What is your attitude to Life Insurance?

There is often an air of reluctance to discuss personal life risk matters. Life insurance sensibility is your general attitude to this topic. In this post, we highlight some of the life risks that you encounter can:

- have a devastating effect on your financial future; and

- be financially mitigated using appropriate life insurance products with adequate levels of cover.

What is your view?

Do you have a personal insurance philosophy?

Is life insurance valued by you as a risk management strategy?

Do you regularly review both your attitude towards – and the amount of protection you have, through life insurance policies?

Your responses to the above questions will help you to determine the level of your sensibility to this financial product. This may also indicate how well your family is protected in the event of you experiencing a crisis. Particularly crises such as an untimely life-changing event through accident or illness.

Why Life Insurance is known as ‘personal risk insurance’…

Risk pervades all aspects of our lives. The occurrence of some events will impact our ability to undertake at least some of our normal lifestyle activities. These events are commonly referred to as ‘personal risks’. Life Insurance policies are outsourced, personal risk management contracts. They allow us to mitigate (offset) the financial costs experienced in these adverse events. Not having life insurance leaves us ‘self-insured’ to bear the financial consequences of those events.

Insurances generally

Having a risk management plan prepares you to deal with events that may arise. To the degree that you can have a reasonable awareness of their financial consequence you will be better protected. It may not be possible to quantify potential financial consequence precisely in advance but good estimates can be made. Some areas of general risk that most households consider (and usually insure), are:-

- Property (building and/ or contents – including whether to include specific items?);

- Motor vehicle/ bikes (and if applicable: marine, caravan, etc);

- Personal health insurance;

- Funeral;

- Pets; and

- Home workers.

How insurance products help

The immediate reaction to life-changing disruptive events is to try to restore our position to normality. Whilst this entails various activities – almost inevitably there will be a financial cost involved. This is the point at which risk management and wealth protection intersect. It is the point at which your personal insurance sensibility will be tested. Almost certainly, you will have the general risks mentioned above covered to an appropriate level. Consider whether having any of those assets insured will be relevant, if you lose your own capacity to earn. Even more consequential, if the financial impact of your injury necessitates drawing capital to restore your health and mobility.

Awakening your insurance sensibility

We have developed a personal risk insurance philosophy. It offers clients the most appropriate level of wealth protection that we can in their personal circumstances. Our philosophy is constrained to personal risk insurance through life insurance policies. Your own life insurance sensibility (your personal insurance philosophy) will extend beyond that – to personal health. It could also embrace general insurances (such as over property and third party liability) .

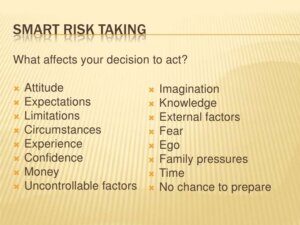

Determining the amount of insurance cover required takes some time and deliberation. In the process, an understanding of how the different types of insurance contracts operate will broaden your awareness. Having determined the potential financial consequences of these risks, next consider how much of that risk you might self-insure. That is, what loss can you bear consequent to of one of these risks materialising, before disrupting your financial future. Don’t overlook the future financial needs of your ‘dependants’ in this consideration.

Why understanding insurance products is important

When you choose a general insurance option you may have to share the risk. This is seen as a ‘claim excess’, or by limitation as to the level of cover available. Consider the way claims on policies such as the following work:

- building & contents. (averaging if under-insured; excess usually applicable on claim.) What would it cost to clear the rubble and to restore your home and furnishings to their previous standard?

- motor vehicle. (comprehensive: usually carry an excess on claim.) How long will you be without use of your vehicle? What are the financial implications of not adequately insuring to mitigate the cost of dealing with that issue?

- personal health insurance. (limits on various health services; excess on claim for hospital admissions.) You will appreciate the principle involved.

Self-insurance dilemma

You may be confident that you have the capacity to bear the financial cost of any one or more of the risk events. The timing of any one of them – or indeed, any number of them coincidentally – may be more challenging.

A question to consider in this regard is whether the loss you are prepared to bear in such an event will jeopardise –

- your future financial security, or

- the attainment of specific financial goals?

A common explanation by people for self-insuring is that they believe that they will set aside the ‘premium’ money and so be able to meet the financial loss from those savings. There are two arguments as to why this is a risky strategy itself:

- Almost nobody ever actually sets the money aside specifically for such events; and

- The cost of a single person carrying the risk as opposed to the pooling of savings by a larger group of insured, is significantly higher. Premiums over time will most likely, prove to have been cheaper than the cost of the repair/ restoration/ recovery.

- Clearly there are some aspects of the financial cost of some risk events that individuals can bear. However, there is a dilemma. If the reason for not outsourcing is that ‘the premiums are too expensive’ it may be that you should not risk self-insuring.

Ultimate wealth protection

Many of the general insurance policies available are ‘asset protection’ instruments: life insurance products can be used in certain asset protection strategies, but are more commonly a wealth protection mechanism.

Wealth protection is important where an accumulation strategy is in place: wealth is being accumulated through regular savings or through capital growth from investment; where future financial plans are dependent on the continuing financial capacity of particular individuals: wealth arising through business valuation growing because of the involvement of particular individuals (and/ or the cashflow from the income they earn); and where personal and business succession planning suggests that there is some inequality or undesirable imbalance: such as for estate planning bequest equalisation, capital gains tax offsets – and for business buy-sell agreement funding.

Protecting the family wealth ensures that lifestyles are not adversely affected financially, at a time when, because of some debilitating event, they are impacted emotionally.

The ContinuumFP philosophy

As mentioned above, we have developed an insurance philosophy that underpins the offer we make to clients (and prospective clients). Our philosophy complements our investment (wealth accumulation) philosophy and guides us in a range of matters to ensure you best interests are protected – and it includes Regular review with a view to maintaining an appropriate level of risk protection.

Our experienced advisers listen to your needs as expressed in identifying areas of risk in your financial plan; understand that there may be extenuating circumstances to consider in evaluating and quantifying the risks involved (by reference to a calculator and researched criteria); and have solutions to the mitigation of those risks – whether that is through a wealth management strategy to self-insure, or to outsource the risk to an insurer (and allow for the cashflow to fund premiums).

You are invited to meet with one of our advisers: call our office (on 07-34213456), or complete the Contact Us detail on our website to arrange an appointment.

(Life Insurance sensibility was first published as a Blog post on this website in May 2015. It has occasionally been refreshed/ updated, most recently in July 2024.)