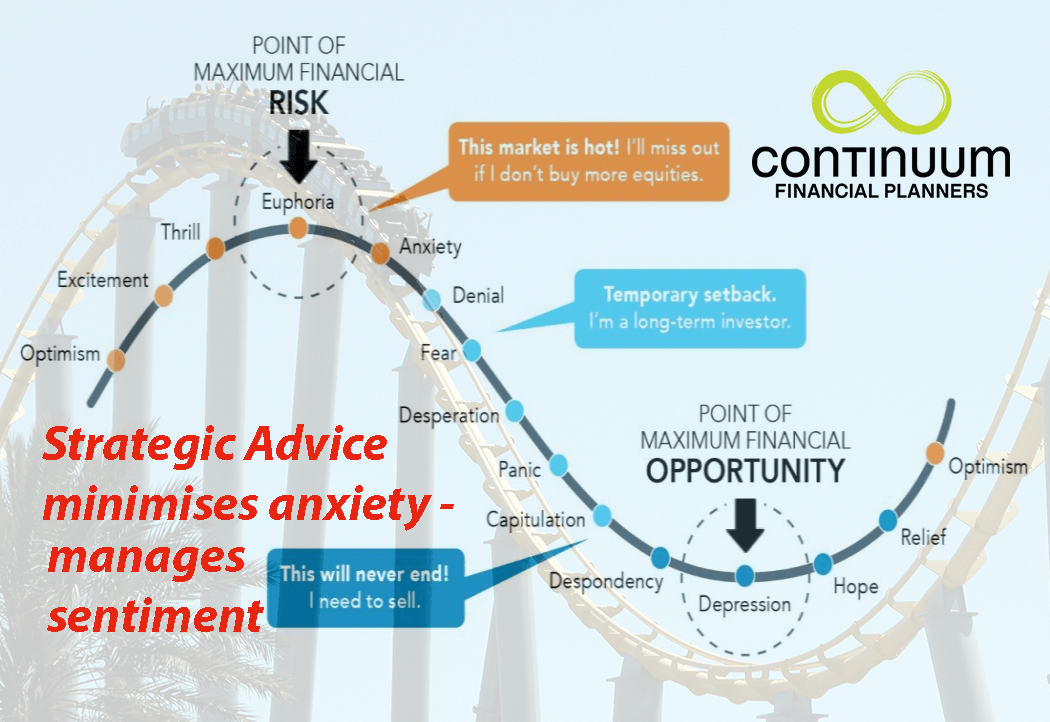

,Asset markets noise is a constant companion for investors, for their advisers; and for their service providers. The need for constant support for investors, encouraging them to avoid making ill-conceived, hasty decisions ‘under fire’ was never greater than at the time of the Global Financial Crisis. The principles and strategies we proposed for investor clients at that time, are relevant in most market scenarios.

In September 2008 we posted an article under the title – ‘There is light at the end of the tunnel‘. In this article we discuss that asset markets noise, if not carefully ‘sifted’, can divert investors from their strategic goals.

Asset market noise from varied sources: economic indices and media included

Considerable commentary about the events and activities from which that near-catastrophic event, labelled the GFC, is available. A simplistic summary of the facts is that in the heady days preceding the GFC collapse –

- an array of ‘derivative’ financial products were created and sold to ill-informed fund managers and trustees,

- many of the financial instruments they were based on were quite valueless (a fact unknown to the investor victims), but

- their development was so swift and the ‘weight of money’ they represented was so great, that

- even well-qualified, experienced investment managers were caught out by them.

When the merry-go-round stopped, settlement was demanded. There was insufficient credit to meet all demands. The term ‘credit crunch!’ was prevalent in commentary.

…and how it unfolded

As the credit crunch took effect, banks called in loans that were underperforming. They simultaneously withdrew approvals on undrawn loan limits. These actions led to sell-downs of share portfolios. As is the economic maxim –

- the sudden increase in supply of shares for sale, combined with

- the consequential reduction in demand to buy those shares (there was a tightening of credit remember),

- the share market did what could be the only outcome: it fell in value, significantly (on average around 60% globally!).

This led to breaches of debt covenants for commercial entities – and margin calls for investors. Those margen calls led to more sales, more downward pressure on share prices….and as they say, the rest became history.

The media did what the media always needs to do (to sell newspapers and other publications). It told the stories of –

- capitulation,

- downfall of ‘once great enterprises’, and

- inaction by regulators,

- inappropriate action by professional advisors, and

- their great wisdom in highlighting the pending ‘doom’.

(Pardon our cynicism, but the media was almost as far behind the market developments as were the markets ahead of economic developments.)

The negativity in these reports was not always unfounded, but –

- it did nothing to allay the fears of the most vulnerable of investors – and

- it seemed to add to the speed of the downward spiral!

Investment performance better and more consistent when strategy engaged

In revisiting the articles posted during the long journey out of that wilderness, it is satisfying to reflect that whilst those clients who were late into the market (some possibly attracted by the almost unbelievable earnings of the three years prior to the GFC) are yet to recover fully, those who have been invested strategically from prior to 2004 are fully recovered (as at the time of this November 2013 update; albeit that their portfolio performance for the period is lower than can be expected in ‘more normal’ investment conditions). It goes without saying that clients who have been investing since 2009 are showing quite good performance on their portfolios – well above long-term averages for their respective asset allocations would suggest based on their risk aversion profiles. ‘Timing the markets’ is said to be a fool’s game – we tend to agree; and have long-espoused the benefits of dollar-cost-averaging.

Clients who seek advice, implement the strategy, regularly monitor the performance, regularly adding to the investment, updating their financial status at annual reviews under their ongoing service package arrangements with us show more stable, sustainable returns – and appear to be more satisfied with their investment performance than those who are less-engaged.

Continuum Financial Planners Pty Ltd work to the mantra that:

‘we listen, we understand; and we have solutions’

– and we are available to provide

personalised, professional wealth management services

to clients who want an active engagement with their adviser and their portfolio.

To benefit from the skills and experiences our advisers, make an appointment, either by –

- phoning our office, on 07-34213456, or

- at your convenience, use the linked Book A Meeting facility.

(This article was first posted by us in September 2008. It has occasionally benn refreshed/ updated, most recently, in May 2025.)