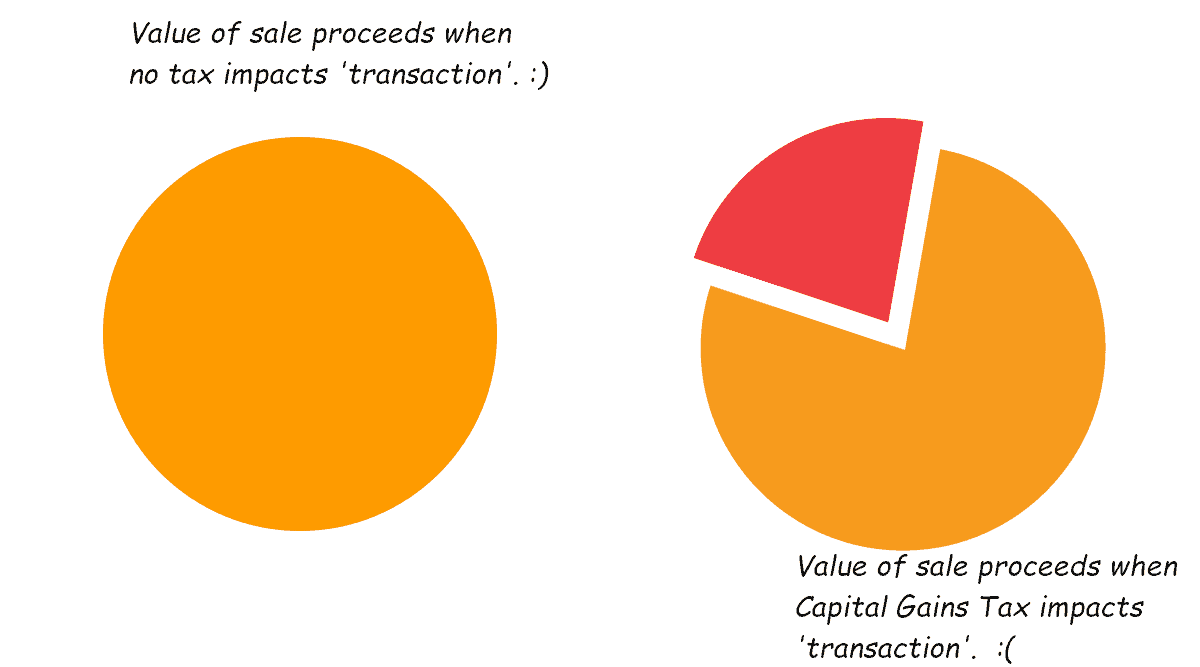

Have you had a Capital Gains Tax (CGT) event during the year? Managing Capital Gains Tax events so as to

What is superannuation investing? Superannuation investing entails two elements of investment concept: firstly, it is important to recognise that superannuation

Financial year end 2012 readiness (indeed any year), will ensure you only pay the tax you are due to pay

Budget Highlights 2011 is almost a misnomer: the content of the Budget this year was ‘highly anticipated’. The Commonwealth Treasurer of the

The strategy of making personal superannuation contributions is being utilised more frequently as people become more aware that the statutory

Dealing with a Capital Gain may not seem too difficult a problem, but reporting the capital gain for taxation and

Paul Ashton & Associates – CPAs

2 Alice Street

Warwick QLD 4370

07 3421 3456