Coping with market volatility – investment market volatility in this instance – is an acquired skill. However, it is one that might be adaptable from our lifelong learning in dealing with other life occurrences. We’ll track some adaptations from the weather.

Consider the following, not unusual, scenario (of coping with adverse weather conditions) –

The Early Warning (Weather) Alert comes out: severe winds, heavy rain and damaging hail are on the way. The alert identifies areas to be affected – and provides safety measures to adopt. What do most people do when they receive the alert? More importantly, what do you do when you receive such an alert? And then: How soon after the severe weather event is life back to normal?

In the main, unless we are directly affected there is only passing interest shown. If our area is affected, unless the storm causes our personal property (or persons) directly, we –

- wait it out anticipating what will happen during the storm,

- perhaps begrudging the interruption to our busy schedule – but

- always ready to move on with the continuation of our business or recreational activity.

We arrive at this state of mind by reflection on what has happened in the past. What our experience has been in seasonal weather patterns. We learn from what we observe has been the consequences and recovery process for all concerned.

How is it that we –

- cope so well with the natural events of storms etc, but

- have much greater difficulty coping with turbulent investment markets?

Is there an opportunity to hone our investment experience around the natural world?

Coping with market volatility (adverse investment conditions) –

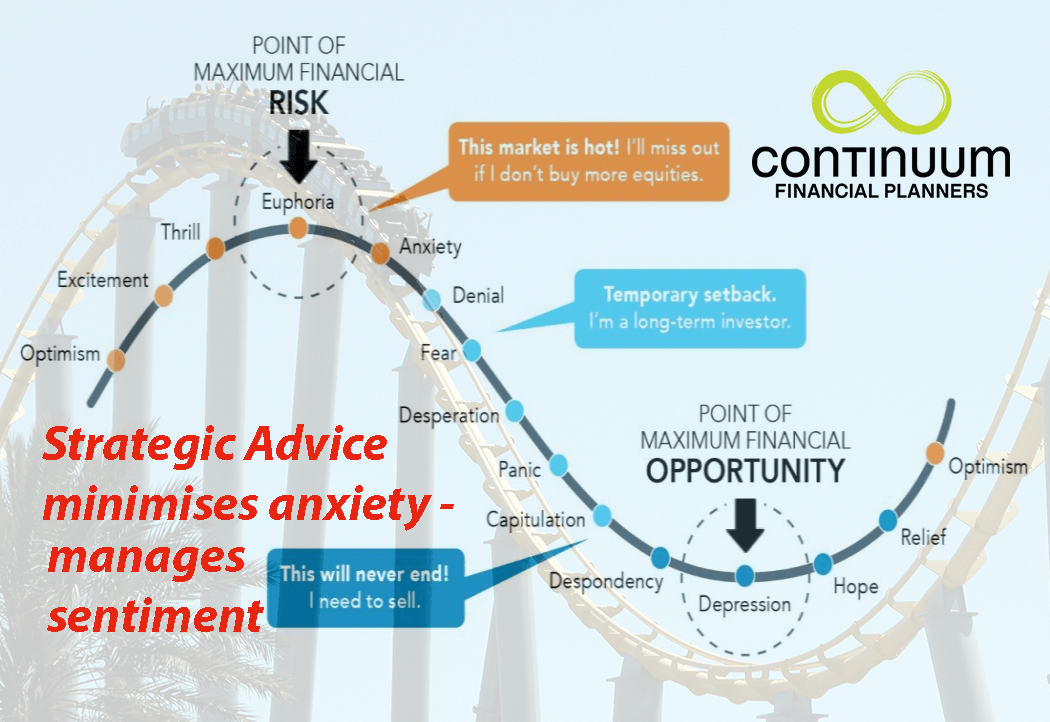

Over many years, financial analysts and statisticians have noted the effects of market volatility. Consequences of, and recovery periods from turbulent financial markets all provide useful learning for investors. (Speak to one of the Continuum Financial Planners Pty Ltd advisers to see some charts showing these positions graphically.) The following relevant quote from Peter Lynch’s book (1) is useful in considering this situation:

The extract

“Over the 70 years up to the end of 1992, stocks provided their owners with gains of 11 percent a year, on average. In spite of all the great and minor calamities that have occurred in this century – all the thousands of reasons that the world might be coming to an end – owning stocks has continued to be twice as rewarding as owning bonds.

In this same 70 years in which stocks have outperformed the other popular alternatives, there have been 40 scary declines of 10 percent or more in the market. Of these 40 scary declines, 13 have been for 33 percent, which puts them into the category of terrifying declines, including the Mother of All Terrifying Declines, the 1929-33 sell-off.”

[From ‘Beating the Street’ by Peter Lynch – a former Investment Director at Fidelity in New York.]

Beyond the turmoil

After a storm passes, life continues for the majority of us at the same or a heightened pace. So it should be with your wealth management. Beyond the ‘bad times’, we still need to provide a home, food, clothing, education – and, to prepare for retirement. Hopefully, that is yet a distant need.

As part of your coping with market volatility, we urge you to take action as follows:

- review your current investment position to see if it is capable of meeting your future expectations;

- review your investor risk profile to ensure that your portfolio aligns with your investment risk aversion profile;

- discuss the situation with your adviser if either of the above is ‘falling short’ against your personal time frame; and

- consult with one of the advisers at Continuum Financial Planners Pty Ltd to review your financial goals and strategy. (Your family, friends and colleagues might likewise benefit from having their position assessed by our team. (Feel free to refer them for a no-commitment, fee-free meeting to initiate the process.)

Advice for coping with market volatility

The experienced financial advisers at Continuum Financial Planners can provide comfort and assurance in dealing with market volatility. To arrange a meeting with one of our financial planners to discuss your wealth management needs –

- phone our office on 07 3421 3456, or

- at your convenience, use the linked Make A Booking facility.

.

(This post was originally posted by us in May 2011. It has occasionally been updated/ refreshed, most recently in January 2025.)