What is dollar cost averaging?

Dollar cost averaging is an approach to investing into investment assets which involves investing a set amount of money at regular intervals rather than a larger lump sum at one time. By investing this way you are not attempting to pick the highs and lows of the market, but rather the cost of your investment is ‘averaged’ over many periods.

What are the advantages of dollar cost averaging?

Some of the benefits of dollar cost averaging include:

- Regular investing in a managed investment means you are not relying on timing strategies aimed at picking when the market has bottomed or peaked. Dollar cost averaging imposes a helpful investment discipline by ignoring timing issues.

- It is a sound investment approach during periods of volatility as it can smooth out the ups and downs of the market. As market prices fall, your regular investment amount will purchase more units, thereby reducing the impact of the decline.

- It is an ideal means of investing for people with a regular income but no large sums to invest. It provides a simple and effective savings program.

- The average purchase price of an investment tends to be lower than the average unit price over the same period as the fixed amount of money invested each time buys more units when prices are low and fewer units when prices are high.

How does it work?

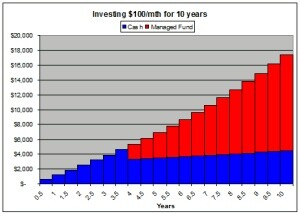

The following example shows the benefits of the dollar cost averaging approach of investing into a managed fund. A fixed amount of $1,000 was invested each month for five months, as the unit price fell and then recovered to its original level.

| Month | Amount Invested ($) | Unit Pice ($) | Units purchased |

| 1 | $1,000 | 20 | 50 |

| 2 | $1,000 | 15 | 66 |

| 3 | $1,000 | 10 | 100 |

| 4 | $1,000 | 15 | 66 |

| 5 | $1,000 | 20 | 50 |

| Total | $5,000 | 332 |

In this example, the units were purchased at an average price of $15.06 ($5,000 ÷ 332). After five months, the investment was valued at $6,640 (332 units at $20 per unit), a profit of $1,640. If the units had all been purchased at the commencement of the five months, there would not have been any gain on the investment when the units returned to the original price.

What are the risks of dollar cost averaging?

Dollar cost averaging does not eliminate the risks of investing into investment markets. It is still possible to lose money with this technique and to under perform the return that would have been obtained if all money had been fully invested at the start.

The three possible outcomes are:

- In a market where prices go up and down but return to their starting level, a dollar cost averaging portfolio will generally gain a positive return. An ‘up front’ portfolio, where all the money is invested on the first day, will not gain any return because the prices are at the same level as when the investor bought into the investment.

- In a market where prices rise steadily (with some volatility), an ‘up front’ portfolio will do better than the dollar cost averaging portfolio. This is because the full gain on the price rise is captured by the full amount of money invested up front.

- In a market where prices fall steadily (with some volatility), a dollar cost averaging portfolio will still lose money, but will generally lose less than the ‘up front’ portfolio.

Dollar cost averaging may reduce the impact of the volatility of markets, but it will not reduce any risks inherent in the investment that you choose.

Continuum Financial Planners can help you…

Dollar Cost Averaging is a tried and tested strategy for long-term investors to accumulate their investment portfolio. Our experienced advisers are available to discuss how you can utilise this strategy effectively: call our office on 07-34213456, or use our website contact us facility to arrange a meeting to start your wealth management strategy. Our team works to the principle that ‘we listen, we understand; and we have solutions’ – that we deliver through personalised, professional wealth management advice.

We acknowledge the resources of Securitor Financial Group Limited in drafting the majority of the detail in the above article: it has been extracted from the Support Information to advice documents.

(Originally published in January 2010, this article has occasionally been refreshed/ updated, most recently in April 2021.)