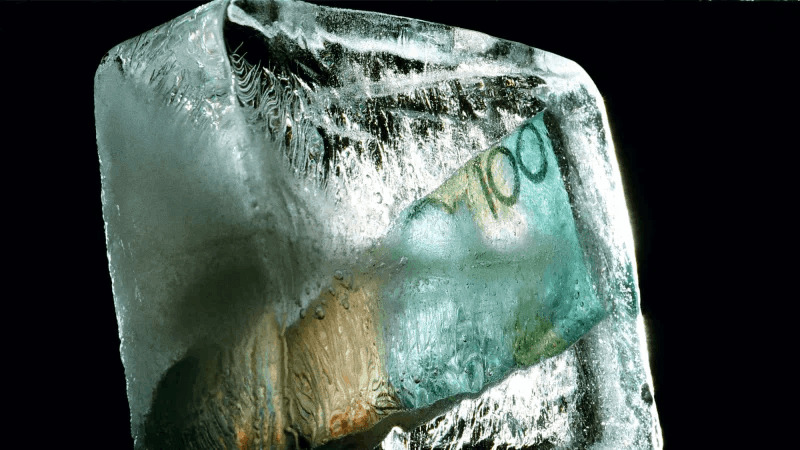

Portfolio liquidity impacted when investment funds access restricted

Since the advent of the GFC, the management of frozen investment funds frozen has been a focus for financial advisers. Investment funds in some assets can be frozen, or closed, in response to financial market events. Other economic circumstances can have a similar effect. When these events are unexpected investor dilemmas are multi-fold. They included dealing with the concerns that –

- their funds are at complete risk, and secondly,

- the financial resources tied up in these funds, preclude participation in the inevitable market recovery.

Why does this happen?

Investors who have a portion of their portfolio –

- invested in frozen funds (often mortgage and/ or income funds), or

- were wanting to do so,

became frustrated with the government decision to provide a guarantee for deposits at ‘Banks’. The introduction of the guarantee (in the aftermath of the GFC) led to a run on other ‘cash deposit’ managers, including their particular funds.

Fund Managers have had to respond in turn by –

- restricting further deposits, and

- placing restrictive conditions on redemptions

– giving rise to the term, ‘frozen’.

In the years since the GFC, investors have become more aware of the illiquidity that can accompany some investments – such as property trusts, private equity, and other assets. These opportunities carry similar effects of illiquidity as the investment industry learned to manage in that GFC event aftermath.

Managing client portfolios containing illiquid funds

Your Continuum Financial Planners team is skilled and experienced at monitoring illiquid assets. We are able to provide recommendations as to appropriate action for our clients’ individual circumstances.

A satisfying feature of many of the GST-era funds was that they continued to pay reasonable regular income – and presented only limited insolvency ‘threat’.

The current products that are being incorporated into diversified investment portfolios are also promising acceptable returns. The risk of insolvency is always one for consideration, but in today’s offerings, is less threatening than was the case for those GFC-era investors.

Managing investment funds

The experienced team at Continuum Financial Planners Pty Ltd is ready and able to assist you with your wealth management goals. Our experienced team of professional advisers can assist with –

- dealing with investment funds that have been frozen or are illiquid, or

- releasing accumulated funds to invest in a strategically targeted set of goals.

To arrange an appointment with one of our advisers –

- phone our office on 07 3421 3456, or

- at your convenience, use the linked Book A Meeting facility.

We look forward to servicing you under our mantra that –

‘we listen, we understand; and we have solutions’

that we deliver as

personalised, professional wealth management advice.

(This post was originally posted by us in February 2009. We occasionally update/ refresh it, most recently in June 2025.)