During times of persistent or extreme market volatility, our advisers are mindful of the effect that has on clients. Apart from the emotional effect, the impact on client portfolios is also considered.

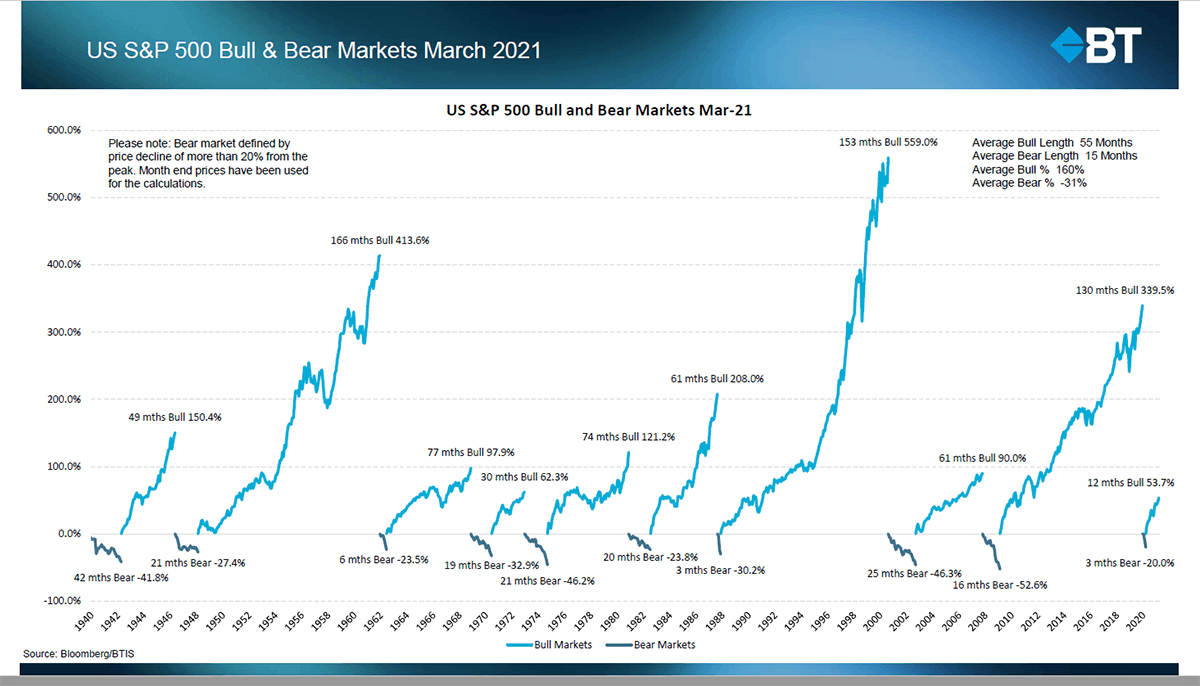

Investors become familiar with the price volatility (valuation rises and falls) and learn to not panic. These are people who participate in markets to attain long term goals. Traders/ speculators and media vendors, increase the hype during these times because of the personal gains they facilitate. These people are the speculators who sell/ buy on the dips. Media vendors profit by selling more of their ‘news’.

Our earlier message to clients

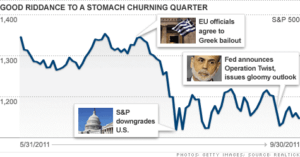

In August 2011 we sent the following message to our investor clients:

Causes of volatility

“While you were sleeping, the ratings agencies threatened a downgrade of the credit rating for France. The USA Super Committee became deadlocked. They couldn’t make a decision about cutting costs and raising revenue to turn the tide of debt for that country. And market traders capitalised on the bad news and drove market prices lower.

…consequences,

The Australian market will most likely open lower today and with our government focused political point-scoring (introducing new taxes; and insisting on a 2012/13 budget surplus) it is likely to stay down during the day.

Your adviser at Continuum Financial Planners is watching developments – and we are reviewing any investment portfolios that might be put at some risk in this situation. Most will be OK, but any with margin loans are under our particular watch. We will be in direct contact with any clients who will be affected by the current downswing.

…and actions

As you will now be familiar, it is our consistent contention that if you are invested in accordance with a strategy that has been formulated for your circumstances, time in this market will ultimately yield its rewards. We also watch the risk profile of client portfolios and advise when appropriate, any necessary change: today would not be an appropriate day to convert invested funds back to cash unless there is an absolute need!

It is our view that the current spate of market volatility is more influenced by market sentiment than by economic fundamentals: and as we have previously noted, these times of deep panic are potential buying signals. Where your position is such that investment would be beneficial to your strategic, long-term goals, we will be in direct contact with you once we are satisfied that a ‘bottom’ has been found.”

This was a period of market volatility while the horrors of the GFC were still fresh in people’s minds)

Our team of advisers and client service practitioners are consistent in our enthusiasm for the wealth management role we have with our clients: we look forward to being of service to you – and to friends or family whom you refer to us – in the developing and ongoing review of personal strategies to achieve personal financial goals and objectives.

In the meantime, if you have any concerns, arrange an appointment with our experienced advisers –

- phone 07 3421 3456, or

- at your convenience, use the linked Book A Meeting facility.

(This article was originally posted by us in August 2011. We occasionally refresh/ update it, most recently in July 2025.)