Market volatility temptations: asset class deceptions

Investor mistakes usually arises during market volatility – whether the consequences of that volatility are trending up, or down. Prolonged market volatility can be, and is, unsettling for many investors. Passive investors have little say as to how their default portfolio(s) are invested and are not immune to this. Superannuation investments, particularly default funds, are prominent in this category.

‘Paper losses’ reflected in portfolio/ account statements may lead to thinking that there may be a better way to invest. The worst reaction to this belief, is to –

- change the portfolio while it is ‘down’ –

- without consideration of the strategic purpose for which it was chosen.

Common investor mistakes

If you, or anybody you know, is considering withdrawing from the traditional diversified investment market –

- (the first and most usual investor mistake in these circumstances), we strongly recommend

- a strategic review of the reasons for implementing such a decision –

a service that our team of advisers at ContinuumFP is qualified, experienced, and ready to provide.

Two great mistakes made by investors at such times, are either

- to hurriedly withdraw from the traditional diversified portfolio and store their remaining wealth as Cash; or

- to move that wealth into a single asset, often property.

There are many reasons for these adjustments to investment portfolio, and they are usually sound arguments. The mistake in each case though, is usually the timing of the change. They tend to react, rather than to act tactically with an eye on the longer-term strategy.

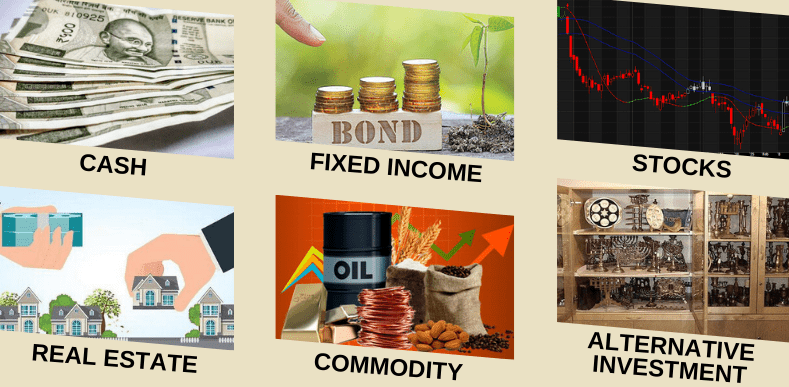

Usual assets misunderstood

Cash is perceived as being bulletproof from a capital preservation standpoint, but –

- it is subject to the vagaries of inflation, and

- for the foreseeable future, the expectation for rates is not always well understood.

Cash has no capacity to increase in capital value except, perhaos –

- during a deep recession, or

- perhaps an economic depression.

In the process of switching invested (growth) assets to Cash –

- because they have fallen in value for the present time,

- locks in the loss with little near-term hope to be recovered.

Directly held Property is a much-loved asset in Australia. However, our faith in this asset is distorted –

- by the infrequency of reporting of the valuation of an individual property,

- the under-reporting of the unpleasant experiences of many investors in the asset class, and

- the much-touted gains by those who have been successful with such investment (usually because they held the property long enough to take advantage of ‘a cycle’ in that market).

Consequences of investor mistakes

Over a rolling five-year cycle returns and risk profiles for shares (equities) and direct property have been very similar for the past fifty years or more. There have been many investors who have ‘done well’ with direct property investments. As a general observation, these have been people who –

- have only borrowed lightly against their property (if at all); and

- who have recognised the need to hold adequate cash to offset unexpected (but seemingly inevitable)

- significant maintenance costs and

- to provide cash when there is an interruption to income from the property.

Our investment philosophy allows for direct property investment provided it meets all of the investor’s individual requisite investment.

Avoid investor mistakes: take advice

When Continuum Financial Planners’ advisers are developing investment strategies for clients, the recommendations for the investment assets selected to target successful attainment of the financial goals and objectives take into account a number of factors, including –

- the client’s investor risk profile;

- the timeframe in which the goals are to be achieved;

- the client’s investment preferences;

- the liquidity of assets in the portfolio (to provide for either income streams, or occasional capital expenditures); and

- the capacity for the recommended assets to provide long-term growth.

The outcome of the research we undertake is provided by way of documented advice that presents:

- benefits and pitfalls for the strategy,

- the platform for its implementation,

- the portfolio of investment assets recommended – and

- (a feature of most of the portfolio strategies), diversification.

ContinuumFP advisers advise and educate

Investor mistakes are most prevalent amongst the unadvised investors and whilst the cost of advice is often given as the reason advice is not sought, the cost of these mistakes often far outweighs the cost – and certainly the value of advice. The financial planning team at ContinuumFP are available and ready to review your strategy and your portfolio, and to set you on the path to attainment of your financial goals and objectives, strategically and confidently.

To make an appointment with one of our team to determine your way forward to avoid those costly investor mistakes –

- phone our office, on 07 34213456, or

- at your convenince, use the linked Book A Meeting facility.

(This article was first posted by us, in July 2022. It has occasionally been refreshed/ updated, most recently in June 2025.)