Direct life insurance, taken online from a TV ad, may be convenient – but can you rely on it to provide protection when needed?

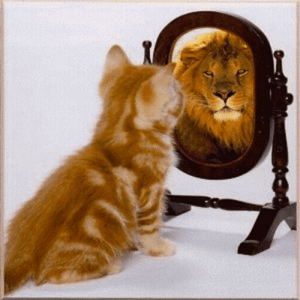

We look at a range of issues that influence people’s decisions in relation to protecting their financial well-being from risks of ill health, accident – and even death; and highlight some of the reasons to beware direct insurance reliance that is not well founded. (As suggested in the image accompanying this article, what we perceive we are getting may not be what we are actually getting!)

Life Insurance – what is your reaction to that term when you see it?

In the context of how you use life insurance to your best advantage: do you understand how it works providing protection for you and your family?

Some typical reactions are:

I don’t understand it (the different types of life insurance)

The application process is too complicated (personal health disclosure, medical reports and/ or financial report requirements included)

I have family health history concerns that will preclude me getting cover (and/ or could result in exclusions from full cover; or premium ‘loading’)

It’s too expensive (without actually having compared the quotes under alternative strategies)

It never pays out (relying on sensationalist journalism of situations, usually where there has been questionable disclosure, ignoring the impressive payout figures published by insurers annually)

I’m not sure what cover I need (including the type of policy, the amount of cover, who should own the policy/ies; and who should benefit from it/ them)

I think my superannuation covers it (whilst this is often correct it is also the case that some such cover is jeopardised on a change of employment status, may reduce over time, may not pay out in all anticipated circumstances – other than to your superannuation account; and may not cover you for all that you expect, nor for as long)

I don’t need it (a situation that could be difficult to explain to anxious dependants if the basis of that determination proves incorrect at a financially inconvenient time)

….and there are a number of other rather typical responses.

Recognising the complexity of this, but realising the importance of protecting the financial future of family and any other financial dependants, some turn to ‘direct’ (phone, or online) providers from whom they can quickly arrange some level of cover – and at what at first instance, appear to be competitive prices.

Beware direct insurance that isn’t always what it seems –

We suggest that the following matters need to be considered when adopting the ‘direct’ provider course: and conclude that a negotiated-cost strategic advice process, implemented through a fully underwritten application is in the best interest of anybody with financial responsibilities. The pros and cons of taking the direct route as we see them are:-

|

Pros |

Cons |

|

| Fast: only minimal information is taken | Uncertainty as to what is insured: absent under-writing at the time, there is a risk that existing conditions will preclude (or limit) claim success | |

| Relatively easy: many offer uncomplicated application processes | Claim risk from incomplete disclosure: where existing conditions give rise to a claim within a specified period, it may be declined | |

| Seemingly cheap: because of the ‘exclusion’ restrictions and absence of advice | False security: insured may believe they are adequately covered with the right policy, but have no certainty that this is correct | |

| (Hopefully) better than no insurance: if time erodes the risks for the insured | May prove to be No Insurance: where existing conditions are such that a claim will never be successful regardless of time |

The process of buying life insurance is complex and the product you are seeking to but needs to be understood: the MoneySmart website has a checklist on what to look for when buying life insurance – at this page, under the heading, ‘What to check before you buy life insurance’

Whilst we suggest that readers beware direct insurance, we are quite prepared to discuss (or elaborate on) these matters further if you would care to raise the matter with us in direct communication whereby we could shed light on possible personal outcomes from taking the ‘quick and easy’ way to put an insurance policy in place.

At Continuum Financial Planners Pty Ltd, we listen (to our clients), we understand (the financial challenges/ aspirations they have); and we have solutions (to their wealth protection dilemmas) – that we deliver in personalised, professional wealth management advice, clearly documented. To see how we can help you ensure that your insurance portfolio is appropriate to your needs and circumstances, call our office (on 07-34213456), or use our website Contact Us page for prompt and efficient attention.

Originally published in September 2014, this post has been occasionally updated/ refreshed, most recently in January 2021.