Bringing retirement dreams to reality

Retirement: what does the word conjure up in your mind? Is it –

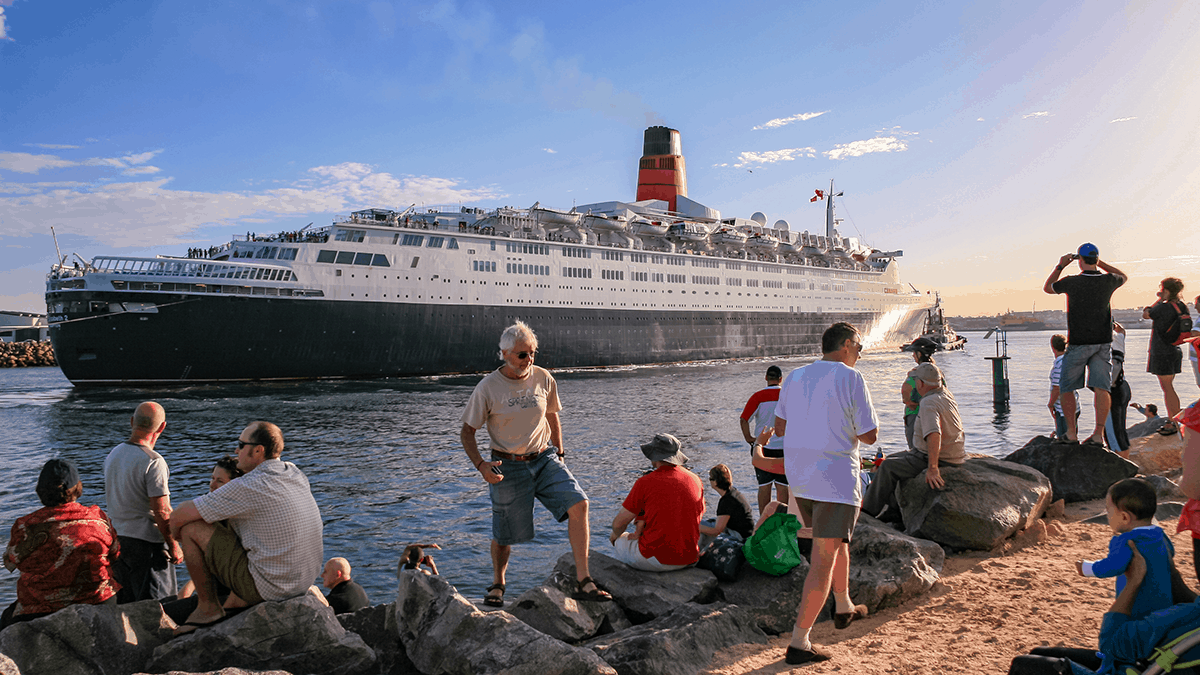

…overseas travel?

…a few years as a grey nomad?

…visits to old haunts?

…beach-combing? fishing? hobbies?

It doesn’t hurt to dream about the prospects that retirement may offer (in fact it’s probably healthy to do so): it helps to form the goals and objectives toward which planning can be focused. Making the dreams realistic – and achievable – is where strategic planning for retirement comes to the fore!

Retirement dreams storylines

If your retirement dreams are for a financially independent phase, some focused lifestyle and financial planning ahead of the event is called for. Answers to questions including the following need to be found, considered; and worked into a viable retirement plan –

- How much will I need to fund retirement?

- How long will I be ‘retired’?

- Will my circumstances remain relatively unchanged?

- What will my annual lifestyle costs be?

- Can I stay in my current accommodation?

Key elements of your retirement plans then, are:

- Availability of funds;

- Disciplined budgeting; and

- Healthy lifestyle.

If your retirement dreams are based on the ‘usual’ pattern (i.e., after turning 65 years of age), you will probably be looking to put all available financial resources into superannuation accounts. These accounts are taxed favourably (concessionally) if contributions are made within prescribed ‘caps’ – and even more so when they finally convert into pension phase. Over the past several years, Continuum Financial Planners Pty Ltd has posted several articles providing information and tips about preparation for this important phase of your life: they include –

- Our Retirement Planning Strategies Services page;

- Planning Your Retirement – (March 2012, updated May 2016)

- Preparing for retirement – (September 2012; updated June 2016); and

- Funding Early Retirement – (February 2010; updated September 2013).

Your best interests are the cultural goal of the experienced team of financial advisers at Continuum Financial Planners Pty Ltd. When it comes to satisfying your needs for financial independence and optimum wealth management strategies – ‘we listen, we understand; and we have solutions’. You are invited to Contact Us by phone (07-3421 3456) or using the website facility, to arrange a meeting at your earliest convenience.

(Originally published in November 2013, this article has been occasionally refreshed, most recently in April 2021.)