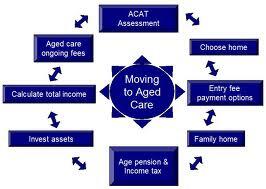

This, the final posting in this series, is provided to assist families with the decision-making process when it becomes apparent/ obvious that a senior member of the family is going to require accommodation in an aged care facility: whether that be in a ‘low level care’, ‘high level care’ or extended services facility. In this post we show some of the options to be considered in making the financial decisions necessary at what can be a challenging time.

Asset assessment

Centrelink or the Department of Veterans Affairs (DVA) may assess client assets on behalf of the Department of Health and Ageing. Even if the client is not in receipt of a Centrelink or DVA payment, Centrelink can perform the assessment.

Applicants do not have to supply their asset details however if they wish to determine if they are eligible for Government assistance they need to complete the ‘Request for an Assets Assessment’ form. This form will generally be provided by the Aged Care Assessment Team (ACAT) which determines the level of care required by the client.

There are two views on completing the assets assessment form. On one hand, if the form is not completed the facility may charge the maximum accommodation bond as they do not have to leave the occupant with $37,500. On the other hand, it can be argued that by not disclosing that the occupant has a high level of assets, the facility may not charge as high a bond.

The asset assessment for accommodation bond purposes is similar to the Centrelink assets test, with three important exceptions:

- Gifts over $10,000 per financial year or $30,000 over 5 years have only been assessable since 10 May 2006

- Income streams purchased before 20 September 2007 that are 50% asset test exempt for Centrelink purposes are 100% exempt for aged care purposes as they are non-commutable

- Former home is included as an assessable asset unless:

- spouse, partner or dependent child is living there, or

- a carer eligible for an income support payment has lived there for at least two years, or

- a close relative who is eligible for an income support payment has been living there for at least five years.

If the client is looking to reduce their level of assessable assets using any of the strategies listed in the second posting in this series, this needs to be implemented prior to completing the asset assessment form.

Former home – accommodation bond assessment

For single people, the former home is generally included in the asset assessment for accommodation bond purposes unless a carer or relative meeting the requirements listed above is residing there.

For couples, when the first member of the couple moves into an aged care facility the home is generally not included. However for the second partner, the home is generally included.

In the case where a couple are entering aged care at the same time, if practical to do so it may be beneficial to stagger entry into the facility so that when the first person enters aged care, the remaining partner is still residing in the home which exempts the home from asset assessment.

Former home – Centrelink assessment

While the former home may be included as an asset when determining the level of accommodation bond, for Centrelink purposes the rules are different.

Where a person moves into an aged care facility and retains their former home, the home will be exempt from the Centrelink assets test for 2 years and they will be considered a homeowner during this period.

The exemption on the former home can be extended indefinitely where they pay part or the entire accommodation bond as a periodical payment and rent out the former home. In addition, any rental income from the former home will be exempted under both the Centrelink income test and the aged care income tested fee calculation.

This is an important exemption which needs to be carefully considered when determining how to pay an accommodation bond. The accommodation bond itself is an exempt asset for Centrelink purposes.

Accommodation bond payment options

The accommodation bond can be paid as a lump sum, periodic payment or a combination of both.

If paid as a lump sum, the client has 6 months to come up with the bond however they will be charged interest on the outstanding amount from date of entry.

If paid by periodic payments, the amount of the payments is calculated based on interest charged on the equivalent lump sum plus any retention amounts. As at 20 March 2012 the maximum current interest rate which is set by the Government is 8.16%

Funding an accommodation bond

The main options for funding an accommodation bond are:

- Sell existing investments

- Sell former home

- Borrow funds through a reverse mortgage

- Family pays the bond

- Pay via periodic payments

Which of the above options produces the best outcome will depend on the person’s circumstances.

One of the main decisions is whether to sell the former home. Often someone moving into an aged care facility does not want to sell their home for various reasons including:

- attachment to the home,

- wanting the option of returning; and

- wanting to leave it to their children.

(Families may want to sell the home as they do not want the burden of upkeep and dealing with tenants.)

Financial planners consulting in these circumstances will provide useful calculations under a number of scenarios so that the family fully understand their options. (Refer linked Case Study for an example as to how this might work.)

Conclusion

Accommodation bonds can be a large amount of money and a decision as to how to fund the bond needs to be made at what is often a stressful time. By understanding the options and exemptions available, financial planners2 with experience in this field are well placed to assist families with this difficult decision.

1Posting 4 in a series of 4 Blogs about preparation for the transition from home to an aged care facility for accommodation and care needs for the aging/ aged.

2Continuum Financial Planners Pty Ltd has experienced planners available to assist families in making the most appropriate decision in your circumstances.

Adapted from articles written by Cecile Apolinario, ThreeSixty; and Pinnacle Financial Services Academy – under the title ‘Aged Care Strategies’ in the April and May, 2010 issues of a financial planning industry journal.