Planning YOUR Retirement

Why ‘Planning Your Retirement’? Planning your retirement optimises your retirement experience. You will benefit from involvement in that planning. Your

Why ‘Planning Your Retirement’? Planning your retirement optimises your retirement experience. You will benefit from involvement in that planning. Your

Preparing a family budget doesn’t have to be difficult. It is an important tool that will help you to understand

The ContinuumFP wealth creation process unites the skills and experience of our advisers and their support team, with the financial resources

Self managed superannuation funds (SMSFs) are private superannuation funds that are managed and controlled by the members. These funds may

Life insurance risk transfer provides financial benefits when qualifying events occur. These are generally when financial resources (and people dependant

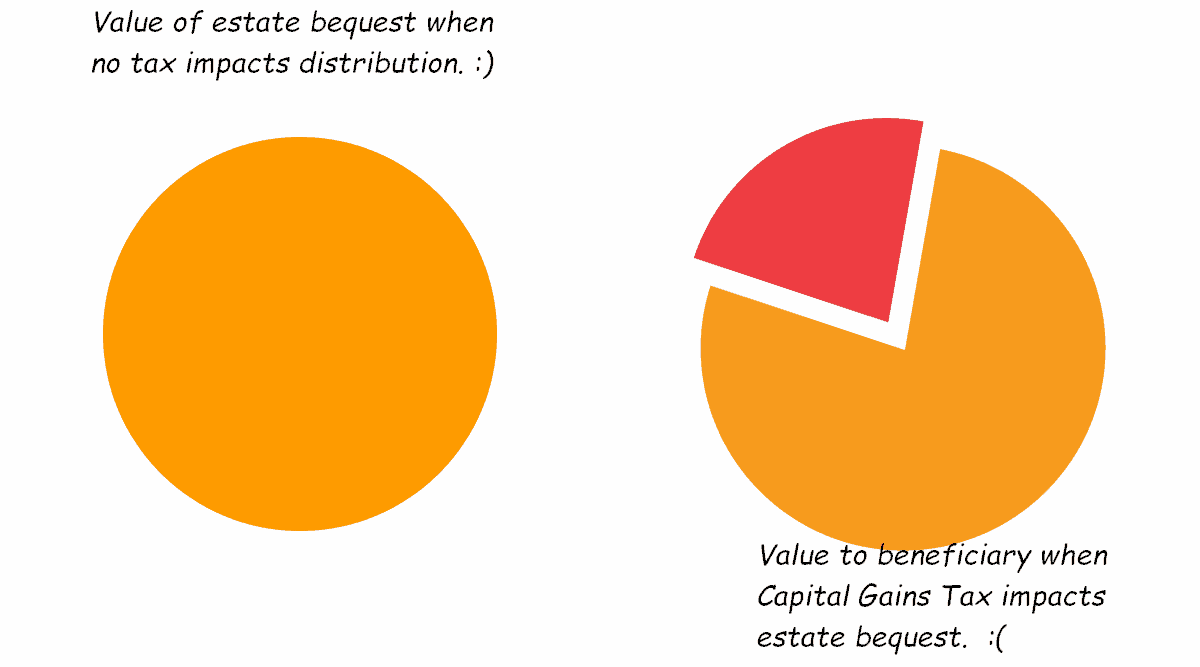

What is the Capital Gains Tax impact on estate bequests? When undertaking your estate planning, be aware that there may

“The affordability of homes in Australia is continuing to decline“: this is how we introduced this post when it was first

Financial risk management risk management engages the financial risk manager in deciding whether to accept the risk, mitigate its effects, or

Income Protection Insurance (aka Salary Continuance Insurance under some Superannuation accounts) Income Protection Insurance provides financial protection against a loss

Strategic wealth management is the management of wealth (financial resources) according to a well-considered plan (strategy). It focuses on financial

Level 1

2042 Logan Road

Upper Mt Gravatt QLD 4122

07 3421 3456

Paul Ashton & Associates – CPAs

2 Alice Street

Warwick QLD 4370

07 3421 3456