Active Vs Passive investing styles compared

There are many types of investors, each having different strategies and goals. For purposes of this article, their investment styles

There are many types of investors, each having different strategies and goals. For purposes of this article, their investment styles

Market volatility temptations: asset class deceptions Investor mistakes usually arises during market volatility – whether the consequences of that volatility

Wealth accumulation without breaking the Bank Gearing wealth creation has long been a popular investment strategy: the level of gearing

The 2015 backdrop to the market outlook for 2016 – As 2015 drew to a close, we reflected on the

Investment Strategy generally The development of an SMSF Investment Strategy is as important a process to the members of an SMSF

Is preparing for retirement on your mind? Clients often tell us that looking forward to their retirement is an interesting, challenging and

Ongoing Adviser Services – The Value of Advice Ongoing adviser services ensure that the financial goals and objectives you are

Risk and Return: key elements of investment risk profiling Investors’ understanding of the terms risk and return is part of

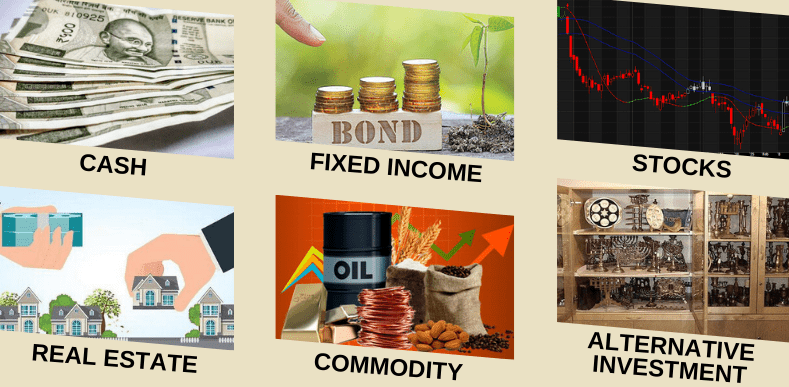

Investment Portfolio Diversification: what is it? …and should you avoid over-diversification? Investment portfolio diversification is heralded as the way to

Paul Ashton & Associates – CPAs

2 Alice Street

Warwick QLD 4370

07 3421 3456