Super in your 40s and 50s

Super in your 40s and 50s Super in your 40s and 50s should be taken as an opportunity to make

Super in your 40s and 50s Super in your 40s and 50s should be taken as an opportunity to make

Superannuation in your 20s and 30s is commonly a least considered financial asset. Numerous studies show that the earlier you

An increasingly important aspect of our wealth management journey in Australia is the understanding and management of superannuation benefits –

The key to life is loving it, not retiring from it. However, there may come times in your life when

It is widely considered that holding certain types of Life Insurance within Superannuation is acceptable practice. For some people, this

The Budget Highlights 2013 presented below, were extracted from the 2013 Budget announcements by the Federal Treasurer, as likely to

What is superannuation investing? Superannuation investing entails two elements of investment concept: firstly, it is important to recognise that superannuation

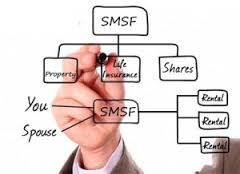

Self managed superannuation funds (SMSFs) are private superannuation funds that are managed and controlled by the members. These funds are sometimes

Retirement planning strategies are one of the specific objectives of a well-considered wealth management plan. Approaching retirement age? Do you

Estate Planning and Superannuation Assets are important considerations in Australia, where compulsory superannuation is now held by almost every adult

Paul Ashton & Associates – CPAs

2 Alice Street

Warwick QLD 4370

07 3421 3456