In this article we focus on personal superannuation contributions that you want to be tax deductible. Superannuation is a favoured form of wealth accumulation, particularly – though not exclusively – designed to provide financial well-being in retirement.

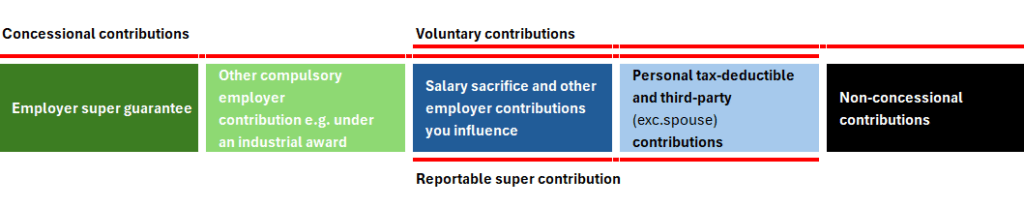

Superannuation is a tax-favoured vehicle for investment and wealth accumulation. It grows in a few ways: mainly by contributions on behalf of the account owner. As demonstrated in the chart below, there are a few potential sources of contributions. One of them is personal deductible contributions.

Why make a personal super contribution?

Tax benefits

Subject to an earnings-test, most superannuation contributions that are tax deductible are taxed at 15 cents in the dollar. That tax is imposed as at the time the contribution is made. For superannuation members earning less than around $25,000 per year, this tax is actually a burden, because if the money was received directly as income, it would only be taxed at that same rate – or less. Superannuation account contributors earning in excess of $250,000 annually will have their contributions taxed at 30 cents in the dollar contributed.

The tax ‘favour’ for superannuation accounts is in the rate of tax charged on the earnings of the fund. In this case, the rate of tax is 15 cents in the dollar of the net income earned – and a concessional arrangement exists for capital gains accrued.

Strategic benefits

Another significant advantage of focusing on superannuation as a wealth accumulation vehicle is the restricted access that applies to it. That restriction is a definite advantage in strategic investment planning terms. It should not be overlooked when deciding whether to invest within a superannuation structure or under some other vehicle. One important issue to consider when contemplating a contribution to your super account(s) is the caps that may apply. Caps apply to various areas of superannuation and you should seek professional advice to avoid the consequences of breaching them.

One of the caps that apply is the concessional contributions cap. For the 2024 financial year (FY), that amount is $27,500. Caps are reviewed annually and adjusted according to an inflation factor under certain conditions. For the 2025 FY, the cap will be $30,000.

Concessional contributions can be from a few sources. The most common sources are superannuation guarantee amounts paid by employers and personal deductible contributions. The employer contributions can also be paid under industrial award arrangements. Personal superannuation contributions can also be paid by way of salary sacrifice. There is no action to be taken by the member regarding contributions under a guarantee, award, or salary sacrifice arrangement.

Making a personal deductible super contribution

So, what is so special about the personal deductible superannuation contribution that requires your attention? Broadly speaking, you will need to attend to the following: take action, comply with timing, and ensure documentation is accurate!

Action

The requisite action is to make the contribution so that it is received by the trustee within the FY intended. You should consult with your financial adviser, or do appropriate research, before deciding on the amount of your personal contribution.

Timing

When we get close to the end of a financial year, that timing can be critical. Members should make such contributions so that the trustee has them in hand at least three working days before the FY. (In 2024, 30 June – the last day of the FY is a Sunday. Our suggestion is that you try to ensure your contribution has been received by the previous Tuesday, 25 June 2024. Each other FY will need to be assessed similarly.)

Documentation

All of this effort will be to no avail if the requisite documentation hasn’t been compliantly lodged. So what is the requisite documentation? It is as follows –

- Notification to your superannuation trustee that you wish the personal contribution being made to be treated as a concessional contribution. This should be done at the time of making the contribution, but at least before the end of the relevant FY.

- Acknowledgement from the superannuation account trustee that the contribution has been received and is being treated as concessional. This should be available before the lodgement of your personal tax return for the FY in question. It will likely be issued within fifteen working days of lodgement with the trustee.

- The acknowledgment documentation from the trustee should be provided to the ATO by the date of your tax return lodgement. (You are able to vary the amount wishing to be claimed as a deduction any time up to the date of lodgement of your personal tax return.)

The team at Continuum Financial Planners are highly qualified and well experienced in advising on superannuation as a wealth management vehicle. For more information and/ or to discuss your superannuation, make an appointment with one of them –

- phone our office on 07-34213456, or

- at your convenience, use the linked Book a Meeting facility.

(This article was originally posted by us in May 2024. We occasionally refresh/ update it, most recently in August 2025.)