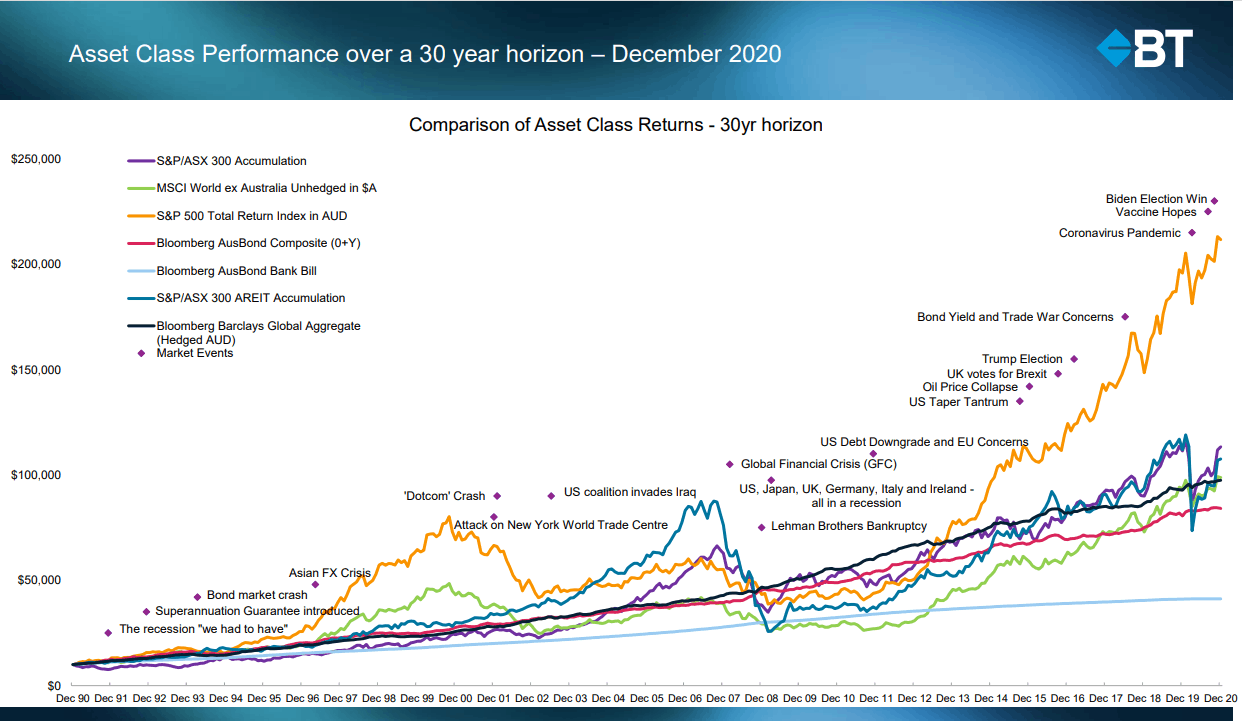

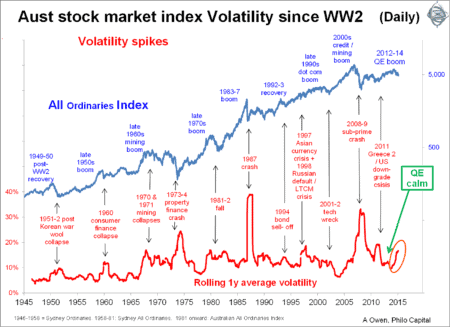

Market volatility is perpetual

Market Volatility advantages the prudent investor. The good news is that it is an ever-present feature of investment asset markets.

It is the feature of investing that gives inexperienced investors most cause for concern. That concern heightens when the rate of change in volatility increases ‘rapidly’.

It is worth noting that investment managers exploit market volatility that suits their strategic investment policies. They use the events to either –

- realise gains (sell), or

- to make a Value trade (buy).

Used in this way, market volatility is the investors’ friend.

We wrote the following paragraphs in a newsletter article in August 2011. In searching for related material about market volatility during October 2018, we noted some recent event similarities. And this is long after the GFC and what was being experienced early in the recovery from that event.

“Whilst we don’t want to add to the concern about the direction (or frequent changes of same) over recent weeks – and more particularly, days – we issue this note to reassure our clients that we are carefully watching the action and closely monitoring the views being expressed as to reasons, potential range of activity (bottom of the market; and volumes of participation) and what action needs to be taken to protect the long-term effect on wealth management and investment strategies.

After a day of reprieve on Wednesday, the markets received disappointing information about liquidity concerns for the European Banks: and any level of disappointing news in markets so volatile at present – particularly when in relation to the financial pillars that underpin commercial activity – is enough to ‘spook’ traders and start the run for the exits.”

The setting

This was a time when the financial press compared market volatility with a rollercoaster ride at an amusement park. The ups, downs, whipsaw changes, thrills and occasional short periods of respite all being hallmarks.

Market volatility and Investment risk go hand-in-hand

In our article ‘Investment Portfolio Diversification‘, we dealt with the key investment risks that accompany the respective asset classes. We referenced –

- Capital,

- Liquidity,

- Income,

- Expenses,

- Taxation and CGT

– indicating how each of those risks can impact the asset classes of Cash, Equities (Shares) and Property.

Market volatility in the generally accepted context, relates in particular to the Capital aspect of the asset class. How much (and how quickly) does the capital value of the asset change. There are numerous causes for price volatility: some of them are –

- economic fundamentals (supply; demand; ‘fashion’ etc)

- geopolitical circumstances (domestic/ trading partner elections; civil strife; war/ rumours of war; etc)

- weather events (cyclones, earthquakes, fires, flood, volcano eruptions etc) – and

- trade policies (free-trade agreements – bilateral/ multilateral; tariffs etc)

In our article ‘Investment risk and volatility‘ we explain further how different market elements affect the market actions – and give rise to those situations whereby, as said above, market volatility advantages become the investors’ friend.

Using strategy to manage the impact of market volatility

The value in working with a financial planner is in the process required to develop and deliver advice – and in engagement in an ongoing service arrangement. To arrive at an investment strategy recommendation, the financial planner takes into account a number of features: financial circumstances and resources; risk aversion profile; clearly described, measurable financial goals and aspirations; timeframe – and the health of the investor is also considered. Recommendations are then formulated and presented that are in the best interests of the client.

Almost invariably, strategic advice provided in this framework will have a medium- to long-term time horizon (of five to ten years and beyond). Rarely will a period of market volatility of the type that invites comment from the alarmists in the financial press, extend more than a couple of months – and so the strategic plan will be likely to succeed over the presumed timeframe. If supported by an ongoing service arrangement, regular reviews of progress toward the measurable goals will overcome anxiety about the occasional bouts of volatility.

Wealth management at Continuum Financial Planners Pty Ltd

The experienced advisers at Continuum Financial Planners Pty Ltd have comforted clients through numerous periods of market volatility. We also manage portfolios to benefit clients from these market volatility advantages. Our process ensures that your best interests are the basis of the recommendations made. We encourage clients to undertake regular reviews of the progress toward achievement of their financial goals. And we do this to our mantra:

‘We listen, we understand; and we have solutions…’

to your investment needs and dilemmas.

To arrange an appointment with one of our experienced adviser team –

- phone our office on 07-3421 3456, or

- at your convenience, use the linked Book A Meeting facility.

(This article was first posted by us in October 2018. We occasionally refresh/ update it, most recently in August 2025.)