Estate Planning is an important – and sometimes complex – process. Estate planning with a testamentary trust may appear complicated, but the complexity of some family situations, make it worthwhile. It can be both cost effective, and efficient for the administration of a deceased estate.

What is a testamentary trust?

A testamentary trust is a trust established under the terms of a Will. It is usually reasonably discretionary in form; and only comes into existence on the death of the testator.

The role of the trustee of the testamentary trust is not unlike that of the trustee of closely-held family trust. The Trust terms specified in the Last Will and Testament of the testator will dictate the Trustee’s activities. The benefits intended for the testator’s beneficiaries will be administered over time, according to their wishes.

Like any trust, a testamentary trust can be as flexible or as fixed as the testator decides. The trustee can be assigned the appropriate level of discretion regarding income and capital distributions from the trust. They can also be directed as to when beneficiaries should receive their bequest.

Why are testamentary trusts used in estate planning?

Testamentary trusts can be used for a variety of purposes, including –

- Minimisation of taxation impacts on the estate. (This includes income tax and capital gains tax. In some circumstances, it may even reduce stamp duty and land tax imposts. In part, minimisation may be by extending the period over which income benefits are paid to beneficiaries. See instances below.)

- Protecting spendthrift beneficiaries from themselves. (By deferring their direct control of the assets: refer Illustration below);

- Caring for children and the profoundly disabled (in the latter case, a special form of trust will be available);

- Keeping an inheritance out of the reach of the Family Law Court where a beneficiary may become involved in a family law property dispute. (Bear in mind though that this may not avoid the financial resource being taken into account);

- Protecting inheritances from a beneficiary’s creditors;

- (Potentially for) avoiding an unintended loss by a beneficiary of their Government sourced pension or other benefit.

Who controls the assets held in a testamentary trust?

As with any trust arrangement, the control of the assets in ‘a trust’ is in the hands of the appointed trustee. In the course of an estate planning exercise, the testator will nominate in their Will, the person they believe most suitable to act as trustee (and consequently to control the trust assets).

The trustee may be the same person who was appointed as executor and can also be a beneficiary. For example, a parent can establish a testamentary trust for each child’s inheritance. Each adult child can be the trustee of their own trust (although there may be reasons, to be discussed with your estate planning lawyers, to make appointments exclusively).

Once the executor (legal personal representative) properly transmits/ transfers assets from the estate to the trustee they are no longer estate assets as such and a different process of administration commences.

The time benefit of a testamentary trust

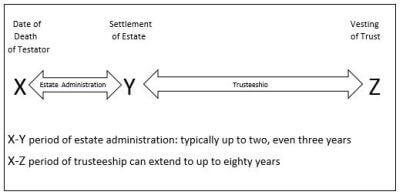

The following illustration shows the effect of including a testamentary trust in the estate plan.

Let’s assume that someone died at point X. The executor’s job involves finding all the assets, paying out any debts and usually, at point Y, distributing the remainder (what is left) to the beneficiaries.

If there is a testamentary trust, part or all of what’s left remains in the estate and is distributed later, at any time between point Y and point Z depending on the terms of the Will. (Under trust law, Point Z could generally be up to 80 years from point X if a testamentary trust is utilised.)

NOTE: A Will can establish more than one testamentary trust.

[When liaising with the professional estate planning advisors, Continuum Financial Planners Pty Ltd will guide you as to

- the appropriate use of such instruments – and that

- appropriate consideration is given to the appointment of trustees in the estate – according to your individual circumstances.]

Where can I get help with Estate Planning?

The Continuum Financial Planners Pty Ltd Estate Planning service offers clients:

- working with them to prepare the detailed information required for their appointed estate planning specialist lawyer; who can then

- consider the client’s individual detail in light of their estate planning experience so as to design a plan appropriate to the client’s present and known likely circumstances; and where needed

- provision of access to our referral connections of such professionals (to whom we are happy to refer you to match their expertise with circumstances such as your own).

The experienced advisers at Continuum Financial Planners Pty Ltd are available to guide you through the preparation of the information to refer to a legal adviser (estate planning specialist) and where necessary, a taxation specialist, so as to ensure that all relevant detail is provided to them to ensure your estate planning strategies are determined as effectively as possible.

To make an appointment to get your estate plan started –

phone our office, on 07-34213456), or

at your convenience, use the linked Book A Meeting facility.

More about Estate Planning…

This is the eleventh in a series of 13 articles on the topic of Estate Planning: further articles in the series seek to bring clarity to some of the issues and implications to be dealt with in fulfilling the three key considerations of Estate Planning – getting the right amount of money, to the right beneficiaries and at the right time; and to prepare you and your family to understand the final plan when drafted. The remaining articles consider –

- Estate Planning outlined;

- Estate planning and flexibility in the modern Will;

- Asset protection using Estate Planning;

- Superannuation death benefit nominations and Estate Planning;

- Estate planning and Business Succession planning;

- Capital Gains Tax impact on estate planning;

- Estate planning and family loans;

- Estate planning and company-owned assets;

- Estate planning for a SMSF trustee;

- Estate planning and superannuation assets;

- Estate planning for younger children; and

- Estate planning dependent on a valid Will.

(This article was first published in January 2012. It has occasionally been refreshed/ updated, most recently in May 2025.)