Financial Year end checklist 2013

The financial year end checklist 2013 contains tax-effective strategies that may be effective for you – depending on your personal

The financial year end checklist 2013 contains tax-effective strategies that may be effective for you – depending on your personal

The podcast transcript following, is of an interview between – CPA Australia senior tax counsel Mark Morris and ATO senior tax

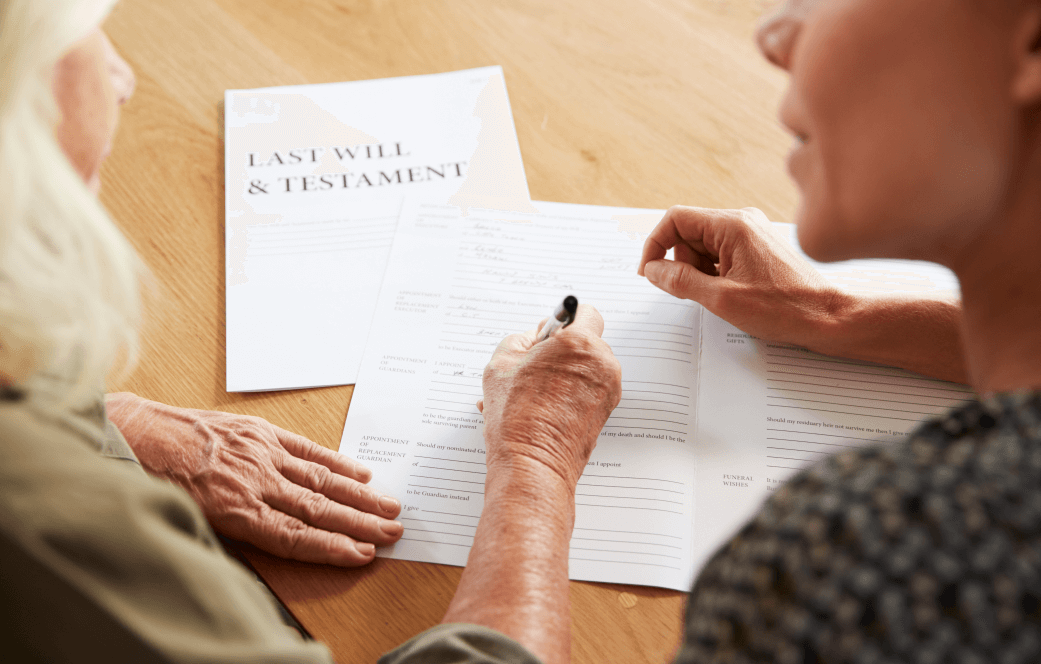

The passing of a family member without a valid Will arouses Estate Planning urgency. The Will (often referred to as

Does your ‘super’ look so super with insurance? Have you super-charged your insurance? Charging your superannuation with life insurance costs

The nomination of beneficiaries is an action we are called upon to consider in a variety of situations. Beneficiaries are

The estate planning foundation: a valid Will, is core to the end process in formulating an estate plan. A valid

Estate planning for younger children may seem at odds with our usual thinking. Typically, when a Will for instance, needs

Estate Planning is an important – and sometimes complex – process. Estate planning with a testamentary trust may appear complicated,

Estate Planning and Superannuation Assets are important considerations in Australia. Compulsory superannuation is now held by every working adult. It

The value in estate planning for a self-managed super fund trustee is in the certainty it provides in the event

Level 1

2042 Logan Road

Upper Mt Gravatt QLD 4122

07 3421 3456

Paul Ashton & Associates – CPAs

2 Alice Street

Warwick QLD 4370

07 3421 3456