Negative investment returns will be a challenge for some and an opportunity for others. In this article we reiterate that markets operate with buyers and sellers –

- each making their decisions as to what to accumulate and what to dispose of –

- and when to make those moves,

and in those actions we see that negative returns can present buying opportunities for a number of reasons.

Why do negative returns occur?

Holding an asset that loses value, whether by market action or economic circumstance, reduces the purchasing power of that asset. This action results in a negative investment return event being reported.

Some investments, like cash and term deposits with banks, never fall in dollar value. However, they can create problems for investors over the medium to long-term as –

- they produce only modest returns with no capital growth – and

- they are not tax effective.

The purchasing power of these investments decreases in real terms over time (taking into account the effects of inflation).

In order to achieve higher returns and better tax effectiveness, it is generally necessary to –

- take some risk through exposure to so-called ‘growth’ assets:

- investments in assets such as shares in trading companies; or

- investment property.

These growth assets produce better returns over time because the underlying investments are economic drivers that facilitate –

- profit-making; and

- wealth accumulation.

As long as an economy continues to grow, companies should increase in real value and pay increasing dividends. Of course, growth can be uncertain and uneven:

- in times when the growth slows or is negative,

- valuations fall,

- dividends (distributions) fall – and,

negative investment returns are experienced.

Irrational market behaviour

All market sectors will occasionally experience negative returns. Most will recover, but there is always the risk that some will not. When the negative returns reflect investor sentiment, while economic fundamentals persist, markets are said to be irrational. It could be that the deterioration in sentiment arises from –

- a misunderstanding, or

- a misinterpretation of information, and

investors respond using incomplete or imperfect information.

How can I cope with negative returns?

Such events can be largely countered by diversification. The variation in returns from one year to the next is known as ‘volatility’. We would all like to receive ‘high and safe returns’ but unfortunately investment markets don’t work that way. Even government bonds rise and fall in value as interest rates change. Generally speaking the longstanding investment adage that, the higher the potential return, the higher the risk, applies.

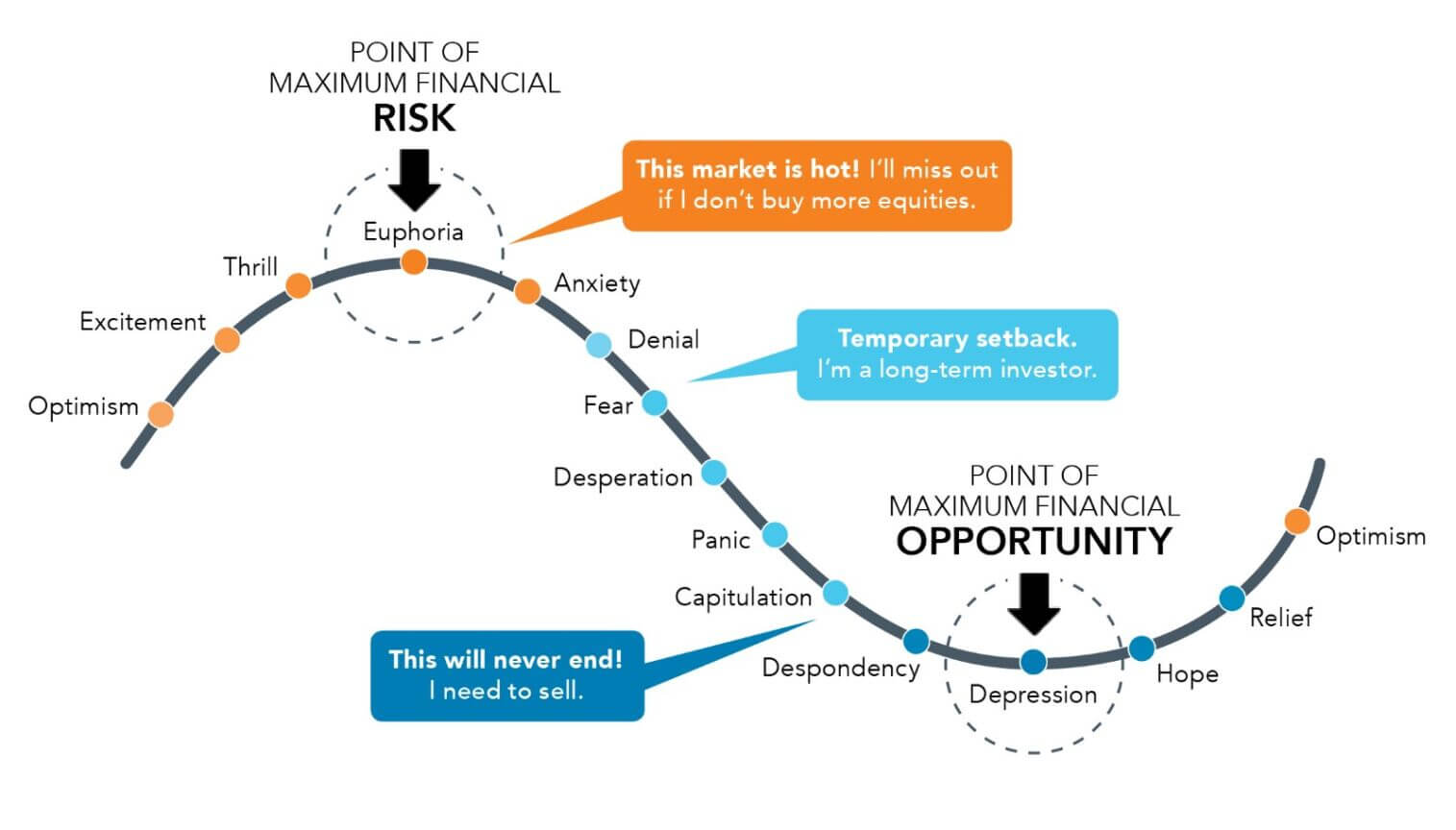

Research on the psychology of investing shows that the pain of negative returns outweighs the joy of investment gains. This helps to explain why many people panic when investment markets decline, even though they knew it would happen.

There is a natural human tendency to be worried when an investment portfolio falls in value. No one likes to lose money, particularly –

- in retirement, or

- in circumstances where you are unable go back to work to replace lost funds.

An important point to remember is to not let emotions cloud implementattion of a carefully planned long-term strategy. It is often said that the sharemarket exists to transfer wealth from the impatient to the patient. Too many people go into markets for the wrong reasons – and get out of them at the wrong time.

Can negative returns be a positive?

Smart investors see downturns in markets as a positive opportunity to make more money. Because many investors allow their emotions to override their common sense, buying opportunities arise when markets fall. It is more advantageous to buy from a distressed seller than buy from one who doesn’t need to sell. These periods of negative investment returns provide opportunities to refine the portfolio to focus on achievement of end goals.

By putting in place –

- an appropriate long-term asset allocation strategy, and

- reviewing it on a regular basis,

you will find yourself taking profits as markets rise and buying more when markets fall.

By doing this, you will certainly turn the market negatives into a big positive for your overall financial position.

Consult Continuum Financial Planners for a positive experience

If you are keen to review your investment portfolio, to –

- efficiently diversify the risk built into it; and to

- find comfort in knowing that your portfolio is well structured with well-researched investment products,

meet with one of our experienced advisers.

To arrange an appointment with one of our team –

- phone our office (on 07-3421 3456), or

- at your convenience, use the linked Book A Meeting facility.

We will ascertain your financial position, your goals and objectives, conduct an investor risk aversion assessment and review your portfolio. Ou team works to the mantra that –

‘we listen, we understand; and we have solutions…’

– that we deliver in

‘personalised, professional wealth management advice’.

(This article was originally posted by us in December 2009. We occasionally refresh/ update it, most recently in April 2025.)