Residential Property Investment

Residential property investment is popular with Australians: this popularity is based on the ‘urban myths’ that property prices increase consistently

Residential property investment is popular with Australians: this popularity is based on the ‘urban myths’ that property prices increase consistently

Diversification in asset allocation smooths volatility Investors have a range of investment asset classes into which a portfolio can be invested.

Risk profiling applied, means better peace of mind for the investor We use investor risk profiling to assess the investor’s

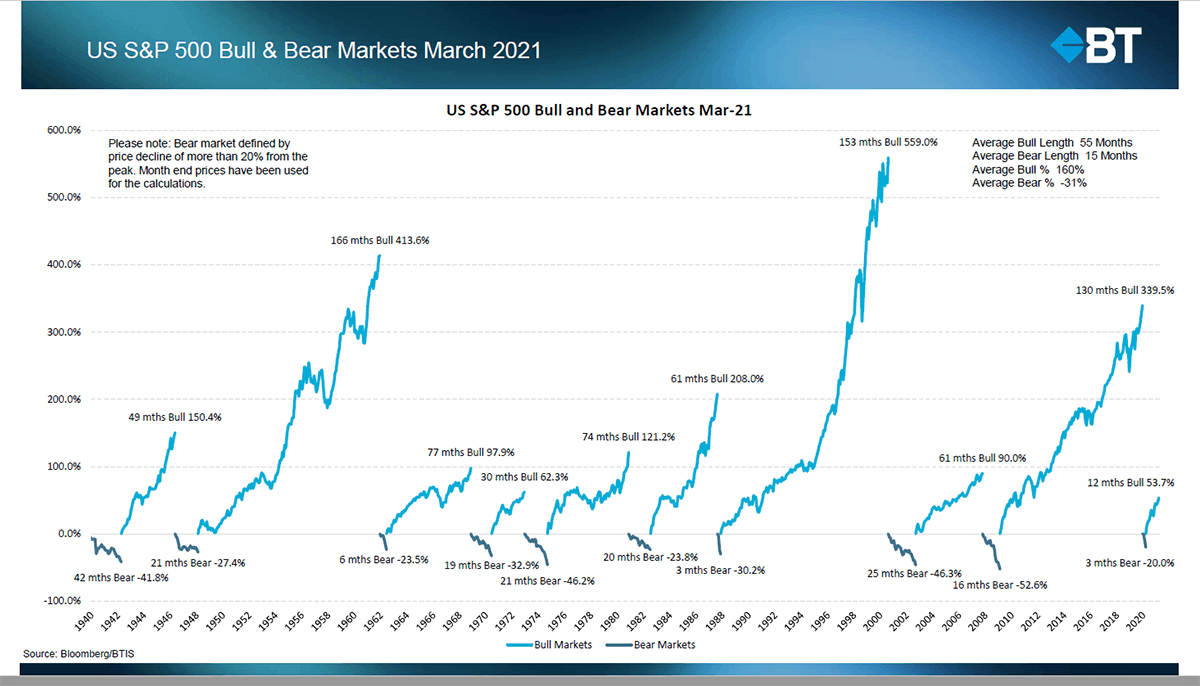

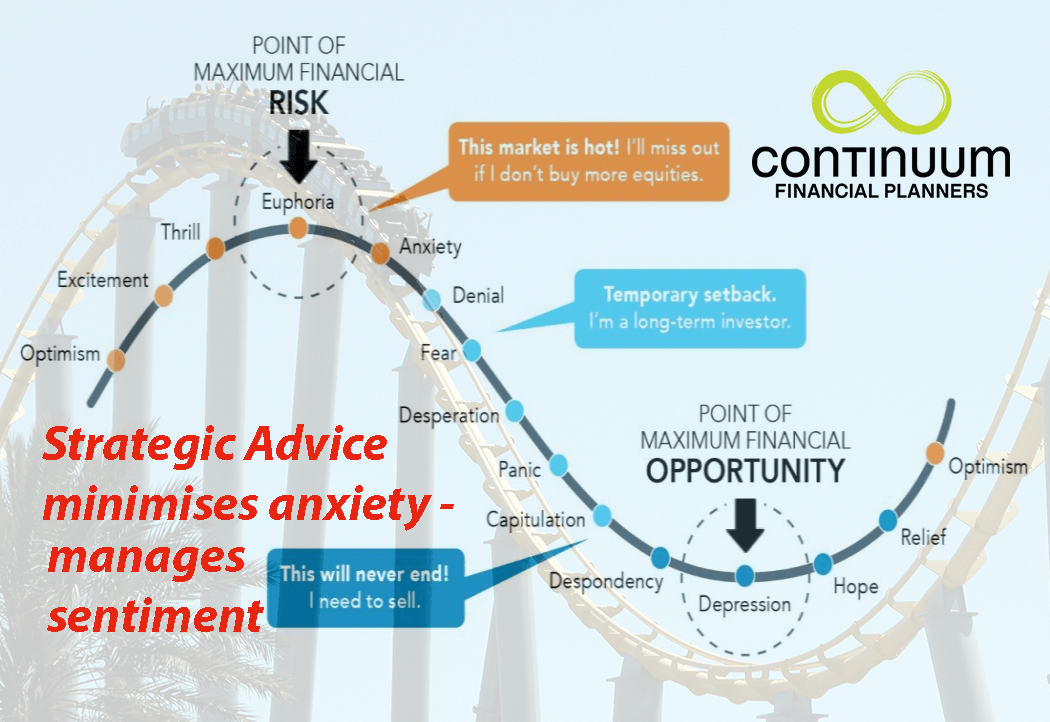

Market volatility anxiety persists especially during times of extreme volatility…but we’re looking out for you! in fair times, or foul.

During times of persistent or extreme market volatility, our advisers are mindful of the effect that has on clients. Apart

…get what you pay for – Financial planning advice is about more than investment returns. It goes much deeper than

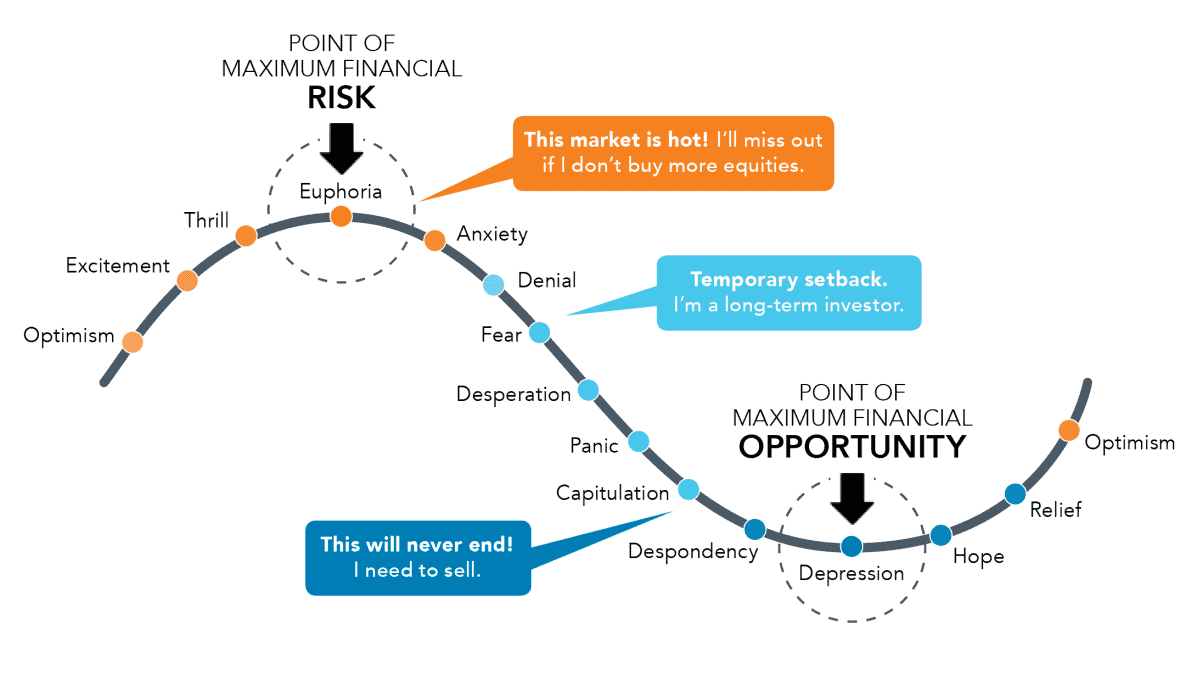

Coping with market volatility – investment market volatility in this instance – is an acquired skill. However, it is one

Investment Risk and Volatility influences Investor behaviour. Investment Risk and Volatility are market bedfellows. Investor behaviour can range from excited

Financial year-end reflection is quite often useful when considering your investment portfolio(s). Whether they be superannuation account(s) or some non-superannuation

Share market volatility is the reflection of the price action at the various exchanges on a daily basis. Price action