How can I set aside funds to invest?

When considering wealth accumulation strategies, you may be concerned as to how to source funds to invest. This concern is accentuated when the daily costs of living are already a struggle! Often, longer term goals being addressed, include:

- a level of financial independence in retirement;

- for estate planning bequests; or

- for establishment of a philanthropic foundation/ fund.

Firstly, some definitions –

In dealing with this topic it is worth considering the difference between the terms, ‘savings’ and ‘investments’. For purposes of this article, we apply the following definitions for those terms. We have précised these from Investopedia dictionary – where knowing the starting letter should find you the term:

Savings: the accumulation of the difference between inflows and outgoings. (Inflows may be in the form of income, realisation proceeds, or other sources. Outgoings may be for the necessary costs of living, including debt servicing.) The difference will either contribute to, or draw on a ‘reserve’ being set aside for a specific acquisition or purpose.

Investments: moneys ‘placed’ with the expectation that growth and/ or income will be generated.

How they work

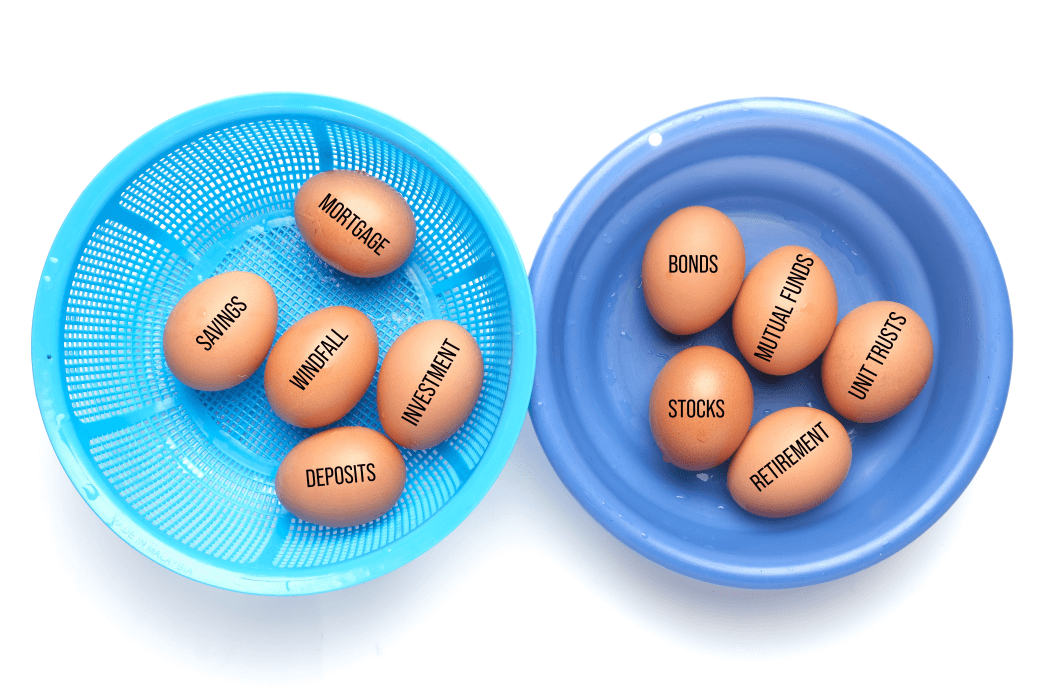

‘Savings’ will generally have a relatively short-term focus, whilst ‘investments’ have a longer-term aspect to them. Over the course of a lifetime, various sources of funds to invest may present themselves. Some of the more conventional ones include –

- Accumulated savings (initiating investment);

- Recurring surplus cashflow (increasing investment);

- Bequests, gifts or other ‘windfall gains’ (increasing investment);

- Proceeds of sale of assets (increasing investment); and

- Various forms of borrowing (debt) – increasing investment.

Another source of funds for investment is the growth in capital value of existing investments. Using capital growth to increase your investment portfolio needs careful consideration. Two consequences of disregarding your strategy could be –

- adverse taxation consequences – and

- diluted strategic outcomes.

Regardless of the source of investment funds, embarking on the investment process should be compliant with a strategic plan. Your strategic financial plan must be formulated to be relevant to your personal needs, goals and circumstances. We strongly urge the use of a reputable, experienced, professional financial planner. (In doing so, you will join the fewer than 40% of investors in Australia who use a financial planner. These people report feeling confident in their plan because of that engagement – and that they sleep better at night.)

Such a strategy will advise on marshaling the available resources to achieve an investment outcome in your best interest. Subsequently, your financial plan should be reviewed regularly according to an ongoing service option with which you will be comfortable.

The abovementioned sources of funds to invest are further discussed here:

Accumulated savings

One of the goals of a savings plan may be to initiate an investment portfolio in a particular form. Different goals of the one person/ family could require different strategies. Matters such as –

- saving to make a purchase in full payment; or

- to make a deposit and support that with either

- ongoing regular contributions – or

- with ‘gearing’ (borrowed funds – see below).

Discipline may need to be exercised with such accounts, to ensure that ‘wants’ are not prioritised over ‘needs’. With strategic investing, needs are the real intention of the saving being accumulated.

These accumulations are generally for short-term purposes and as such, will usually attract only minimal interest/ earnings. They will most likely be retained in the form of Cash (including in appropriate circumstances, term deposits of suitable duration).

Recurring surplus cashflow

Whilst this may initiate as part of the savings account, the opportunity to add to an existing investment persists. Surplus cashflows can be directed into the investment portfolio whether on irregular, frequent or as infrequently as annual deposits basis. An example of this use of recurring additional funds was described in this article. (This article originally focused on self-funded retirees but applies to other circumstances as well.)

A savings plan may be the initial destination for such surplus, but to be confident that a sound investment strategy can be implemented, the preparation of a reliable personal budget will be helpful.

Bequests, gifts or other ‘windfall gains’

You may be fortunate enough to benefit from the goodwill of family members, employers or others by way of a gift or estate bequest. Lump sums such as this should be considered as a potential start of/ addition to an investment portfolio. Windfall gains such as ‘winnings’ should also be considered in this context.

Proceeds of sale of assets

Where assets are sold and the proceeds from the sale are surplus to other needs (such as acquiring a replacement asset; debt reduction; or satisfying another high priority goal), the lump sum should be treated like the item immediately above – a lump sum available for investing.

Various forms of borrowing (debt)

Debt-funding, or borrowing to invest, is a common way of ensuring that an investment portfolio is sustained. Readers will be familiar with acquiring property using such a transaction: paying a deposit and the acquisition on-costs, then completing the purchase with funds raised under a mortgage. With an investment other than direct property, debt-funding can also be utilised – and because the capital sums involved may not be as substantial, a more manageable process will likely be available.

Borrowing for investment purposes is often referred to as ‘gearing’: some of the common avenues available for such funding include (in no particular order of significance) –

- Borrowing secured against a property (e.g., home equity loan);

- Personal loan;

- Credit card;

- Margin loan; and

- ‘Vendor’ finance.

Caution needs to be exercised when gearing investments. The structure of the borrowings, as well as of the investment/ portfolio need to be considered in the development of the strategic plan for the investing – and criteria relevant to loan servicing and fall-back options clearly planned.

Sourcing advice on investing

The experienced advisers at Continuum Financial Planners Pty Ltd are available to assist you with your planning around sourcing funds to invest. Our team works to the mantra that ‘we listen, we understand; and we have solutions’. When it comes to undertaking an investment program we can advise you about a strategy that will target the achievement of your financial needs, goals and objectives. To arrange a meeting with one of our advisers, call our office (07-34213456), or use the Book A Meeting facility on our website.

(This article was originally posted in April 2015; it has been updated/ or refreshed occasionally since then, most recently in August 2024.)