Commodities investment is emerging as an important component in portfolio construction

Investment Strategies using Commodities within a diversified portfolio have grown considerably since the ‘equity-like’ performance of this investment asset class was first embraced in the aftermath of the GFC around 2009.

The equity-like feature of the asset class, without the shocks that accompany global share markets, have continued to make them popular amongst investment managers –

particularly those engaged in unlisted assets (including Industry Super Funds in Australia).

During 2010, when we initially posted this article, we engaged with some experts in the commodities field to prepare ourselves – and our clients – to better understand the asset and its benefit in portfolios we construct. At that time, we also identified a couple of commodities funds available to use in our clients’ portfolios – having given them some consideration and analysis, approvingly we hasten to add.

Which commodities are investment assets?

As many of you will be aware, commodities are a diverse range of goods that represent the basics of most enterprise: from energy goods (oil, gas, coal); through production metals (iron, aluminium, even gold); and include foodstuffs (corn, wheat, sugar etc). Some ways of investing in these assets include: direct investment in the ‘hard goods’, through derivative instruments held over their title; and through shares in companies that hold such assets directly.

Investment strategies using commodities have been a common thread in business enterprise for centuries: its recognition now as an investment asset class, is not surprising. Consider: tulips, spices, cotton, gemstones and the like, throughout the history of Europe and the East.

Strategies to match your financial goals and objectives

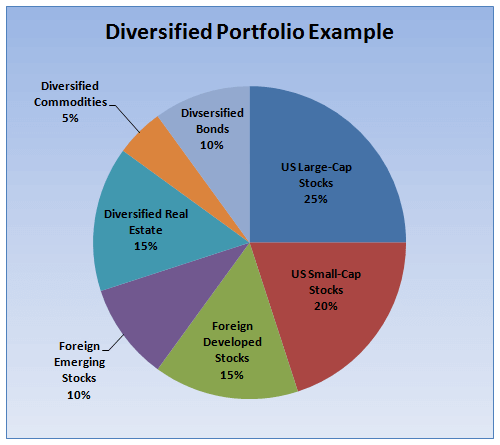

We look forward to working with you to introduce this asset class into portfolios to assist in achieving strategic goals with fewer ‘highs and lows’ and with an improved positive trend line. Whenever we recommend an investment portfolio, there is a range of criteria that we address: consequently, not all portfolios that we recommend are the same – and not all of them include the same assets; and hence commodities may not be part of your portfolio at this time.

Some of the criteria that need to be considered are: the timeframe until you will need to draw capital from your investment; the amount of liquidity that needs to be held in your portfolio to meet recurrent or identified income needs; the investor risk profile that you display; and whether the strategy – and the assets selected to implement that strategy – are indeed, in your best interests.

For an investment portfolio review with one of our experienced advisers, call our office (on 07-34213456), or complete the Contact Us form on our website.

(This article was first posted as a Newsletter article, in December 2009: it has occasionally been updated/ refreshed, most recently in August 2020.)