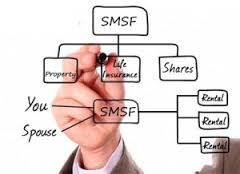

SMSF Investment Strategy

Investment Strategy generally The development of an SMSF Investment Strategy is as important a process to the members of an SMSF

Investment Strategy generally The development of an SMSF Investment Strategy is as important a process to the members of an SMSF

What is your attitude to Life Insurance? There is often an air of reluctance to discuss personal life risk matters.

It is widely considered that holding certain types of Life Insurance within Superannuation is acceptable practice. For some people, this

Should I hold my TPD insurance within Superannuation? In our article ‘Superannuation linked Life Insurance‘, we discussed which insurance products

Funding early retirement can be a challenge Funding early retirement is an important consideration for those choosing to opt out

Investment satisfaction is enhanced with advice At the time that the article on which this post was based was published,

The retirement savings vehicle that was so proudly introduced by a former Labor government as a compulsory system by which

What is superannuation investing? Superannuation investing entails two elements of investment concept: firstly, it is important to recognise that superannuation

Why are superannuation structures so misunderstood? A question that is frequently asked of investment advisers and financial planners is: ‘Why would you invest

Self managed superannuation funds (SMSFs) are private superannuation funds that are managed and controlled by the members. These funds are sometimes

Paul Ashton & Associates – CPAs

2 Alice Street

Warwick QLD 4370

07 3421 3456