The occurrence of the Global Financial Crisis (the GFC) in late 2008 gave birth to a range of investment slogans. Some of these will permanently enhance the financial vocabulary. One of the most valuable slogans, modelled on “Cash is King”, was ‘Strategy is King’. In our view, investors maintaining wealth management strategy consistency in the aftermath of the GFC was strategic in itself.

The challenges to remaining consistent with wealth management strategy

As the reports from each reporting period are distributed, investors look over the results and are –

- drawn into short-term thinking about where their investments sit and

- what the more immediate future means.

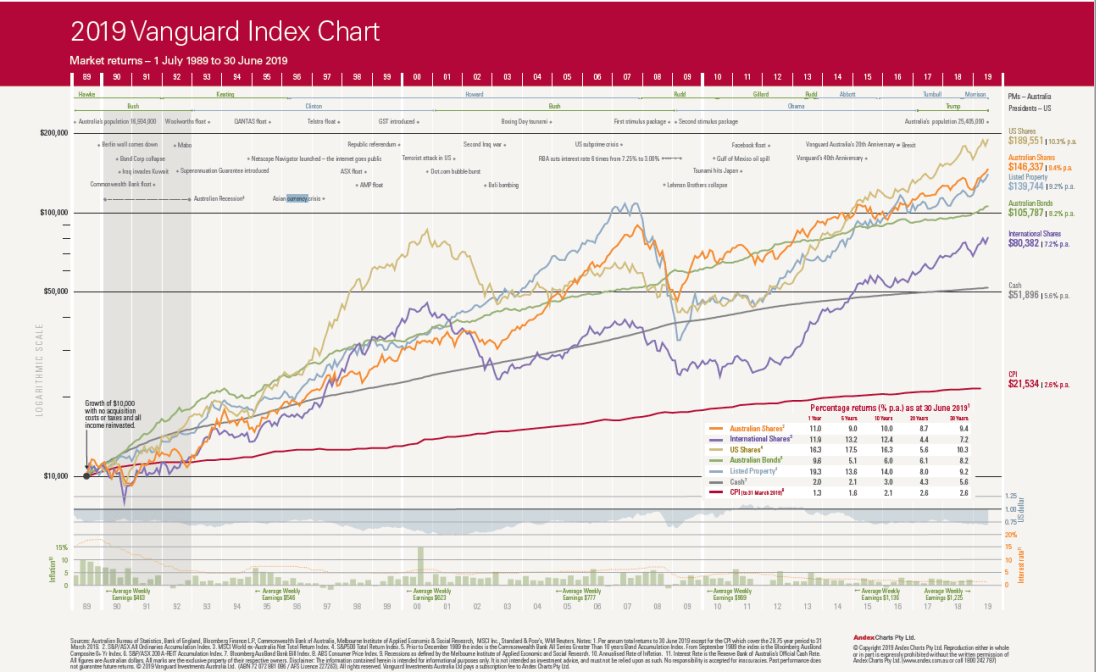

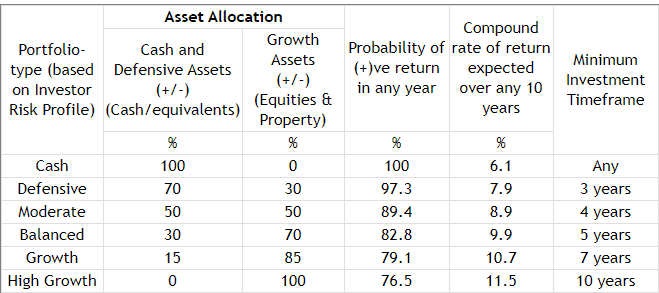

When considering your investment portfolio it may be helpful to understand the following asset allocation data vis-a-vis your situation. (Important to note is that as your risk profile becomes more aggressive, the term of investment needs to extend. These matters are evident reading down the first column, and as per the final column, in the Table.)

Note: the values shown in the following Table were correct as of June 2011. Since this time, there have been a number of revisions, particularly to columns four and five. Before relying on these values to guide your investment strategy decisions, you should seek more recent data.

On the above basis, a Balanced Investor should invest for a minimum term of 5 years. They can anticipate at least one negative year in every nine years of consistent investing.

A Balanced Investor, fully invested since 2006, will still likely be showing a positive return up to 30 June 2011. They could fall short of the 9.9% p.a. cumulative performance showing above with an interruption to their strategy. Clear evidence that wealth management strategy consistency pays dividends.

Investors working to a carefully considered – and rigorously implemented, long-term strategy – should ‘stick to their guns’. Strategy is King and they should hold fast with their relevant asset allocation. They may choose to change assets within the Class; or the managers of invested funds. The asset allocation should only change after a considered appraisal of their strategy in their prevailing and perceived circumstances. The following quote is still as relevant today as it was in 2008. Consider the economic and market consequences of the issues mentioned:

“Investors need to remember that markets will fully price in all of the bad news out there and, once this happens, value will begin to build. This value is released when sentiment or confidence returns. There are headwinds out there but forward PEs down to 12 times Australian Shares reflect that. The chances of the Australian economy slipping into a recession are very low, given the amount of public and private sector investment spending in the pipeline and the boost the country is getting from higher commodity prices. A period of more modest growth is exactly what the Reserve Bank of Australia is after, this will allow inflationary pressure to moderate and ultimately create room for an easing in tight monetary conditions, resulting in a more bullish market.”

Brian Thomas: Perennial Investment Partners Ltd

What happens when investors fail to exercise strategic wealth management?

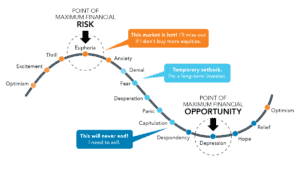

The following chart shows the investment cycle of undisciplined investors. It is worth noting that these people often end up with up to 40% less than the final outcome achieved by disciplined investors working to a well-structured strategic plan appropriate to their circumstances. (There is evidence from surveys, that investors working with a qualified, experienced financial planner will not be in this ‘undisciplined’ category.)

ContinuumFP would like to assist you with your wealth management strategy

Whilst we do not have the ‘mythical crystal ball’ available to us, we regularly access statistical and fundamental data to guide us in the formulation of asset allocation recommendations to fulfil the strategic financial needs of our clients. Wherever you may think we are on the ‘roller-coaster’ showing on the above Chart, our experienced advisers can guide you to formulate the appropriate wealth management strategy to best suit your individual circumstances.

If you have any questions regarding the above matter, and you would like to consult with a member of our team –

- phone our office (07-34213456), or

- at your convenience, use the linked Make A Booking facility.

(This article was originally posted by us in July 2008. It has been occasionally updated/ refreshed, most recently in May 2025.)