Achieving strategic investment objectives is a process

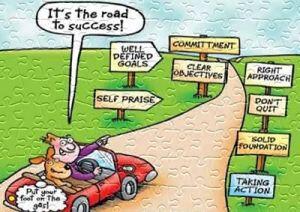

When clients first set out to provide for their future financial independence, or to achieve some more specific financial objective, they embark on a journey. Achieving strategic investment objectives then, becomes both a process – and a discipline. This journey starts out with some detailed analysis of present circumstances; takes into account available resources; sets a timeframe; sets investment risk parameters to be respected; and requires them to ‘hold their nerve’ when market volatility upsets the progress toward the ultimate goal.

Are We There Yet?

With touring holidays still popular in Australia this might be a familiar call from the younger, less patient passengers when on the road.

As investors look at the performance of their portfolios over particular periods of time, they might well ask the same question: or at least question whether adequate progress is being made. The fact is that there are cycles, there are trends – and there are events, none of which can be ignored (and each of which need understanding). Achieving strategic investment objectives is not a ‘set and forget’ action.

Calling back to the touring analogy, just as on our journey we travel lengthy highways, climb steep ranges, traverse lengthy plains and bridges – and occasionally strike speed zones before we finally arrive at the planned destination; the investment journey will encounter economic and market events (including business cycles, financial trends and geopolitical events) that need to be negotiated as we progress towards the ultimate goal.

Where is ‘there’ for you?

Some investors (particularly those who entered ‘the market’ close to the tipping point leading into the GFC) are pining to see their portfolio return to the late-2007 levels (allowing of course for any withdrawals along the way); some will be satisfied with a ‘better than bank interest’ performance; and yet others want to have complete comfort and peace of mind that their ‘nest egg’ (existing or accumulating) will be adequate to fund the lifestyle they would like to enjoy in retirement. Achieving strategic investment objectives will be a different journey for each of these investor categories, but each requires disciplined attention to the process.

Each of these objectives is legitimate and real for the individual involved. Whatever your financial situation, your family (and/ or business) structure – or your age, gender or other personal circumstance – the ultimate goal for many is financial independence for themselves and the loved ones dependant on them. To achieve that financial independence will include dealing with:

- wealth accumulation;

- wealth protection;

- life event risk management;

- estate planning (and other succession planning); and

- retirement planning (and aged care planning).

Guidance to achieving strategic investment objectives for you

At Continuum Financial Planners Pty Ltd we work to the mantra that – “we listen, we understand, we have solutions – and we care!” – and that all of this is focused on YOU (our client). We have many years of experience as financial planners – your financial needs, goals and objectives are our highest priority, attended through personalised, professional wealth management advice – and service.

To arrange a meeting with one of our experienced advisers, phone our office on 07-34213456, or Contact Us on our website facility: you will receive prompt and courteous attention.

[This is an update of an article originally published in our April 2011 eNewsletter; occasionally refreshed since then, most recently in September 2016]