Income Protection Insurance (aka Salary Continuance Insurance under some Superannuation accounts)

Income Protection Insurance provides financial protection against a loss of income whilst unable to work due to illness or injury. The specifics of eligible disability are detailed in the Policy Definitions.

The policy will provide for the insured to be paid a prescribed benefit –

- after the conditions of disablement have been met and

- the nominated waiting period has elapsed.

Generally, to qualify for an income protection benefit the insured must be –

- unable to perform at least one of the duties of their occupation,

- not be working, and

- be ‘under the care’ of a doctor.

Note that over time, insurers vary the definitions that qualify as the eligibility conditions of disablement. There were changes to the law surrounding this form of insurance, during 2020, including to the regime of occupation definitions. The main impact of those changes have been experienced since October 2021. You are encouraged to review policy definitions with your financial adviser. The ‘occupation definition’ in the policy documentation will specify the level of disability that will qualify the insured for benefit. This is explained further, below.

Income Protection insurance policies were previously issued on an ‘agreed value’ basis, as well as on an indemnity basis. Agreed Value policies have not been available since October 2021.

Who is eligible for Income Protection insurance cover?

Income protection insurance (IPI) is particularly suited to the following groups of people:

- The self-employed;

- Those who primarily earn commissions on sales;

- Salary earners with limited sick leave provisions.

Others will be eligible to take protective cover under an IPI policy. Where there is debt and/ or financial strategies in place relying on regular funding, they they are certainly warranted. An experienced financial planner should be consulted before dismissing the relevance of IPI in your circumstances.

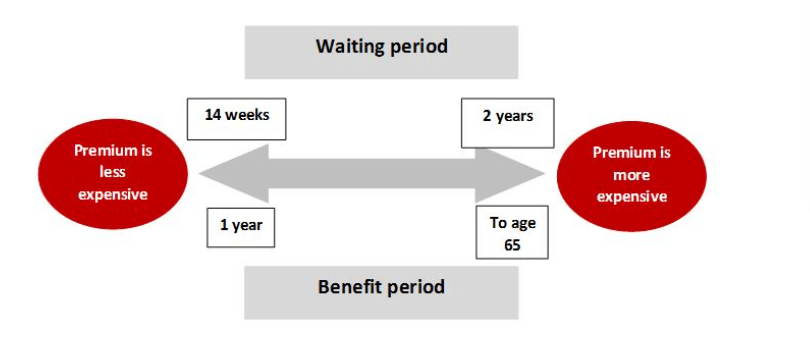

There is a waiting period before Income Protection Insurance benefits are paid:

An insured person, eligible for a claim under their income protection insurance will have to wait –

- for a period between disablement and the commencement of receiving benefits;

- the waiting period is normally 14, 30, 60, or 90 days, but can extend to 2 years.

Generally speaking, the shorter the period, the higher the premium. See the graph below, highlighting this aspect –

Personal cashflow considerations

Insurers generally pay the benefit amount under an IPI policy 30 days after the qualifying waiting period has been met. The payments continuously at monthly intervals during the eligible benefit period. If you have a 14-day waiting period, you will actually wait 44 days to receive the first benefit amount. You will wait 90 days to receive the first payment under a 60-day waiting period policy schedule.

Some IPI policies allow for the waiting period to be interrupted by attempts to return to work.

The amount of benefit available under Income Protection Insurance is ‘limited’

Most policies traditionally offered a maximum of 75% of the insured’s recent income, payable each month during the continuance of the qualifying disability. A few insurers added superannuation contribution options to this cover (at added premium cost). The claim amount may be reduced if the insured receives income from other sources including another income protection policy, social security, or worker’s compensation.

The 2020 revisions

The 2020 revision of regulations on this type of policy significantly changed previous expectations. These impact a few areas, summarised as –

- the income on which the insured amount is calculated;

- restricting total benefits payable under the policy; and

- varying the rules regarding guaranteed insurability.

Income on which insurance/ claims based:

- is the income stable, or variable?

- For stable income, the insured income has to be based on annual earnings at time of claim, not older than twelve months;

- For variable income, the insured income has to be based on –

-

- Annual average earnings over an appropriate period,

- Reflecting the policyholders occupation, and

- Future earnings lost due to the disability.

-

Benefits available under an IPI policy

- Total benefits under the policy cannot exceed 90% of the insured income at risk – for the first 6 months of a claim; and

- Not exceed 70% of that insured income, for the remainder of the claim period;

- Payments to third party rehabilitation/ retraining service providers working to return the insured to work,

- can be paid in excess of the above limits, as can

- contributions to superannuation funds (directly)

Guaranteed insurability

- post-1 October 2022 policies not to be in force beyond 5 years;

- continuation of cover beyond 5 years with the original insurer is allowed, subject to –

- a medical review (may be required by the insurer), and

- terms and conditions on offer from that insurer at the relevant renewal date.

The occupation definition applicable can affect the eligibility of a claim

The determination as to whether a claim will be paid will be based on whether the income protection policy definition covers the insured for ‘any occupation’ – or limits their income earning incapacity to some ‘suitable occupation’. Whilst these terms are compatible in some occupations, where a distinction can be drawn, it is important to ensure the correct definition is applicable to the policy you hold:

- Under a ‘suitable occupation’ definition, the insurer will pay the benefit where the insured is unable to perform one or more key elements of an occupation to which their education, experience and skills makes them suitable;

- • Under an ‘any occupation’ policy, the insurer has greater scope to require the insured to undertake employment for which they consider the insured reasonably capable of, through prior training, qualification or experience.

‘Suitable Occupation’ protection invokes a higher premium cost than ‘any occupation’ cover.

Other features

The insurer may reimburse the insured for emergency transport costs incurred outside of Australia.

If the insured has a recurring disability, the insurer may waive the second waiting period if it occurs within a short time after the first benefit period. That is, the second benefit period may be regarded as a continuation of the first benefit period.

As you might expect, the more favourable the benefits sought to be covered under your IPI policy, the higher the premium cost is likely to be.

Tax treatment

The proceeds of income protection policies are assessable at the client’s marginal rate of tax. Premiums are fully deductible.

It’s time to act…

Continuum Financial Planners recommend using income protection insurance as a wealth protection measure in their financial plans: it provides regular income stream to support the cash flow needs of the insured (and their dependants) – but must be initiated whilst a person is gainfully employed. Our service includes conduct of annual reviews of insurance policies to ensure adequacy and relevance for the owners: contact us to meet one of our financial advisers.

(We acknowledge the substantive input to this article from the Deutsche Bank Desk Caddie article. We have modified the Desk Caddie material to meet additional needs for the purposes of our website.)

(This article was originally posted by us in August 2011. It has occasionally been updated/ refreshed, most recently in January 2025.)