Money Management Matters

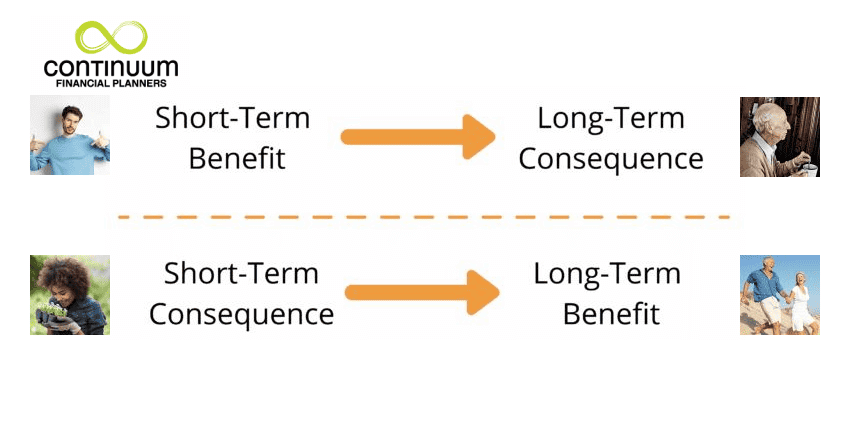

Skill in money management matters. Common money management misconceptions lead many to financial despair. This is in the face of

Skill in money management matters. Common money management misconceptions lead many to financial despair. This is in the face of

An increasingly important aspect of our wealth management journey in Australia is the understanding and management of superannuation benefits –

The key to life is loving it, not retiring from it. However, there may come times in your life when

Financial education for children (of all ages) is a gift that will see them in good stead for the rest

Managing money and debt is one of the key responsibilities of governments. The management of money and debt is an

From minimum pension drawdown… Does your minimum pension drawdown give rise to surplus cashflow? Have you thought about investing surplus cashflow arising

Estate planning provides assurance for dependants The adequacy of provision for your emotional and financial dependants is reflected in estate

An investment success contributor: tax refund apportioned to its contributing components – and deposited to the appropriate account! Ever thought

The nomination of beneficiaries (the person/s to receive the benefits arising from an event or transaction) is an action we

Before we look at education funding per se, education funding options that include endowment benefits and special purpose funds will

Paul Ashton & Associates – CPAs

2 Alice Street

Warwick QLD 4370

07 3421 3456