Continuum Financial Planners Pty Ltd produces its annual Economic and Markets Outlook on an annual basis. It provides a backdrop for clients (existing and prospective) to understand the framework on which we will base investment recommendations. Beyond the first two quarters of the year will usually take a refreshed view to maccount. In this instance, the outlook is for the 2022 calendar year. (To review prior year editions of this topic, search our website Articles for the Category: Market Updates.)

Background scenario

Several issues have been identified as we have gathered information on which to form our views. We address them in detail here for your information. The following issues, or various combinations of them, have been drawn from the published works of –

- researchers,

- analysts,

- economists,

- fund managers and/ or

- market commentators on whom we rely for market intelligence.

The views expressed in this article, are a combination of –

- our team’s collective knowledge and experience in investment market advising; together with

- our understanding of what these informed sources have published.

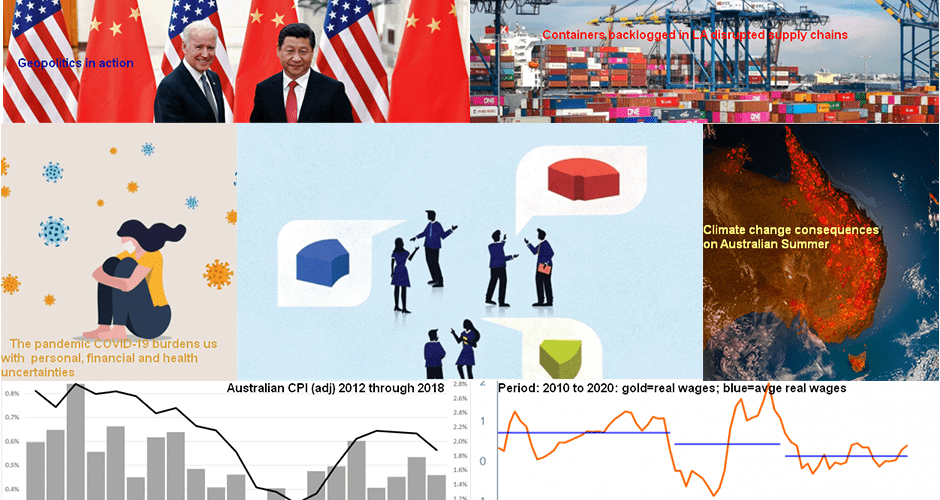

We elaborate on the identified issues, and on the anticipated consequences of them, below: they are –

- Inflation

- Supply Chains

- Central Bank(s) error(s)

- Wage growth

- Wealth imbalance/ inequity

- Climate change resolve

- Geopolitical instability

- Coronavirus variants

- Asset allocation -v- Risk management

The above list of issues is not arranged in any order of affect or relevance. However, they all have an effect, especially where they combine or conflict with another/ others simultaneously or consequentially.

Setting the scene for our comments, it is important to note that –

- the economy of the United States represents around 40% of the global economy; and

- the equities market of that country, represents between the mid-40% and early-60% range

- depending on the phase of the market in which it is being measured:

- it was recently estimated to be 62% of global equities market.

Thus, much of what happens – or is expected to happen – in the USA, will influence the performance of markets generally. This will especially be the case for investors in passive structures (i.e., based on established indices, rather than actively managed).

Inflation –

For sake of simplification, we take inflation to be –

- the increase in an item’s price, whether an article or service, at the close of one period,

- compared to the price of a similar item, article or service at the end of the prior like period.

In Australia, we typically measure Inflation as the Consumer Price Index (CPI). Other countries use different indices, but with similar intent. Inflation has implications for personal, industry and community financial well-being. It is one also of the mantras of most Central Banks, such as –

- the Reserve Bank of Australia – the RBA; and

- the Federal Reserve of the United States, the Fed).

Their goal is to keep inflation in a tight range, centred around 2% to 2 ½% or 3% pa.

The target on the level of inflation is important to Central Banks in formulating the official interest rate setting for their respective jurisdictions. If inflation stays within their target range – and other factors (more on this below) are also normalised, then –

- the interest rate can be set at a level that promotes productivity and

- ‘gets out of the way’ of the growth and development of the economy.

If inflation runs higher than the target range to which the interest rate has been set –

- the value of assets (and people’s savings) is diminished,

- particularly if the inflation persists at that higher rate.

At the individual level, inflation impacts every consumer differently. Depending on their lifestyle and consumption pattern: this generally has a greater impact on the poorer members of the community. Those folk have fewer assets, and are usually on low and fixed incomes. They have less discretion about what they spend their money on.

Inflation outlook

The concern for the economic and markets outlook 2022 is whether the current above-target rates of inflation, is –

- transitory (as was the initial categorisation by the Fed Chair, J Powell), or

- persistent.

The term transitory has been dropped recently, because people were interpreting that to mean short-term or temporary. It was originally meant to relate to the particular set of circumstances (of COVID and related effects). These circumstances were expected to take more than a year to come back to stability. (See more on these areas below.) Given that annual inflation is what receives most attention, we are of the view that it is likely that we will not have a clear answer to this question until the end of the third quarter of 2022.

Supply chains –

The supply chain disruption, occasioned by COVID, is attributed as the biggest contributor to inflation in many developed economies. Over the past several decades, the ‘just in time’ approach to inventory management in modern industry – from manufacturing, to retail –

- led to economic globalisation as businesses developed tools, resources and logistics

- to acquire their inputs at the lowest cost,

- often from countries with the lowest labour input cost.

Consequently, many developed economies (with higher wage structures) lost skills and capital resources (manufacturing facilities).

The disadvantage of this development has been highlighted during COVID as borders closed and transfer of goods and services interrupted. The issue was compounded as successive variants of the virus impacted the work force that provided –

- the logistics of importation (unloading ships, clearing containers from docks), and

- distribution (transporting the goods to warehouses and ultimately to end-users).

The result was obvious to all consumers, when –

- retail store shelves were unable to be replenished,

- building materials prevented the construction of houses (and impacted renovations progress), and

- new cars were slowed in manufacture because of the unavailability of computer chips on which the modern car is so dependent.

Inflation is exacerbated when supply and demand are ‘out of balance’ –

- when the supply of goods and/ or services is inadequate to meet demand, prices tend upwards; and conversely,

- when the demand for goods is less than the supply of them, prices tend downwards.

There is a sense that the logistics issues described above are likely to be overcome during the course of 2022, both –

- through innovative solutions, and

- by a rebalancing of the supply/demand equation as consumers refocus their intentions.

We agree with this view but hold reservation that inflation will completely normalise during this calendar year.

Central Bank errors –

The Central Banks (CBs) role in the economy is –

- keeping the financial system stable in a way that facilitates the economy to grow and develop,

- facilitating improvement in the lifestyle of the population.

At least for Australia, the USA and the UK, the key areas of focus for the CBs are –

- to ‘manage’ inflation within established ranges they set for themselves; and

- support the labour market toward full employment. (This measure means different things to the CBs of different countries; and it changes from time to time).

For many decades since the CBs were established, the primary tool they used to control these economic elements of the economy has been the official interest rates they imposed on the financial (banking) system.

Since the Global Financial Crisis (the GFC) of 2008, another weapon has been added to their arsenal. This new ‘weapon’ is quantitative controls (easing; or tightening) that they exercise in a number of ways. The popular methods include –

- purchase and/ or sale of Bonds. (Treasury Bonds traditionally; and ‘corporate’ bonds, more recently.),

- with then transactions undertaken to add or withdraw liquidity from the economy.

The opportunities to make mistakes in the use of their arsenal are several, but mainly relate to –

- the timing of their deployment, or

- the strength at which they are deployed.

Increasing interest rates too early, too quickly, or by too much will act as –

- a dampener on the economy,

- destroy asset value, and

- diminish employment opportunities.

Doing so too slowly heightens the risk that excess liquidity in the economy will allow asset prices to run rampant and increase the risk of business failure when the ultimate tightening point is exercised vigorously.

The RBA outlook

At time of writing, our view is that Australia has these measures about right through the RBA. We suspect that the UK may have gone too early; and that the USA may be lagging in their efforts. The ‘weight’ of the US economy forces us to be aware of their actions and adjust our investment programs accordingly. We will be watching their actions very closely during the first two quarters of 2022.

Wage growth –

Wage growth is significant on a number of fronts, both personally and for the economy more generally. Wages need to grow at a rate at least equal to the rate of inflation. For those individuals whose wages are stagnant or growing slower than inflation will suffer a decline in their living standard. This affect is felt most adversely amongst those with the lowest standards of living in an economy.

The most satisfactory way for wages to grow, is for the members of the workforce to be more productive in performing their duties – and this can be achieved in a number of ways, such as becoming more efficient through experience, improvements in processes, and/ or utilising technology. There will ultimately, be a sharing of the benefits of this productivity between the provider of the labour (the employee) and the provider of the resources such as training, suitable work environment and appropriate plant and equipment (the employer).

The economy benefits from both earned wage increases, and from increased workforce participation, as the goods they produce and services they deliver are consumed in the economy – or exported to others in return for valuable foreign currency.

Workforce participation

The current state of developed economies is that unemployment is low, wage growth is modest (in some economies, still low) and workforce participation has fallen since the beginning of the pandemic. This latter feature of the labour market is broadly attributed to the actions taken by governments in response to COVID with payroll support and individual support during various lockdown situations.

We are of the view that wage growth will stay constrained for some time yet, but we hold some hope that workforce participation will lift, and the unemployment rate stay low as we (the world) adjust to ‘living with COVID’: we are cautiously optimistic about the economy in this area.

Wealth imbalance/ inequity –

One of the emerging themes in investment markets in recent years is the Environmental, Social and Governance (ESG) attributes of organisations and institutions. The matter of wealth inequity is clearly an issue in the evaluation of Social management practices and principles of enterprises.

As with each of the issues we have identified as matters to take into account as Risk factors for 2022, wealth inequity is one that is resolved or exacerbated by other issues: its complexity means that it could be the subject of an extensive article on its own. Some readers may question why wealth inequity is a concern for investment markets: the two most concerning answers to that question are –

- The health and well-being of the workforce (and thus, the community generally); and

- The threat of civil unrest when inequity is accompanied by injustice and mistreatment.

Many studies over recent times have revealed that the rate of growth of wealth inequity has increased since the time of the GFC; and is emerging as a bigger issue again since the advent of COVID. There are concerns that this is an emerging threat to economic and civil stability; and that, whilst there is no immediate threat of a complete breakdown, the sense is that action should be taken soon to address the problem before it does become a civil unrest disaster.

Wealth redistribution

The addressing will mean a shift in the allocation of profits (and wealth) from future productivity but is one that may not have such a great impact on the economy as some fear, by virtue of the way the rebalanced wealth will be put to use by those who benefit from the change. It is a well-recognised economic fact that the less financially well-off spend a higher proportion of any new funds they receive than do those with financial resources in reserve: this spending will reflect in greater economic activity and the ‘size of the pie’ (to be shared) will grow.

We are of the view that there will be minimal impact for investments on this account as we consider the economic and markets outlook for 2022.

Climate change resolve –

Regardless of the camp that we sit in regarding the impact of industrial activity and atmospheric pollution by carbon dioxide, other harmful chemicals and material particles on the climate and the reason that it is changing, the evidence is being more widely interpreted now, that human activity is at the least, exacerbating climate change even if the jury is still out on whether it is the cause (and we hasten to acknowledge the significant section of the community who have no doubts about this matter).

The issue is that governments around the world need to encourage, initiate, and support action to reduce pollution and carbon and other harmful chemical emissions – and they need to do this in an urgent and coordinated way. There is a long-standing investment adage that the sooner you start investing for your long-term future, the less painful it is on your current lifestyle: this adage also applies to the climate change question – the best time for economies to start addressing these issues is now, and together.

The unified approach is important so that the effects of the change are immediately measurable (and observable); but the timing of the change is less straight forward, as resources, infrastructure and investment/ divestment are managed through the process.

From an investment viewpoint, this issue is actively considered by investors at the retail, corporate and institutional level as part of the E in the aforementioned ESG calculation and on that front, corporations are getting ahead of governments by initiating change – and these corporations are being rewarded by consumers, and by investors for their activity.

We believe that this will be a continuing and increasingly important aspect of investment research and risk management consideration this year and beyond.

Geopolitical instability –

Looking back at previous issues of our economic and markets outlook, this issue is omnipresent for investors: it seems that unrest within countries and aggression between them is always with us in one form or another; and in one part of the world or another. Whilst these turbulent events are not always of consequence on our personal safety, on our individual lifestyle, or on access to the goods and services that we rely on, we need to remain vigilant to those areas that will impact us economically and/ or from an investment market standpoint.

Humanitarian issues that can impact our lives are ever-present in these scenarios – and should not be discounted because they have little economic impact for us, but threatening behaviour by rogue elements or states (countries) can quickly escalate in a way that will bring about the adverse effect that we seek to avoid. Resources, supply chains, and national security all have to be considered in this context.

Our view at the time of writing is that the geopolitical disharmony between China and several developed economies needs to be closely monitored as part of this concern; Russia and its threat to the Ukraine and the flow-on effects that might have for resources flowing into Europe is a red flag at present; and areas such as the Middle East and Afghanistan and what might flow from those areas are also on our radar (and that of the researchers, analysts and fund managers we follow).

Coronavirus variants –

There has been much ADO about COVID (i.e., Alpha, Delta and Omicron variants) and the unfortunate experience is that the longer we persist in this state of pandemic, the less clear are the messages as to how best to protect the population from the virus. The lack of clarity leads to confusion, and the confusion leads to uncertainty: and uncertainty in the minds of consumers, business leaders and political leaders becomes threatening to investment markets.

As we have espoused in numerous previous articles and communications, investors do not respond well to uncertainty and the markets often experience volatility whilst that uncertainty prevails. (More on volatility later in this article.)

Treatments for and protection from COVID-19 continue to be developed and are largely endorsed and welcomed in most communities: the threat regarding new variants, however, arises from the low vaccination rates of people in under-developed countries around the world. As the virus has more freedom to move in those populations, it is more able to mutate and present with further variants.

From an investment viewpoint, the uncertainty mentioned above, is heightened in this environment, and we remain alert to philosophies that consider sustainability of economic enterprise in coping with this situation.

Asset allocation -v- Risk management –

Asset allocation in building an investment portfolio is the process by which an asset manager reflects the financial aspirations of the investors for whom they manage funds, within prescribed investment risk aversion constraints. Traditionally, portfolios have been built utilising assets acquired through public markets including, but not limited to stock exchanges (such as the ASX, Wall Street’s NYSE etc) for shares (equities), and similar markets for bonds and other ‘securities’. In the evolution of such traded assets, those other securities have included managed funds (also known as mutual funds), other fixed income securities, and derivatives of the traditional assets. More recently, access to private equity investments is being provided for some retail investors.

For more than a decade now, we have been communicating to clients and our readers generally, that interest rates and returns on investments will be ‘lower for longer’. This mantra is still being proclaimed by many – and in the traditional sense, we also continue to subscribe to it. The outcome of that learning by investors, which has been their experience now for most of the period since the afore-referenced GFC, is that they are fighting back by accepting higher levels of investment risk in their search for higher returns.

Earlier in this article, we referenced the extra liquidity in financial markets as a consequence of monetary policy (low official interest rates, Bond purchases) and fiscal policy (employee support, business support, and economic stimulus through tax breaks and government spending): this same liquidity that many have appreciated and benefited from directly, has also resulted in higher prices for shares and other assets. With higher prices, it is often (usually) the case that yields reduce – i.e., returns are lower.

Time – and timing – of market participation

This understandable search for improved yields, ensuring that investments are achieving financial goals, impacts investors differently at different phases of their life journey: those with a longer-term horizon (say with 10 or more years to anticipated retirement) are more likely to be able to cope with the volatility that we expect to persist for the near- to medium-term, than are those who are within a year or two of – or are already in – their retirement phase. There are a couple of obvious reasons for this, including that those with time to plan are still accumulating, have no requirement to sell-down and can wait for markets to recover, based on their capital base preceding the fall; whereas those in retirement are decumulating and the recovery they can participate in is from a reduced base.

We believe that attention to portfolio construction – asset allocation and risk management – will be a feature of the service our clients will be looking to us to provide comfort and assurance about at an even higher level than is currently the case, for the whole of the 2022 calendar year.

After all of that, what is our view as to what the future holds, economically and financially?

Please note that this article is not personal advice, nor is it general advice, but rather expresses views and opinions that we share so that clients (both existing and prospective) have an understanding as to the biases we may bring to the advice we provide during the current calendar year; and that it is subject to revision as the year unfolds and new facts become known.

In summary,

we see the following as features of the economic and markets outlook 2022, for the calendar year and perhaps beyond:

- Reasonably persistent volatility in public market asset values/ prices that could be as extreme as ‘corrections’ (price drops from peak to trough exceeding 10%);

- Inflation to moderate and eventually decline over the year;

- Supply chains to be normalised, as we learn to manage life with COVID;

- Increasing transparency in reporting by managers of privately-held assets;

- Some realignment of asset allocation to manage emerging market risks;

- Central Banks start/ continue the increase in official interest rates (but with cautious steps for this year);

- Little movement in wage/wealth inequity (in either direction);

- Higher level of workforce participation, albeit that some of that increase will be as self-employed and/ or in micro business;

- ESG issues will continue to drive enterprise to get ahead of government, until they force the hand of government to provide a stable pathway;

- Developed nations to more liberally share their resources with under-developed countries to help reduce the risks of further COVID-variants.

At the end of the year, we look forward to reflecting on financial returns that are positive – even if only at a sustainable long-term rate (and we note that a Balanced portfolio return of around 7% as has been forecast for 2022 in a few articles over the past couple of months).

Concluding comment

Regardless of all of this, whether the above ‘plays out’ or is totally ‘off key’, we will be monitoring developments in markets, with asset fundamentals, the investment philosophy of researchers and managers on whom we rely, and the needs and concerns of our clients, to serve the best interests they proclaim to us in their stated financial goals and objectives.

Update with our advisors

We have published economioc and market outlooks annually for a number of years now. Each year’s presentation is different, reflecting the prevailing sentiments of the year ahead. To discuss how these views might influence your investment strategies, make an appointment with one of our experienced advisers –

- phone our office, on 07-34213456, or

- at your convenience, use the linked Book A Meeting facility.

(This article was first posted by us in January 2022. It has occasionally been refreshed/ updated, most recently in June 2025.)