Gearing investments to accumulate wealth

Gearing investments is a long-standing strategy to increase the funds at work in an investment portfolio: as we explain in this article, the gearing process has an accelerating effect on market changes – increasing both the rises and the falls, according to the level of the gearing undertaken.

What is involved in gearing investments?

Do you know what it means to ‘leverage’ an asset?

Would you accept some ‘risk’ to grow your wealth?

Is there a safe level of ‘gearing’ that makes a meaningful difference to the accumulation of wealth?

We have published a number of articles in our website Library that show the value of regularly building on an investment portfolio (for example, The Tortoise and the Hare…; and Slowly but surely…): others have also expounded the virtues of dollar-cost-averaging and of ‘the magic of compound interest/ earnings’ (for example, see ‘Dollar Cost Averaging’). Whilst investors occasionally enquire about the benefits of gearing investments, it is notable that even in the continuing low interest rate environment since the 2008 GFC, there has been reluctance to enter into such arrangements.

Where do most people experience ‘gearing’?

Most people who purchase a home know that it is only the fortunate few (or those who live in less populace areas perhaps) who can afford to purchase a home without having a reasonably substantial mortgage debt (a form of ‘gearing’). By using the lender’s funds a purchaser can acquire a home with a value of say $350,000 even though they only have accumulated savings of say, $100,000. Any growth in the value of that asset will all belong to the homeowner, not the lender.

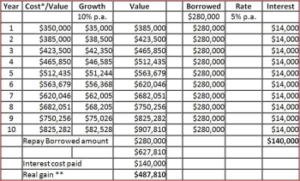

As a consequence of this factor, if the home loan has been raised at say, 5% per annum and over time, the value of the property grows at an annual rate of 10%, then after ten years the property will be worth over $900,000 – and the borrower will only repay the original amount borrowed (having met interest costs along the way!). The following Table shows the benefit of this strategy –

Notes to the above Table:

Whilst gearing (funds borrowed to make the investment) is at 80% in the above example, this is not a level of gearing that is palatable – or in fact even available – to most investors.

* Cost in this example excludes acquisition costs of stamp duty, legal; and ‘inspection’ and related costs, but the borrowed amount takes these into account.

** This gain needs to be adjusted for inflation to be considered ‘real’ but the borrowed money also needs to be similarly down-valued to reflect a still rather healthy gain.

NOTE: assumed in this instance that the funds borrowed were taken on an interest-only basis.

Will gearing investments work with other assets?

Whilst there are a number of assumptions made (or ignored) in the example shown in the above Table, the principle is applicable and can apply to investments in shares, managed funds and other investment asset classes. It can be shown that modest gearing into assets whose growth and income prospects are greater over the available time-frame than the interest and holding/ operating costs, will leverage the gains to be made over that time. (Note: there is always the inherent risk that an untimely significant market downturn will also leverage the loss that could be incurred in such an investment.)

Only investors who have an appropriate risk profile should contemplate any level of gearing for their portfolio: we can assess you so as to determine whether you really are prepared for the ‘shocks’ that might accompany such a strategy (as well as be welcoming of the potential benefits!).

Continuum Financial Planners can also show you a level of borrowing at which gearing investments can be undertaken and that should never result in a margin call: nor a loss in value that would put in question the security of the investment made.

Combining the benefits of dollar-cost-averaging, compounded earnings and modest gearing can produce rewarding outcomes for the patient and well-advised investor. If you have an interest in making such an investment – whether for yourself or for a family member as part of a long-term strategy – call our office on 07-34213456; or use the website Contact Us facility to make an appointment with one of our experienced financial advisers.

(This article was originally posted in October 2013: it has occasionally been updated and/ or refreshed, most recently in September 2020.)