Have you had a Capital Gains Tax (CGT) event during the year?

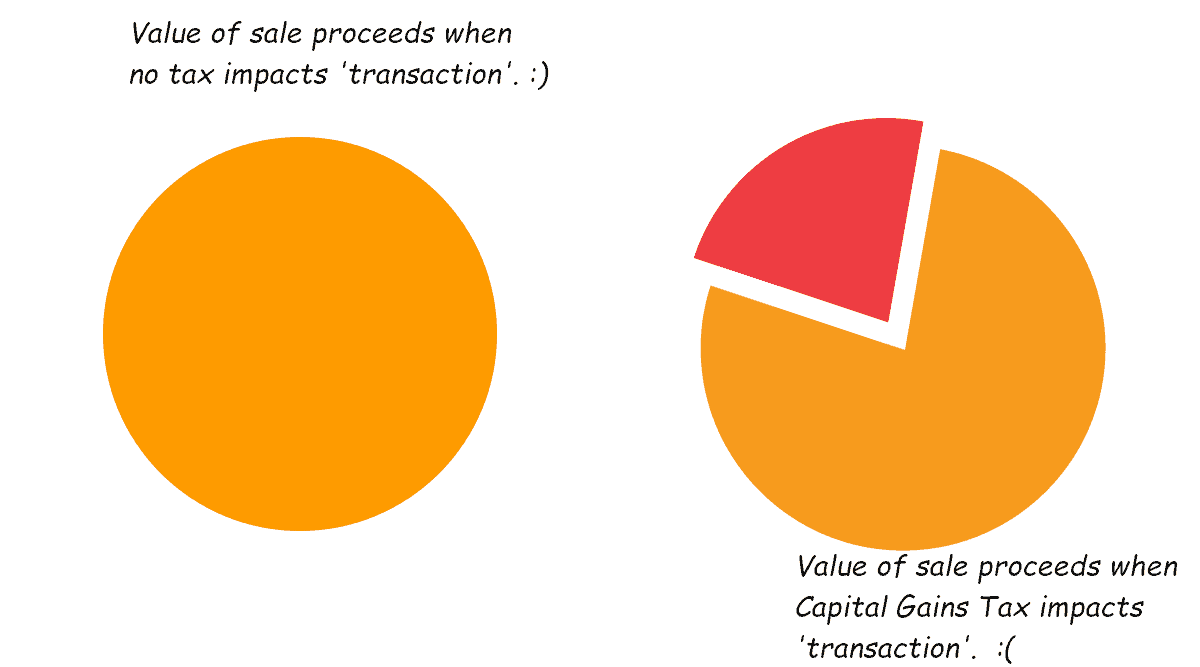

Managing Capital Gains Tax events to minimise the CGT payable optimises the benefit accruing from the ‘transaction’.

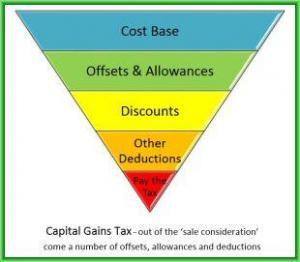

Capital gain during a financial year may arise from the ‘sale’ of an eligible asset. Some of the taxable capital gain may be able to be offset, with either –

- business losses within that same year, or

- capital losses brought forward from prior periods.

Whilst our financial planners can help you to identify events that give rise to a CGT liability, we recommend that –

- you seek the advice of your tax adviser (accountant or lawyer), to confirm that

- you bring to account any ‘transactions’ that could give rise to a Capital Gains Tax liability.

Under the legislation, property transfers without financial compensation, can be caught under this tax impost. (Property has a specific definition in the relevant legislation and regulations.)

(Tip: Always ensure that verifiable detailed asset register records are maintained so that the taxable capital gain can be accurately determined – whichever year it is ultimately realised.)

Investment Strategies that can minimise the impact of CGT

You may also consider the use of following strategies help reduce your taxable gain for the year –

- Rebalance your investment portfolio: take the opportunity to change the asset allocation in your portfolio, focusing in particular on potential losses on underperforming assets. (You could reinvest into better performing assets if cash flow permits: but beware buying back into the same asset immediately – the ATO has issued a warning about this practice as a tax management strategy);

- Invest some of the realised gains into a geared, diversified investment asset portfolio; and/ or

- Make concessional contributions to eligible superannuation accounts.

Getting advice on managing Capital Gains Tax event liabilities

The experienced team of advisers at Continuum Financial Planners Pty Ltd can assist you to implement the strategies needed to minimise the Capital Gains Tax liability –

‘we listen, we understand; and we have solutions…’

to your financial management dilemmas, that we deliver in

personalised, professional wealth management advice.

To make an appoitment to meet with one of our experienced advisers,

- phone our office on 07-34213456; or

- at your convenience, use the linked Book A Meeting facility.

(This article was originally posted by us in June 2012. We occasionally update/ refresh it, most recently in July 2025.)