Investor risk profiling is a process that assesses how much risk an investor is willing to take with their portfolio. Where appropriate, investable assets can be siloed, and a different risk profile applied to each group of assets. The overall risk profile of the entire portfolio should remain within the range tolerable to the investor.

Some elements that influence your risk profile

Each investment asset class has an array of risks associated with it. Some of the risks include yield, liquidity, economic factors, regulatory change, environmental effects, and cultural considerations. When assessing an investor’s risk profile, their attitude to the questions raised is reviewed in detail. Different levels of risk aversion are assigned to different responses to some of them.

When answers are posed to/ by the investor as to matters such as:

- how long the investment is to be held for;

- what capital is expected to be available at maturity;

- how dependent they are on the particular investment;

- what their attitude is to matters such as Environmental, Ethical, Social and Governance issues; and

- investment asset preferences,

their risk profile is used as a filter by which the assets can be included in their portfolio.

An investor risk profile should help in your understanding of your reactions to market effects on your portfolio. Investing accordingly should give you peace of mind that your investments are being managed without raising anxiety.

Looking for better peace of mind about your investments?

There are several risk profiling tools available for use by/ for an investor. Most financial planning firms have a workbook or online tool available to have the investor client complete. They then review their answers with them to determine their risk aversion tolerance.

When correctly applied, the consequential asset selection should reflect in a portfolio with which the investor is comfortable . Thereafter, it should work progressively toward the achievement of their financial goals. In that process they should better be able to sleep at night. They can have confidence that any market volatility can be tolerated and unlikely to detract from the expected outcome.

How well do you cope with unpredictable adversity?

What is your level of anxiety as an investor?

Are you considering a geared portfolio?

Answers to these questions will be influenced by your stage of life; the level of wealth you have accumulated; the certainty of your cashflow stream (income); and your past experiences as an investor. In a professional environment, risk profiling is used by investment advisers to determine an appropriate asset allocation within your portfolio – and how to help you understand what market movements mean to that portfolio over time.

Understanding risk can relieve investor anxiety

For a significant number of investors, the concerns that cause most anxiety fall into two categories: financial; and emotional. They include –

Financial

- loss of capital (investment capital lost during market volatility/ upheaval);

- income volatility (interest rates, rent and dividends can all fall or rise according to economic/ financial circumstances); and

- duration of wealth (will the capital accumulated last long enough to meet the goals sought).

Feelings

- uncertainty (about the influences on investment assets);

- confidence (anxiety over any lack of transparency/ knowledge);

- event duration (concern when volatility is prolonged).

The features and characteristics of assets constituting the investment portfolio that could cause investors concern, include whether –

- the assets maintain a reliable, clearly understood ‘returns’ profile;

- the capital value of the assets moves within acceptable ranges during market changes;

- the liquidity of the assets remains adequate in changing markets;

- the size and duration of any fluctuations in any of these matters is acceptable; and

- there is stability in the management engaged with the assets.

Ranges of risk profiles

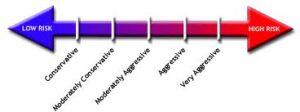

There are several categories of investor risk aversion profiles: depending on how you rate them, they range from Extremely Low Risk (Cash only), through to Extremely High Risk (Growth/ speculative assets only) – but there are five fairly well accepted profiles between those extremes. Different Australian Financial Services Licensees (AFSLs) name them differently, but they all translate to a similar risk profile of the appropriate portfolio and are represented as comprising Defensive to Growth assets, usually in the following ranges (+/- up to 10%) –

(A question raised above as to whether a geared portfolio is being considered: this should NOT be contemplated by most investors whose risk profile is anything other than aggressive or highly aggressive.)

How does risk aversion awareness guide the financial advice process?

Financial planners are required to apply two core standards when delivering investment advice: they are to –

- know their client; and

- know the products they recommend.

At Continuum Financial Planners Pty Ltd, knowledge and awareness of human behaviour patterns, together with the financial and personal data that we glean from you forms the basis of ‘knowing you – our client’. The investor risk profile we establish in discussion with you over the appropriate tool forms part of our knowledge of our clients.

Knowledge of the financial products that we seek to recommend to clients is derived from understanding the financial markets and staying in touch with investment managers of various persuasions (particularly about whom we are satisfied that we have adequate research information).

The assessment of the risk aversion profile – and applying it to the portfolio construction process – ensures that we can recommend an asset allocation strategy that should –

- allow them to sleep at night;

- give their ‘family’ peace of mind about their future;

- achieve their goals over the available timeframe; and

- facilitate understanding that there will be fluctuations over time, in asset values and income arising from investments.

Is your risk profile still appropriate?

Experience over time has shown our team that investor risk profiles should be reviewed periodically. Whilst no exact timeframe is applicable to every client, we believe that the following provide occasions to at least undertake a review exercise –

- whenever there is a significant life event occur;

- following a significant market disruption; and at the least

- every three years.

For example, in the first several years following the GFC, we noted that a number of clients for whom we undertook an investor risk profile review recorded a profile at least one-step more defensive/ conservative than had been the case prior to that event. Clients who had borrowed money to invest in shares, managed funds and/or property prior to that event, often re-rated at a level where gearing their portfolio would have been precluded.

Continuum Financial Planners Pty Ltd uses two assessment processes, each relevant to particular circumstances: one is markets-specific (‘the Risk Profiler’ workbook); the other is psychometric. If you find that market volatility is stressful – and particularly if you are losing sleep over the performance of your investments (including in your superannuation account) – please contact our office and arrange for an investor risk profile review.

To arrange a review meeting with one of our experienced advisers, call our office on 07-34213456; or use our website Contact Us facility and we’ll confirm arrangements with you promptly.

(This article was published in March 2021: it will be refreshed/ updated occasionally in the future, as appropriate.)