Investor uncertainty leads to Market Volatility

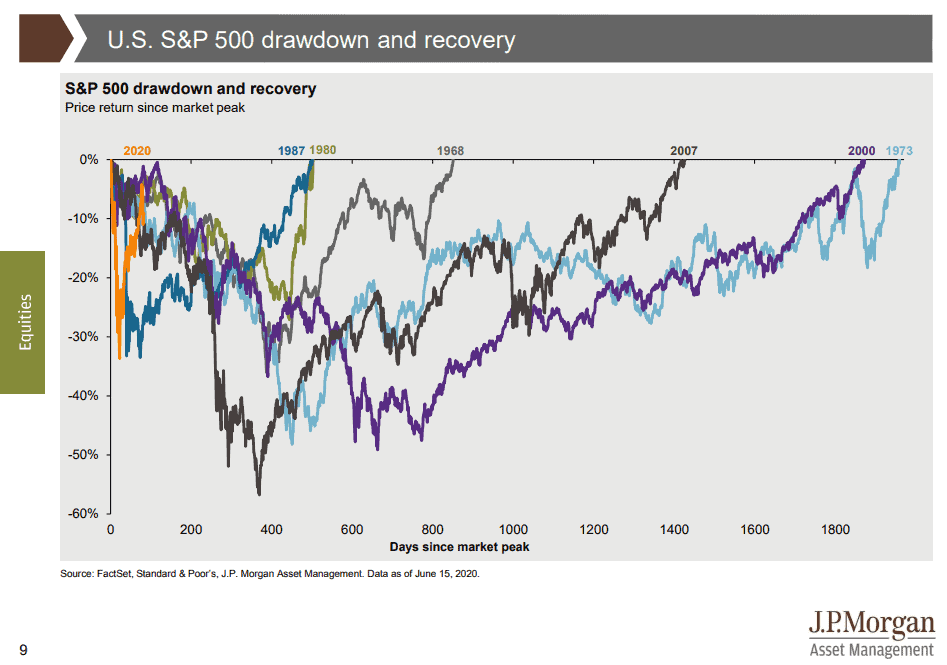

Market volatility is an ever-present feature of investing: it is heightened during times of investor uncertainty. In this post we focus on those days in late March 2020, that saw the U.S. Equities market (as represented on the S&P 500 Wall Street index) decline 29% within a couple of days, followed by a rapid recovery of around 80% of that decline within a couple of weeks (see orange ‘line’ in the graph), that left investors, analysts and strategists perplexed as to what was driving the recovery. During market volatility 2020 that uncertainty accelerated at that time – and in the few months that followed. Most observers understood the rapid decline, none readily understood, nor accepted the rapid recovery – and very few, either expected or were able to explain the recovery that then continued through the June quarter to the point where the whole of the March decline in that index, was recovered by the second week of July!

Explaining Market Volatility 2020

Slowly, and as yet not convincingly, explanations as to why so many missed that this could happen in spite of the widespread lockdowns and disturbingly abrupt levels of unemployment, under-employment and ‘furloughs’, are starting to emerge. And they don’t make sense in the context of investment strategy being for the longer-term.

Some of the explanations that are being analysed and investigated to assist industry strategists understand what actions might be warranted in response to market volatility induced by future events comparable to a pandemic, include –

The market over-sold in panic reaction to the news of the pandemic

Algorithms and index-based investment products caused indiscriminate selling of the good equities with the bad

Monetary policy applied by central banks globally (and almost synchronously), together with government fiscal policies – also globally as the virus spread, but not as closely synchronised – fed enormous liquidity into the economy protecting jobs, businesses and the livelihoods of those impacted by the health crisis – and

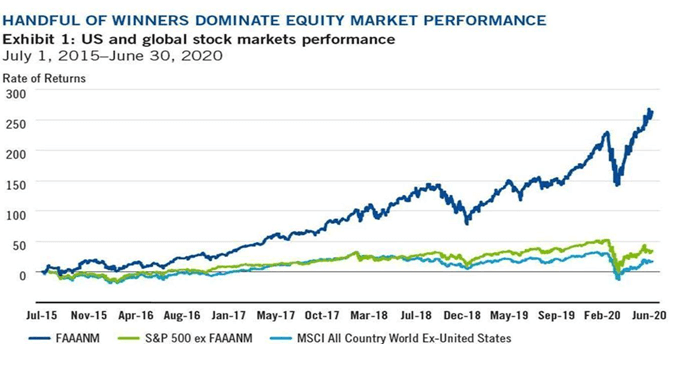

Millennials sitting at home, at their computers, flush with cash (in many cases, more cash than they were previously receiving in their jobs (and in any event, being ‘stuck at home’, spending less)) speculated on the equities market – particularly chasing the so-called momentum stocks such as Facebook, Apple, Alphabet (Google), Amazon, Netflix, and Microsoft (the FAAANM’s).

Whatever the reason, or combination of reasons, proves to be, it is certain that there is no justification for the current valuation of the equities in most economies at present.

Fundamentals of investment tell us that we invest at a known price of an asset, having made a calculation as to the probable income flow (from dividends) and the possible growth in the value of the asset over the time we are prepared/ willing to hold that asset. Breaking those elements down, we make the following observations –

The price we are prepared to pay is influenced by:

- Recent sales in the market

- Demand for the asset/ asset class

- Availability and price of funding for the purchase

- Risks associated with acquiring/ holding the asset

The possibility/ probability of income flowing is influenced by:

- Equities markets participants are not uniform in dividend policy

- Not all dividends are equally taxed

- Dividend income is dependent on the cashflow generated from profits (and the confidence the Directors of the Company have for sustainability of profits and cashflow)

- Capital projects may adversely affect dividend payments

The outlook for growth in the value of the asset is influenced by:

- The industry they operate in being able to stay abreast of technological demands and changing consumer tastes/ wants/ needs

- The state of the economy (both domestic and global) with growth and expansion of economies more likely to benefit the growth in value of assets than are recessions or plateaued economies

- The level of innovation providing efficiencies, generating new products or expanding product/ service offerings

Will the volatility persist

We all recognise that it was critical for governments to shut their borders and encourage their citizens to ‘shelter at home’ when the significance of COVID-19 was finally acknowledged by the World Health Organisation in their declaration of it by name, as a global pandemic. We all see the effects of that action on businesses, especially those ‘service’ businesses involved in the tourism and travel-related industries: and we all now have a greater appreciation for the enormous contribution those industries make to the economy globally. And we all should by now, recognise the unfortunate effects of having to deal with a second wave of contagion from COVID-19. Bearing all of this in mind, none of it makes a case for expectation that this market volatility (2020) event would value of equities at this stage in the management of the virus, as high as before we saw international borders close, cross-border personal travel stopped for most countries, closed factories impacting the supply chain and ‘real’ unemployment multiples of what it was before the ‘declaration of war’ on the virus. Rather, it suggests that market volatility lies ahead for most asset classes – and for some time to come.

Considering the brief overview of the fundamentals of investment outlined above, it is easy to make a case for market volatility 2020 to impact most companies’ shares (and certainly industrial companies and those in the hospitality, tourism and accommodation industries), with decimation, total destruction, or at least, reduced by a significant discount relative to pre-virus values all likely outcomes.

To highlight the analogy, the following chart of the S&P 500 index shows that index in two dimensions: the top line is the index relating to the FAAANM ‘momentum’ stocks mentioned above; the next line down is all of the remainder of the companies forming the S&P 500 index; and the bottom line is all of the global companies constituting the global equivalent of, but excluding, the S&P 500 companies.

At Continuum Financial Planners Pty Ltd (ContinuumFP), we have been consistent in our application of fundamental analysis to our recommendations and in assessing the performance of the managers engaged to invest our clients’ portfolios: those fundamentals at the manager level, include their investment philosophy, their implementation strategy, and their consistency in applying those characteristics (or in our parlance, whether they are ‘true to label’). Where clients have engaged us to provide Ongoing Adviser Service, our annual review is when we formally report to them on our findings in relation to the managers in their portfolio – and during times such as we have been experiencing in the period to date since the declaration of the pandemic, our review of managers is under constant scrutiny with the intention that any concerns we have for clients who have so engaged us, will be drawn to their attention when the concern is identified, regardless of when their review is formally scheduled.

This article is being published at a time that we have been indicating to clients (for a number of weeks now) will be a testing time for markets: it follows on from the distributions from fund managers for the June 2020 quarter; and the reporting season for that quarter is well advanced. Part of the process of reporting includes projections by companies as to what they forecast the coming quarter/ year will be – and this year, will also include reporting on the effect of COVID-19 on their operations for the 2020 financial year and its anticipated effect for the coming year.

There are ramifications of making these forecasts – and of not making them. If the forecast is anything but positive, the company’s share price would be expected to decline (on the basis that future earnings will be less, resulting in reduced dividends); and if the opportunity to provide a forecast is declined, the market concern would be that the outlook is so uncertain, that to continue to invest in that company will be at a higher risk.

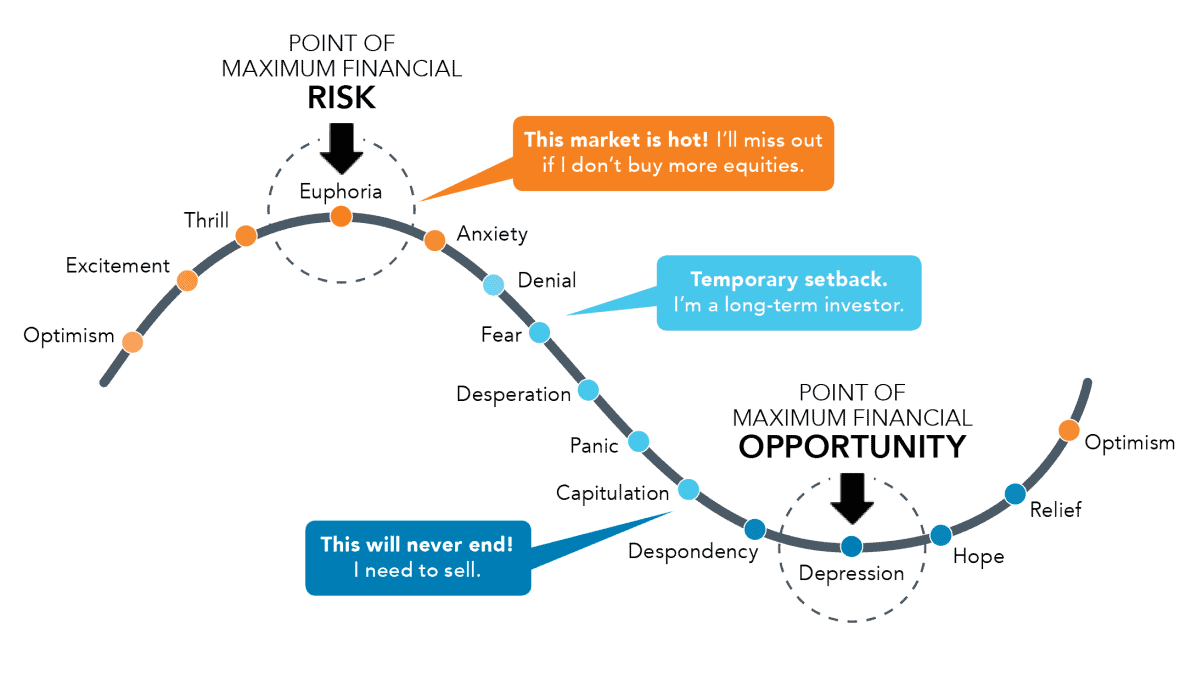

As an investor, the expectation is that a timeframe will be able to be adhered to – and where equities (company shares) are concerned the timeframe generally needs to be five or more years: daily, short-term fluctuations in values should be seen as ‘of interest’ but not necessarily immediately ‘of concern’. As an investor, the ability to be patient and to ‘hold one’s nerve’ will be important when fluctuations are taking place in share markets (and being expressed on the evening news in the context of the market having fallen by billions of dollars for the day): being confident in the strategy set for your investment and staying with it. The ‘lot’ for a day trader or speculator in market assets is quite different: for them, market volatility can be exciting and profitable (or depressing and loss-making) on a regular basis.

The investment philosophy of the advisers at ContinuumFP – and of the fund managers/ researchers we engage to manage your investments – will protect you from the worst consequences of the investing according to emotions: we continue to promote investing to a strategy based on SMART goals and with due consideration to individual circumstances, personal and financial.

A strategy to avoid confusion from uncertainty

The experienced financial planners in the ContinuumFP team are assisting clients to understand the ramifications for their investment portfolios from the market volatility 2020 events and working with them to optimise their future outcomes: to join them in reviewing your financial goals, investment objectives, and wealth management strategy, contact our office to arrange a meeting with one of our team. You can call on 07-34213456; or use our website Contact form – your request will be promptly attended.

(This article posted on 30 July 2020)