Incremental wealth accumulation is a slow but sure way of building an investment portfolio to meet future financial needs.

Small accumulations, regularly contributed, build a financial portfolio on which reliance can be had, when goals are reached.

Perhaps it could be a deposit for a car; or towards the purchase of a property?

Perhaps even as a start of an investment portfolio?

Want to see how making a small, but regular investment can grow to be a useful ‘lump sum’?

Tried and true steps to wealth accumulation incrementally achieved

Dollar-cost-averaging (DCA) is a tried and tested financial wealth strategy that has proven itself effective over the continuum of market cycles. What is DCA? Why does it work?

What is Dollar Cost Averaging?

DCA is a wealth management process of investing a consistent amount at regular intervals into one portfolio. An example of this is say that may be familiar is a school savings account. For example, consider a monthly deposit of $100 into a bank passbook account.

Saving becomes investing …

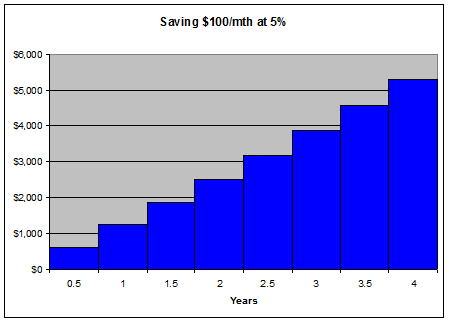

Having run such a savings program for a few years – say at $100 per month to a passbook account earning 5% per annum credited monthly, we accumulate $5,000: now we feel confident to invest some of the saved money. (We will keep a portion ‘for some rainy days’ – or some other ‘opportunities’.)

(Note: does not take account of fees and taxes)

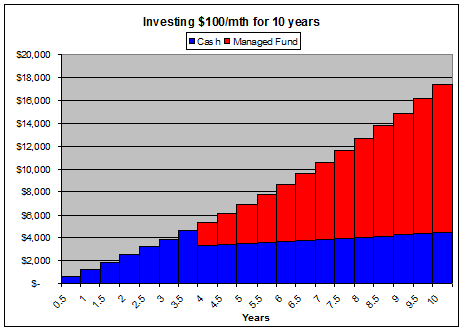

… and so we continue to ‘invest’ $100 per month – but now it is into a diversified, multi-manager managed fund account started with say $2,000 from the original account. (For purposes of the exercise we assume a Balanced Risk Profile and anticipate a 30% tax effective income distribution of 4% p.a., paid quarterly; and capital growth at an annual average of 5% p.a. – although we understand that in some short periods there may be negative growth in the accumulated capital. We also suggest consultation with a financial planner to select the fund used.)

(Note: does not take account of fees and taxes)

Ten years from starting out on this process, we have accumulated $17,380 and have hardly missed the $100 per month, especially as our income from which it is invested has likely increased throughout this period.

Why does DCA work?

Without running an exposé on investment theory, the quick summary of the success of this story is that the investments are made over a range of market conditions: sometimes buying investment fund units at higher than average market prices; other times buying them at lower than average – and always re-investing the distributions received. This is wealth accumulation incrementally – and consistently!

The real secret of this success is the consistent investment of an affordable amount throughout a term regardless of other circumstances and situations – that is, we don’t run hot and cold with whether we will invest or not!

(There is material available that will show that investors who try to time the market often miss critical days – or times of day – and in doing so, miss significant value. DCA works through all this and brings consistently improved outcomes for the patient investor.)

Looking for guidance on wealth accumulation incrementally?

This strategy can be useful for a number of financial objectives (and is at work for most of us through our regular superannuation contributions). For an opportunity to ensure you don’t miss out on these benefits, contact us to meet with one of the experienced financial planners (or to refer a family member or friend to have such a meeting) – at Continuum Financial Planners Pty Ltd: you can call us directly, on 07-3421 3456.

[This article was originally posted in October 2012; and has been refreshed occasionally, most recently in June 2022.]