Estate planning for a Self-Managed Super Fund trustee

The value in estate planning for a self-managed super fund trustee is in the certainty it provides in the event

The value in estate planning for a self-managed super fund trustee is in the certainty it provides in the event

Estate planning and company-owned assets require particular attention because of the legal implications of each environment (entity). Not all assets

Estate planning and family loans: what could go wrong?! Loans between members of the family, particularly between the testator and

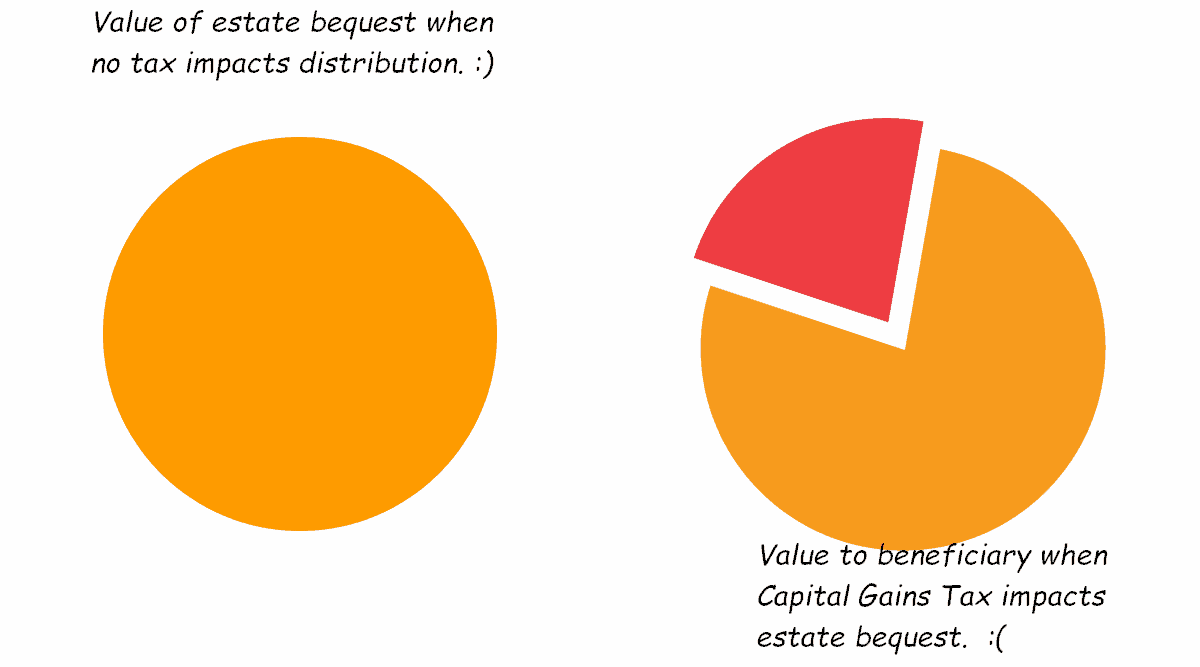

What is the Capital Gains Tax impact on estate bequests? When undertaking your estate planning, be aware that there may

Estate Planning is vitally important when a business is involved: and if that business is co-owned with members of extended/ unrelated families, Estate

Superannuation Fund Trust Deeds provide a process by which the trustee can consider your intent as to distribution of death

In the context of preserving assets for the continued use for which they were accumulated, even beyond your passing, asset

A ‘modern’ Will facilitates estate planning flexibility. This article discusses some features of a modern Will that give that flexibility

Estate Planning is an important wealth management exercise. Estate Planning outlined provides links to a series of articles to guide

You need to attain Estate Planning certainty for those for whom you intend to provide whilst you have mental competence.