Risk profiling applied, means better peace of mind for the investor

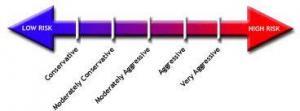

We use investor risk profiling to assess the investor’s aversion to investment risks. These are numerous through various investment markets and/ or asset classes into which they may be investing. Various formats are used in Risk Profiling. All address attitude to risk in a general sense. But they also explore time horizons, adaptability to volatility – and reaction to capital fluctuations.

How comfortable are you with unpredictable adversity?

What is your level of comfort as an investor?

How would risk profiling help?

Most likely, your answer will be affected by your stage of life; the level of wealth you have accumulated; and your past experiences as an investor. In a professional environment, risk profiling helps an investment adviser determine an appropriate asset allocation within your portfolio. It also helps in guiding you to understand what is happening to your portfolio over time.

For a significant number of investors the concerns that cause most discomfort fall into two categories: financial; and emotional (feelings). Those two discomforts impact retirees more substantially: they include –

Financial

- loss of capital (investment capital lost, partially or completely, because of financial distress/ failure);

- income volatility (interest rates, rent and dividends can all fall or rise according to economic/ financial circumstances); and

- duration of wealth (will the capital accumulated last long enough to meet the goals sought).

Feelings

- uncertainty (about the influences on investment assets);

- confidence (concern about the lack of control/ consistency);

- irritation (when extended duration of volatility persist).

How does investor risk profiling fit in to the financial advice process?

Financial planners apply two specific standards (among a range of requirements) when delivering investment advice. Those standards, required under the Corporations Law, are to –

- know their client; and

- know the products they recommend.

Knowledge and awareness of human behaviour patterns, together with the financial and personal data that we can gather from you forms the basis of ‘knowing you – our client’.

We derive our knowledge of the financial products we recommend from –

- understanding the financial markets, and

- staying in touch with investment managers of various persuasions. (ContinuumFP is particular about the adequacy of research information.)

Linking these two is the investor risk profile. By assessing an investor’s aversion to the various types of risk that are involved with investing in their recommended portfolio, we are then able to ensure that their level of comfort with the asset allocation strategy recommended will be adequate to –

- allow them to sleep at night;

- give their ‘family’ peace of mind about their future;

- achieve their goals over the available timeframe; and

- facilitate understanding that there will be fluctuations over time, in asset values and income arising from investments.

Does your investor risk profile need updating?

Continuum Financial Planners Pty Ltd uses two risk aversion assessment processes. Each is relevant to the client circumstances. One is markets-specific (‘the Risk Profiler Questionnaire’); the other is psychometric. We strongly support the policy of our Dealer Group* in the requirement for investor risk profiles to be reviewed:

- whenever there is a significant life event occur;

- following a significant market disruption; and at the least

- every three years.

To ensure your Investor Risk Profile is properly appraised, arrange a review appointment with one of our experienced advisers: to do so,

- call our office on 07-34213456; or

- at your convenience, use the linked Book A Meeting facility.

* Lifespan Financial Planning Pty Ltd.

( This article was originally posted by us in May 2012. We occasionally update/ refresh it, most recently in June 2025.)