The benefit of investing overseas

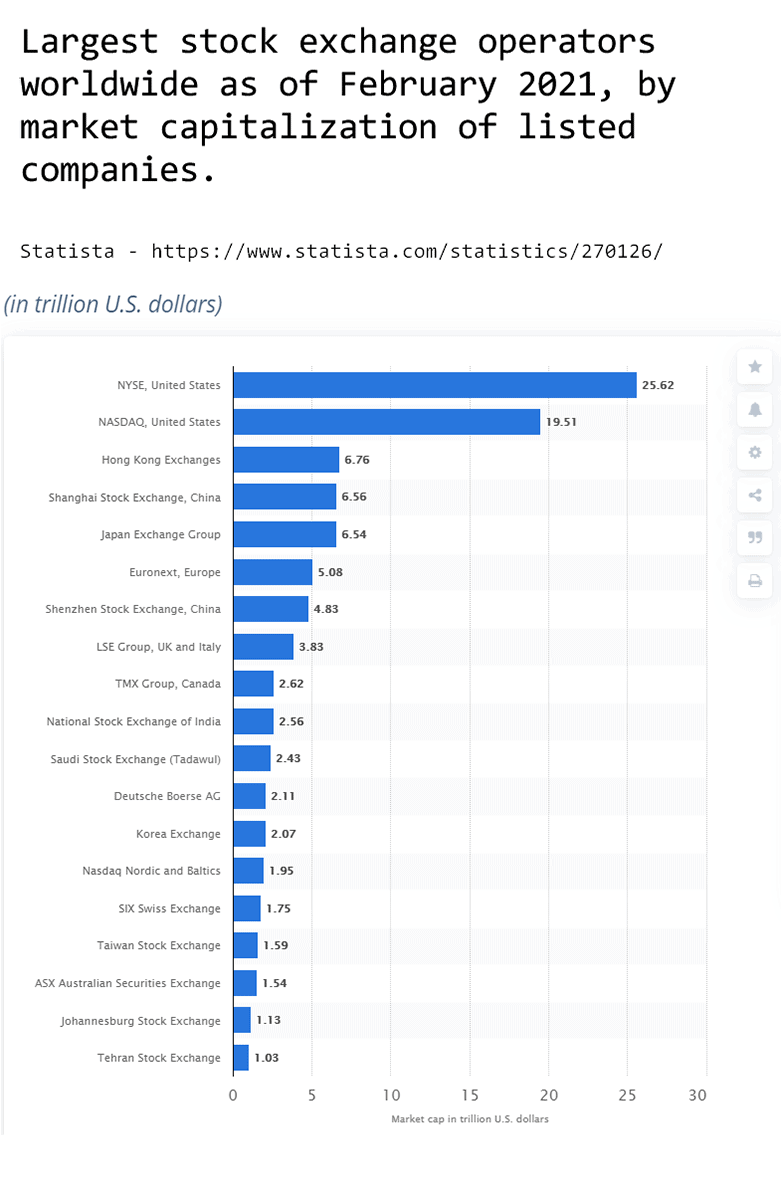

In global terms, the Australian equities market is quite small and is less than three per cent of global equities on a market capitalisation basis. This represents only a small proportion of the world’s investment opportunities: investing overseas allows Australian investors greater portfolio diversification; and through that, risk management.

Investing in overseas markets opens up a range of potential investments much greater than that available in Australia.

Should I consider investing overseas?

Investing overseas gives you access to a much larger range of investment classes which, as part of a balanced investment portfolio, have the potential to give you higher returns with lower risk.

The reduction in risk comes about because not all markets move up or down at the same time. World economies have different rates of inflation, varying interest rates and different rates of economic growth. Diversifying allows you to benefit from strong performing markets at times when other markets may not be performing as well.

Investing overseas allows you access to investments with characteristics that differ to those available in Australia. For example, it can open up opportunities to invest in companies and industry sectors largely unavailable in Australia. It may also be possible to purchase investments with a longer time horizon, such as 30-year Treasury bonds in the USA (and since 2016, 100 year Bonds in Europe).

What are some of the risks of investing overseas?

Investing overseas is considered a high risk investment and it can be quite volatile in the short-term. However, over the longer-term, investments with higher levels of risk or volatility generally produce higher returns. It is important to invest in assets with a degree of risk that you feel comfortable with.

Investing overseas exposes you to the effects of currency movements. If international share markets are rising and the Australian dollar is falling, it is possible to make two profits, one from the share market and one from the currency. If the reverse occurs, you may make a greater loss. Many fund managers try to limit this risk by using hedging instruments such as futures and options.

Do I have to pay tax on earnings from overseas investments?

Like applies to earnings from all investments, Australian investors have to pay tax on investment returns when investing overseas. Any income and realised capital gains from overseas property, shares and fixed interest investments may be subject to foreign tax, such as withholding tax.

If you pay tax in another country and in Australia on the same overseas investment, you are generally entitled to a tax credit in Australia to offset the effect of double taxation.

How do I go about investing overseas?

There are two ways in which you can invest overseas:

- Through a professionally managed international unit trusts, or

- By directly buying shares on overseas stockmarkets – usually with arrangements with a Bank or stockbroker, operating with a foreign currency account.

A unit trust allows individual investors to pool their money to access a greater range of investment opportunities. Unit trusts have the benefit of a team of professional investment specialists who are responsible for investment decisions.

They aim to get the best returns and manage the complex issues of taxation and currency movements. You may invest in either a unit trust that invests only in international investments or a trust that invests in both the Australian and international markets.

It is possible to invest overseas on your own but this often requires a large outlay of money. It also requires a lot of time and expertise to analyse financial markets and currency movements. Most Australian investors access overseas shares through professionally managed unit trusts.

Continuum Financial Planners can help…

Investing overseas can help to diversify your portfolio, but needs to be understood as to the taxation consequences and the potential effects of currency value changes: to seek advice as to how this asset class might benefit your investment strategy, call our office (on 07-34213456), or by completing the Contact Us form on our website and arrange an appointment with one of our experienced financial advisers.

We acknowledge the resources of Securitor Financial Group Limited in drafting the majority of the detail in the above article: it was extracted from the Support Information to advice documents in May 2010. We have refreshed and updated the article periodically – most recently in August 2016.