Super in your 40s and 50s

Super in your 40s and 50s Super in your 40s and 50s should be taken as an opportunity to make

Super in your 40s and 50s Super in your 40s and 50s should be taken as an opportunity to make

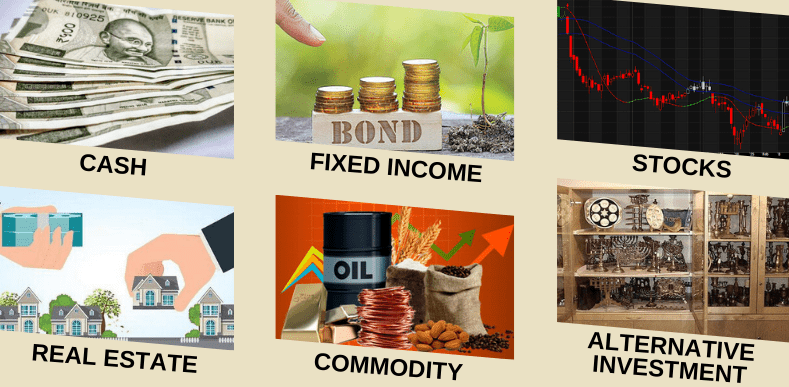

Investment Strategy formulation, documentation and implementation are amongst the most important tasks for trustees of self-managed super funds (SMSF). An

Superannuation in your 20s and 30s is commonly a least considered financial asset. Numerous studies show that the earlier you

An increasingly important aspect of our wealth management journey in Australia is the understanding and management of superannuation benefits –

The key to life is loving it, not retiring from it. However, there may come times in your life when

Market volatility temptations: asset class deceptions Investor mistakes usually arises during market volatility – whether the consequences of that volatility

The Australian Government announced its Budget for the coming year on Tuesday 8 May 2018 (with implications for the ‘forward

Each year after the Federal Treasurer brings down the government’s budget (or at least its aspirations of such) for the

Investment Strategy generally The development of an SMSF Investment Strategy is as important a process to the members of an SMSF

From minimum pension drawdown… Does your minimum pension drawdown give rise to surplus cashflow? Have you thought about investing surplus cashflow arising

Paul Ashton & Associates – CPAs

2 Alice Street

Warwick QLD 4370

07 3421 3456