Superannuation Death Benefits reviewed

An increasingly important aspect of wealth management in Australia is the understanding and management of superannuation. The taxation and other

An increasingly important aspect of wealth management in Australia is the understanding and management of superannuation. The taxation and other

It is widely considered that holding certain types of Life Insurance within Superannuation is acceptable practice. For some people, this

Beneficiary nomination clarifies entitlement Nominating beneficiaries provides guidance to trustees charged with the task of paying benefits arising from particular

…benefits of funding Buy-Sell Agreements Business succession funding secures the financial certainty of the parties who are dependant on your

The value in estate planning for a self-managed super fund trustee is in the certainty it provides in the event

Estate planning and company-owned assets require particular attention because of the legal implications of each environment (entity). Not all assets

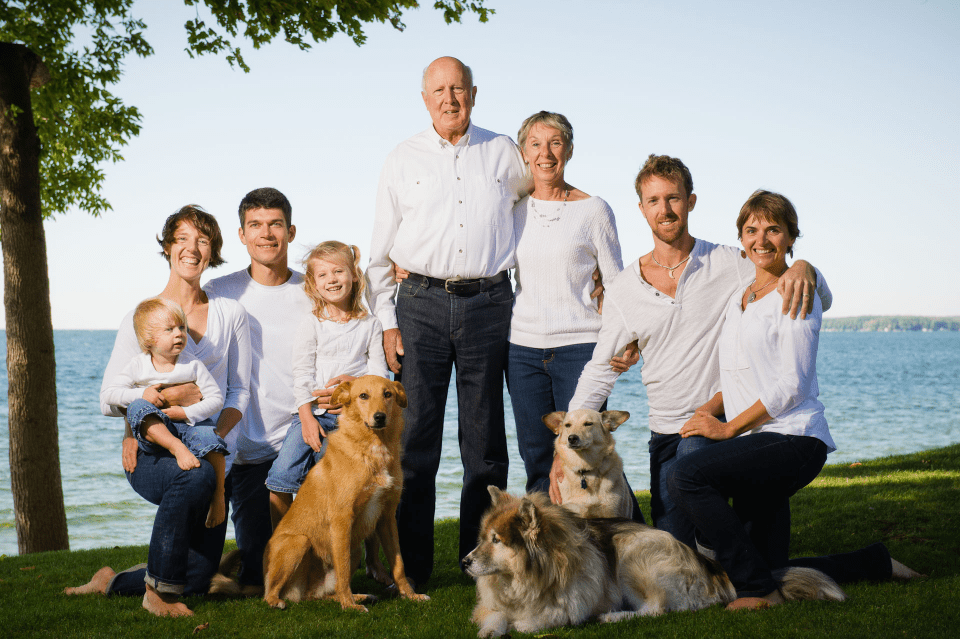

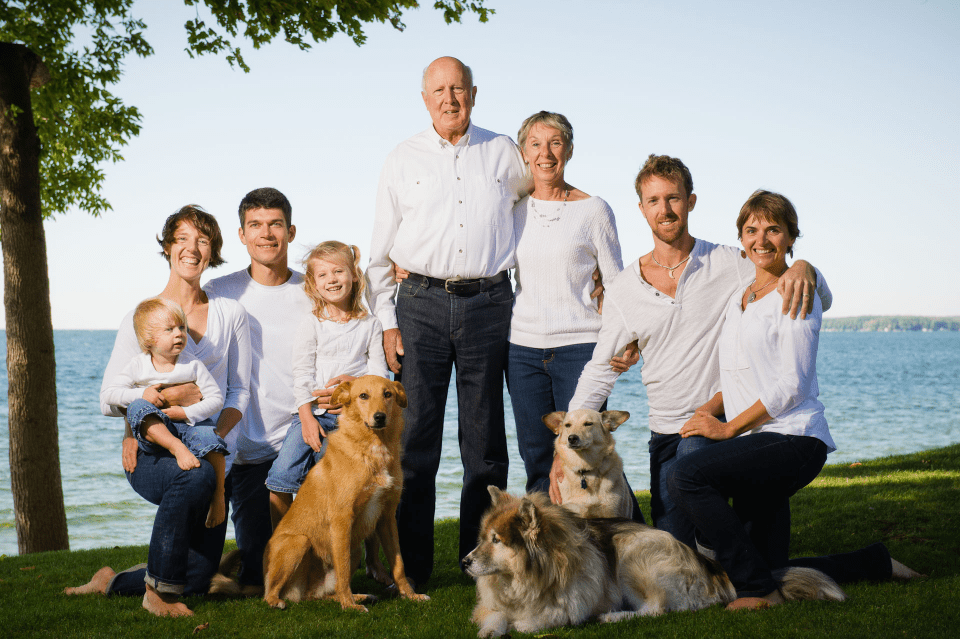

Estate planning and family loans: what could go wrong?! Loans between members of the family, particularly between the testator and

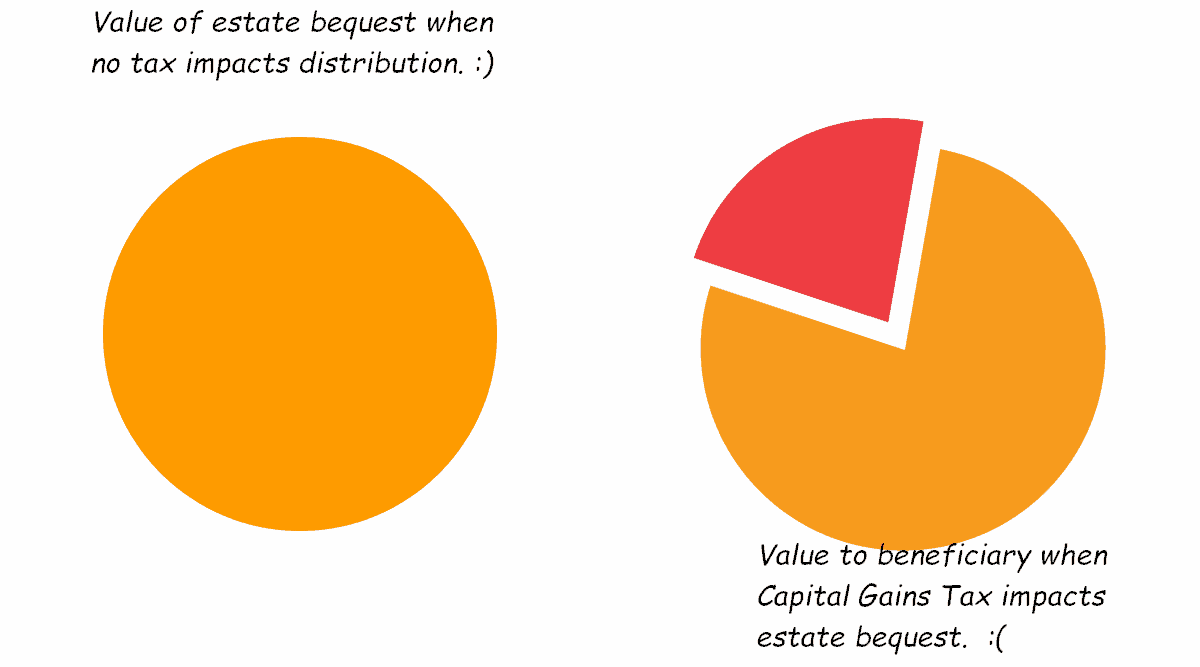

What is the Capital Gains Tax impact on estate bequests? When undertaking your estate planning, be aware that there may

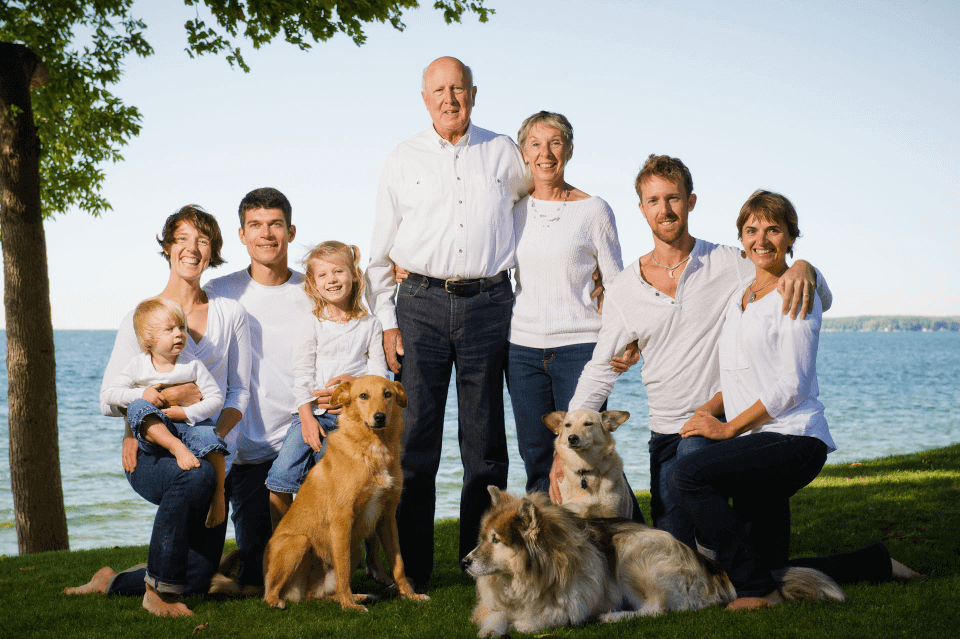

Estate Planning is vitally important when a business is involved: and if that business is co-owned with members of extended/ unrelated families, Estate

Superannuation Fund Trust Deeds provide a process by which the trustee can consider your intent as to distribution of death

Level 1

2042 Logan Road

Upper Mt Gravatt QLD 4122

07 3421 3456

Paul Ashton & Associates – CPAs

2 Alice Street

Warwick QLD 4370

07 3421 3456