This Economic and Markets Outlook 2021 is presented so that our clients and other followers have some insight into factors that will be in our minds as we construct, review and revise investment portfolios in 2021 – particularly during the first half of the year. (If a day in politics is a long time, a forecast year in investment markets is an eternity!)

2021 – a year of financial intrigue, of economic growth, of market volatility; a year of two halves; a year in which low interest rates persist, yet savings grow, and asset prices respond to drivers other than conventional fundamentals: this is the backdrop to the economic and markets outlook for 2021. It is so, because of the impact on the financial world that has been imposed by the health crisis, the COVID-19 pandemic.

The ContinuumFP Outlook 2021

Before analysing the reported outlooks by our trusted sources, the following observations are made as to what 2021 might bring in investment considerations, including factors that are likely to influence performance and that are not just financial. In making these observations, we look to the experiences of years past but acknowledge that they provide no guarantee that performance this year will mirror the performance of those years, even if the ‘events’ appear quite similar!

As we entered 2021, two of the major risks of 2020 were at distinctly different phases of resolution:

- COVID-19 continues to threaten the populations of most Northern Hemisphere western economies, as well as many of the Southern Hemisphere economies of all persuasions; and

- the US election appeared to be a done deal, other than final affirmation of the outcome (and results awaited on the two Senate run-off elections for the State of Georgia).

Brexit was finally resolved, albeit with some further tweaking yet to be done – notably in relation to Financial Services, and the UK can now busy itself with establishing trade deals globally, as well as refining its trade relationship with the Eurozone.

Looking around the globe it is apparent that most governments are focusing on keeping their economies afloat amidst the affects of the coronavirus; with many private sector businesses relying very substantially on stimulus and/ or support packages to survive. This action is giving rise to an interesting development: household debt is falling, and with interest rates low, those without debt are utilising funds they didn’t expect to have available, to invest into equities and other investment products.

The conundrum is that share prices are high even though economic activity is constrained, household debt is low in spite of high unemployment, and house prices are increasing even though new housing construction is at high levels. So, what is going on (and will it continue like this)?

With this backdrop, we perceive a year of continuing growth in investment market valuations as they navigate through periods of volatility: a year when a diversified portfolio allocated to your investment risk profile, regularly rebalanced though aiming to be fully/ near-fully invested (with ‘time in the market’ continuing to be the winner compared with attempting to ‘time the market’) will be the favoured option for informed investors.

Fixed Income is expected to deliver mixed results, with little contribution from sovereign bonds generally, reasonable returns from investment grade (IG) corporate bonds, better returns (though at higher risk to capital) of high yield (HY) bonds – and the best source of secure yield being longer-dated sovereign and IG bonds.

Other assets such as real estate, infrastructure, private equity and unlisted assets all have potential to deliver higher returns, but the risks attached to them need to be clearly understood and be acceptable to the investor wanting to pursue those gains.

Outlook 2021: what do our sources say?

This year we have turned to some long-standing sources and have added a couple of new ones: the list includes: Franklin Templeton, J P Morgan Asset Management, Macquarie Investment Managers, Mercer, Morningstar, RARE Infrastructure.

Our sources are either Asset Managers who are on our current panel of investment managers providing expertise in the placement of investment funds for our clients, Fund Managers whom we are considering using in our client portfolios, or Investment Research houses on whom we rely in formulating our approach to advising investment strategies. Most of them will be recognised by investors generally, but almost certainly by our clients.

Following are summaries and/ or excerpts from articles published by these sources, in which they provide insights as to their outlook for the year ahead. (They have been listed alphabetically, not indicating any other attribute.)

Franklin Templeton –

Cautious, but optimistic as vaccines take effect against coronavirus – but not for many months into 2021 (that will be accompanied by outbreaks and flare-ups from time to time; expect less uncertainty (the bogie-man of investors) over health, political and financial issues; favouring small-cap &/or Value stocks as they rebalance away from overweight allocations to FAANG tech stocks; volatility in US markets likely – and some increased inflation possible. FT is also cautiously optimistic in its outlook for Australia, noting ‘there appears to be agreement across the major political parties on the importance of working alongside the RBA to lower the unemployment rate. We expect broad programs like JobKeeper to morph into targeted support for specific industries and groups of workers to address any unevenness in the labour market recovery. As Milton Friedman famously said, “nothing is so permanent as a temporary government program” ‘.

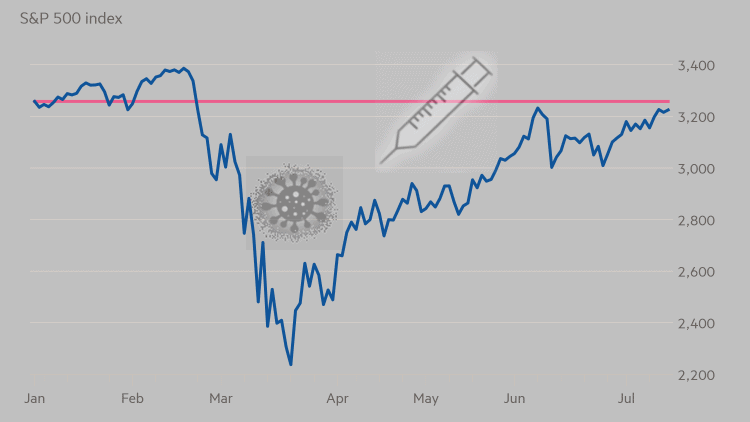

2021 likely to be a year of two halves: the first two quarters showing glimmers of recovery hope as the anti-virus vaccines are administered (especially in the densely populated and highly-affected Northern Hemisphere countries – also emerging from their Winter); the second two, much stronger as the Northern Summer, more wide-spread inoculated populations return to work – and the less-populated Southern Hemisphere countries endure their Winter under the protection of widespread inoculation.

Governments reining in stimulus may see increase in corporate failures, introducing some credit risks for the heavier borrowers amongst them: short-duration paper being the preferred investment.

Interest rates to remain lower for longer, but QE may be wound back as governments try to rein in burgeoning debt to GDP ratios in the face of interest rates rising as economies strengthen.

Environment, Social & Governance (ESG) to play a bigger role in fixed income markets in particular, especially with Joe Biden as President promoting his environmental and social agendas. Indeed, governance at the political level is likely to be an influence on economic and fiscal performance for the coming decade. Diminishing globalisation because of increasing nationalisation will be a part of this playbook and could impede economic outcomes over the coming several years.

Multi-asset portfolios managed to the evolving circumstances should protect investors with diversity, strategy and stock selection. Stock-picking will be an admired and rewarded skill. Active asset allocation based on high-quality fundamental analysis will serve investors well over the coming year and beyond.

Economic performance for 2021 forecast to touch 5.2% as growth compared to 2020 (4.4% retracement!) (a 9.6% turnaround)

Low-growth, low-interest rate environment, likely to increasingly drive investors to equities: and they are likely to take a different approach to the industries they will support – continuing the trend to support the digital transformation, innovation in technology, health care and consumer sectors. When the economics are fixed, travel and leisure sectors are set for a dynamic improvement.

Shares in companies that pick up on the economic trends that are successful and either enable or support the enhancement of fundamentals that drive those companies – theme investing if you will – will be amongst the smaller companies (the Value stocks) to succeed in the year ahead.

Some quotes from the Franklin Templeton paper reviewed:

“2021 will be challenging, but it could be equally rewarding.”

“The challenges of 2020 have highlighted structural advantages and other beneficial secular trends in emerging markets

that bode well for 2021… For so many different markets across this landscape to concurrently offer compelling investment

potential, individually and in aggregate, presents an exceptional investment window, in our assessment.”

“In our view, the timing, efficacy, and adoption of vaccines remains the wild card, as it were. Progress has been highly

encouraging, yet the longer the world waits, the longer it will likely take for a robust economic rebound to get fully

underway.”

J P Morgan Asset Management –

JPMAM publish their Long-Term Capital Market Assumptions annually: whilst they are long-term assumptions, they are published annually reflecting their expectations for the immediate future and confirming/ revising their long-term view.

The use of Alternatives for income and diversification seen to be imperative in balanced portfolio construction – in 2021 as in any year.

From an economic perspective and for a range of explained reasons, JPMAM clarifies that the mid-2020 recession, ‘caused by a truly exogenous shock rather than an endemic issue or imbalance that pushed the economy over a cliff.‘, leads them to believe ‘that economies will bounce back over the course of the next 12 months…’ – and seeing little change in the long-term expectations previously reported (with Developed Markets growing at an average 1.6% over the next 10 to 15 years), Emerging markets growing at an average 3.9% over that term, to give Global growth at around 2.4% per annum.

Climate change considerations will play a role in how economies (and political ‘fortunes’) perform over the coming several years. This year, the group reiterates the call for a review of the standard (US) 60/40 portfolio and introduce more diversification for capital preservation and income returns.

Bond yields and money market/ Cash rates will persist at lower levels, supporting equity prices where yields are clearly higher. (No expectation of central bank action to attain rate normalisation before 2024.)

On a comparison with Bonds, Equities are not fairly described as expensive – and in fact, look attractive at this stage. Return expectations at around 6 to 7% held for publicly listed equities for the 2021 year.

In spite of the consequences for modified use of commercial office space, real estate is perceived to have robust return prospects. ‘Infrastructure and transportation also offer standout returns to investors, with global core infrastructure returns (anticipated at) 6.10%, this year and global core transportation, … at 7.60%.’

‘To maximize returns while acknowledging wide-ranging risks, investors should look at the widest array of assets available and consider an expanded opportunity set.’

Macquarie Investment Managers –

Economically –

The global economy will continue to improve through 2021 as a vaccine is rolled out and policy settings remain easy. Pent up demand (and savings) provides upside growth drivers. Geopolitical risks will remain but at a lower level than throughout 2020. China will be a powerful support for the global recovery. A policy mistake – a premature winding back of monetary or fiscal supports is the biggest threat to the cyclical rebound.

In Australia, the economic recovery will remain underpinned by relative success at containing COVID-19 as well as ultra-easy fiscal and monetary policy. Low rates will boost house prices and other rate sensitive assets – the former despite net immigration remaining a strong headwind for most of 2021. The A$ is likely to move higher. The labour market will remain a constraint to spending despite continued improvement throughout 2021. Weak wage growth will remain a feature for the foreseeable future.

Investments –

Global and Australian equities to both trade higher into 2021. Performance will favour cyclical (laggard) stocks and markets. Low bond yields will drive further inflows into equities as investors chase both higher returns and look to supplement incomes. Small caps meaningfully outperform Large caps as earnings normalization progresses. Value investing should outperform Growth but this will be fleeting. Commodities will also benefit from a cyclical rebound.

From the Fixed Income perspective: Bond yields to creep higher driven by improving economic growth and a near term normalization in cyclical inflation expectations. Central banks will remain dovish through 2021 and beyond as they look for strong evidence that rising inflation is sustainable beyond a cyclical bounce. Credit spreads can tighten further but credit worthiness will be a differentiator for some time to come. Flows will still follow superior yields into credit markets through 2021.

Alternatives (private debt/ equity, real estate, commodities in particular) are seen to have the following prospects: Look for opportunities within private debt where significant yield enhancement is on offer. Private equity returns tend to be strongest coming out of economic slowdowns. Real Estate will perform between bonds and equities. However, sector performance will remain diverse as it balances cyclical tailwinds with structural headwinds. Look for a strong yield pick-up and valuation normalization within residential. Commodities are likely to be mixed over 2021, with oil recovering and gold under pressure. Industrial metal and bulk commodity prices are likely to peak soon, as consumer demand rebalances away from goods and back towards services, and Chinese growth moderates to a more normal pace.

Mercer –

The Economic Outlook –

Expecting the global economy to grow strongly as broad-scale vaccination progresses globally; and Central Banks continue to be supportive for at least the medium-term. The long-term economic effect of the sudden lockdowns, high government debt to fund support and stimulus for both individuals and businesses, and the uncertainty as to how the burgeoning debt to GDP ratio can be normalised is hovering as a cloud over the recovery process.

Global economic contraction during 2020 reduced inflationary pressure and continuing low employment suggests that wage growth – and hence inflation – will remain subdued through 2021.

The economic recovery seen ahead is expected to be uneven during 2021, with higher expectations for pro-cyclical segments and for a selection of companies that are expected to bounce back but have not yet participated in the recovery.

Economic performance is expected to reflect a year of two halves: the first half showing modest – and volatile – growth as Northern Hemisphere economies emerge from their Winter, with increasing numbers of their populace receiving the vaccine; and the second half showing accelerating growth as the less-densely populated Southern Hemisphere economies emerge from their Winter, with significant numbers of their people vaccinated, with these circumstances likely to relieve trade and travel constraints that have prevailed since late in the March quarter of 2020.

The Market Outlook –

Equities:

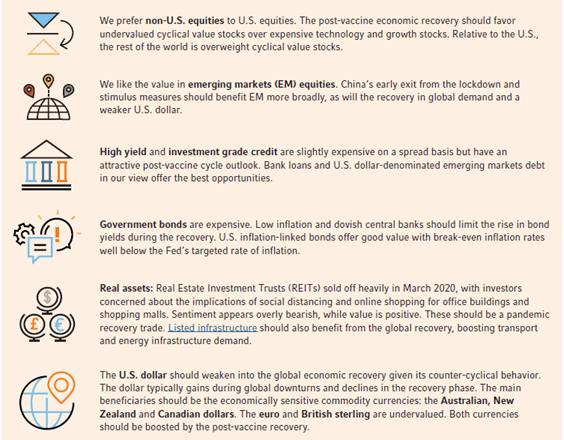

Expectation that equities generally, will do well during 2021 as economic activity becomes more normalised and the low costs of borrowing and of labour persist during this year. Shares in those company sectors mentioned above are expected to perform well in the markets, with particular interest being held in emerging market stocks, aided by the anticipated continuing decline in the US dollar (the USD).

Government Bonds:

Sovereign bonds are expected to remain in a tight valuation range with little to no return available during 2021, at least in the developed economies. These economies are not expected to produce higher yields in the short-term, but the medium term (3 to 4 years hence) will be something to watch.

Credit:

Anticipating that both investment grade (IG) and high-yield (HY) bonds will perform well through 2021 with a slight favouring of HY because of the pro-cyclical environment. Central Banks are expected to continue to stimulate their economies through credit market intervention (participation).

Foreign Exchange (FX):

The USD is expected to continue to deteriorate against the basket of currencies in the face of the declining current account position for that economy and continuing offshore borrowing to support the economic recovery. The Japanese Yen is anticipated to improve against its trading partner block, as is the euro – and potentially, the pound sterling. Emerging Market currencies are also expected to rise against the USD, even if only on the back of the decline in the value of that currency.

Morningstar –

Anticipating 2021 to continue the economic (and markets) upswing of late 2020, but as the year unfolds any uncertainty about economic recovery may see that continuation falter, baulking at the level of risk asset valuations. High levels of liquidity in the markets, provided by central banks and government stimulus packages has chased these valuations to ‘bubble’ levels of concern – too much money chasing too few goods!

Unemployment and underemployment will be a continuing concern during 2021, with the unprecedented job losses during COVID-19 in 2020 unlikely to be fully restored over the course of this year (and as governments pare back their support for consumers) household consumption is expected to be somewhat subdued, constraining economic recovery and corporate profitability.

Investors are perceived to have been forced into risk taking by investing into the riskier market asset, equities, and with income from bonds to be lower for (even) longer, there is an investor perception that there is no alternative (TINA), but this ignores the risk profile of the investments and the effect that could have on those seemingly attractive returns.

RARE Infrastructure –

The outlook for 2021 is promising for Infrastructure, particularly listed infrastructure.

COVID-19 recovery plans by many governments include infrastructure projects, with a view to supporting local economies, stimulating job markets, supporting small- and medium-enterprises – and in some cases, allowing private funding (providing investment opportunities): whilst these projects tend to be accretive to value, they are often missed by the markets.

Climate related polices and trends affecting utilities are inducive to asset growth – and provide a pathway to future earnings, cashflow, and ultimately, dividend growth. As they contribute to lower emissions, certain transport infrastructure projects are also attractive as the global supply chains are recalibrated in response to the disruption brought about by COVID-19.

Russell Investment Managers –

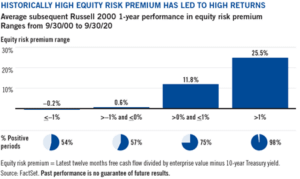

Has a positive medium-term outlook for economies and corporate profits. Being in the early phase of the post-COVID19 recession, extended periods of low inflation and low interest-rate growth are implied – favouring equities over bonds, particularly in the early part of 2021.

“We have a positive medium-term outlook for economies and corporate earnings. We’re in the early post-

recession recovery phase of the cycle, which implies an extended period of low inflation, low-interest

rate growth that favours equities over bonds.”

Andrew Pease, Head of Global Investment Strategy, Russell Investments

Overall, we see the following asset class implications for 2021:

• Equities should outperform bonds.

• Long-term bond yields should rise, though with steeper yield curves likely limited by continued low inflation and central banks remaining on hold.

• The U.S. dollar will likely weaken given its countercyclical nature.

• Non-U.S. equities to outperform given their more cyclical nature and relative valuation advantage over U.S. stocks.

• The value equity factor to outperform the growth factor.

A return to normal by the second half of the year should help extend the rotation that began in early November away from technology/growth leadership toward cyclical/value stocks.

Government Bonds –

Long-term government bond yields are expected to rise as economies recover (although the short-term bond yields should remain constrained for 2021 – and perhaps a little longer).

Equity Markets –

The rotation away from technology stocks towards more cyclical value stocks that commenced in late 2020 is expected to continue during 2021. Because the rest of the world has a more balanced mix of financial and cyclical stocks than does the US S&P500 index, the non-US stocks are likely to be favoured by investors through 2021.

The risks to the markets performing to expectations expressed, include resurgence of the virus resulting in further lockdowns, problems with distributing and administering the vaccine widely enough (and soon enough) – and the risk of investor optimism being too elevated are the most apparent risks for 2021.

ASSET CLASS PREFERENCES

ContinuumFP Advisers are ready to help improve your outlook 2021

The experienced team of advisers at Continuum Financial Planners are ready and available to work with you on your wealth management plan and accumulation strategy: to arrange a meeting with one of the team, phone our office (on 07-34213456), or complete the Contact Us form on our webpage.

Our personalised, professional advice services are appreciated by our clients and we look forward to sharing our philosophy – we listen, we understand, and we have solutions – and our service experience with you.

This post was published in early February 2021: it may be refreshed/ updated from time to time.