What is the Capital Gains Tax impact on estate bequests?

When undertaking your estate planning, be aware that there may be capital gains tax (CGT) issues to be considered by your legal personal representative (your LPR). Your LPR is otherwise known as the executor of your estate. CGT may also impact a beneficiary under your Will. A CGT liability can crystallise on the sale (or transmission/ transfer) of an asset. Estate assets such as shares or an investment property are prone to this tax.

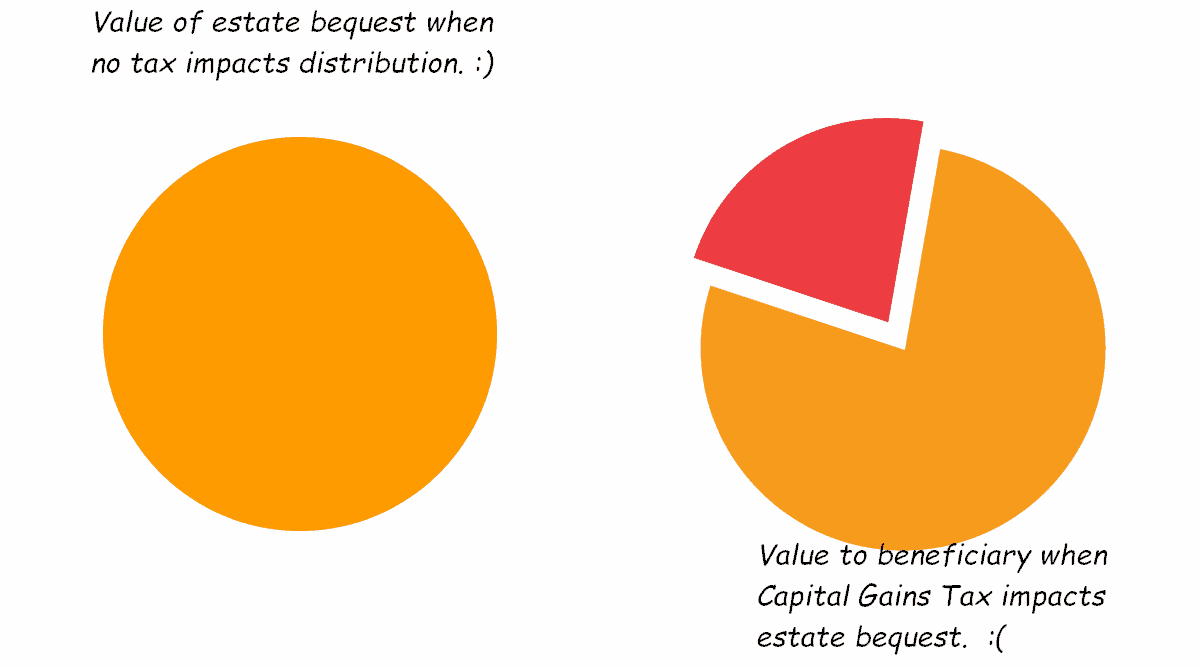

Consequences of CGT paid on estate assets

Under current legislation, the bequest of two identically valued assets –

- one acquired before – and the other after, 20 September 1985,

- to two different beneficiaries

is likely to result in two entirely different benefit outcomes after tax is accounted for.

Strategies to deal with imbalance caused by CGT

It is likely to be more tax efficient to gift an asset with a CGT liability to a beneficiary with a low marginal tax rate and the CGT-free asset to the beneficiary with the higher marginal tax rate. Such a solution may not sit comfortably in your estate planning, but if value-equity in estate distribution is important to you, this strategy must at least be considered – and it will ensure that the impact of the CGT is lessened.

Other strategies to consider to offset the consequences of Capital Gains Tax impact on estate bequests:

- Allocate specific gifts having taken CGT into account. (This can be difficult where market-related assets are involved, as the status of markets at the time of death may be considerably different from that at the time estate planning is undertaken.)

- Investigate whether your Will can be appropriately drafted so that your executor has clear instructions as to your beneficiaries’ respective share of your estate, after taking CGT and other taxes into account – but give discretion as to whom is to receive particular assets.

- Life insurance policy proceeds may be able to be used to balance up any inequities – but ensure consideration is given to any conditions that may attach to the policy (especially if a direct beneficiary is nominated).

Consider the following hypothetical case

.. you might like to consider Claire’s predicament relative to the strategies outlined above –

- Claire owns two very similar investment properties, but in different localities; and purchased at different times.

- She wants to leave one to Damien and the other to Ernie: the properties are currently worth roughly the same amount.

- However, Claire has been made aware that the two properties carry very different unrealised capital gains.

- If Damien and Ernie were to dispose of their inheritance it is unlikely that the net amounts would be the same.

Where can I get help with Estate Planning (including CGT issues)?

The Continuum Financial Planners Pty Ltd Estate Planning service offers clients:

- working with them to prepare the detailed information required for their appointed estate planning specialist lawyer; who can then

- consider the client’s individual detail in light of their estate planning experience so as to design a plan appropriate to the client’s present and known likely circumstances; and where needed

- provision of access to our referral connections of such professionals (to whom we are happy to refer you to match their expertise with circumstances such as your own).

To make an appointment with one of our experienced advisers for this service –

- phone our office, on 07-34213456; or

- at your convenience, use the linked Make A Booking facility.

More about Estate Planning…

This is the sixth in a series of 13 articles on the topic of Estate Planning: further articles in the series seek to bring clarity to some of the issues and implications to be dealt with in fulfilling the three key considerations of Estate Planning – getting the right amount of money, to the right beneficiaries and at the right time; and to prepare you and your family to understand the final plan when drafted. The remaining articles consider –

- Estate Planning outlined;

- Estate planning and flexibility in the modern Will;

- Asset protection using Estate Planning;

- Superannuation death benefit nominations and Estate Planning;

- Estate planning and Business Succession planning;

- Estate planning and family loans;

- Estate planning and company-owned assets;

- Estate planning for a SMSF trustee;

- Estate planning and superannuation assets;

- Estate planning with a testamentary trust;

- Estate planning for younger children; and

- Estate planning dependent on a valid Will.

(This series was first posted to our website over a period from late-2011 through early-2012. We occasionally refresh/ update them; this one, most recently in June 2025.)