Investment diversification – sharemarkets

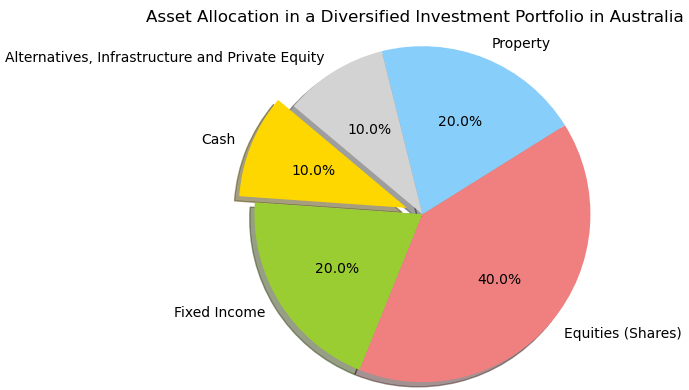

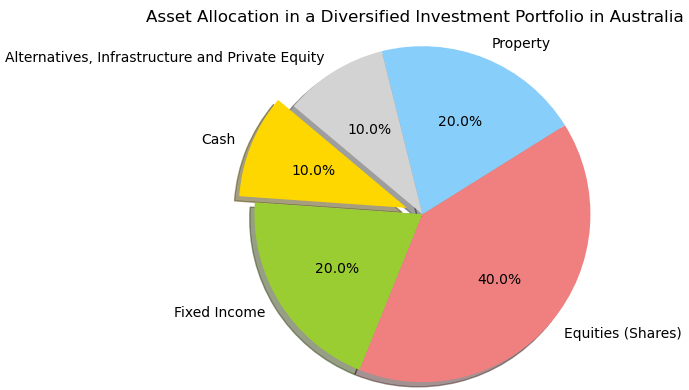

Investment assets Investment diversification is a strategy that has well supported wealth accumulators for many decades. In normal circumstances, the

Investment assets Investment diversification is a strategy that has well supported wealth accumulators for many decades. In normal circumstances, the

Are negative gearing and capital gains tax discounts sustaining your investment success? An investment success contributor for many ‘ordinary’ Australians,

Residential property investment is popular with Australians: this popularity is based on the ‘urban myths’ that property prices increase consistently

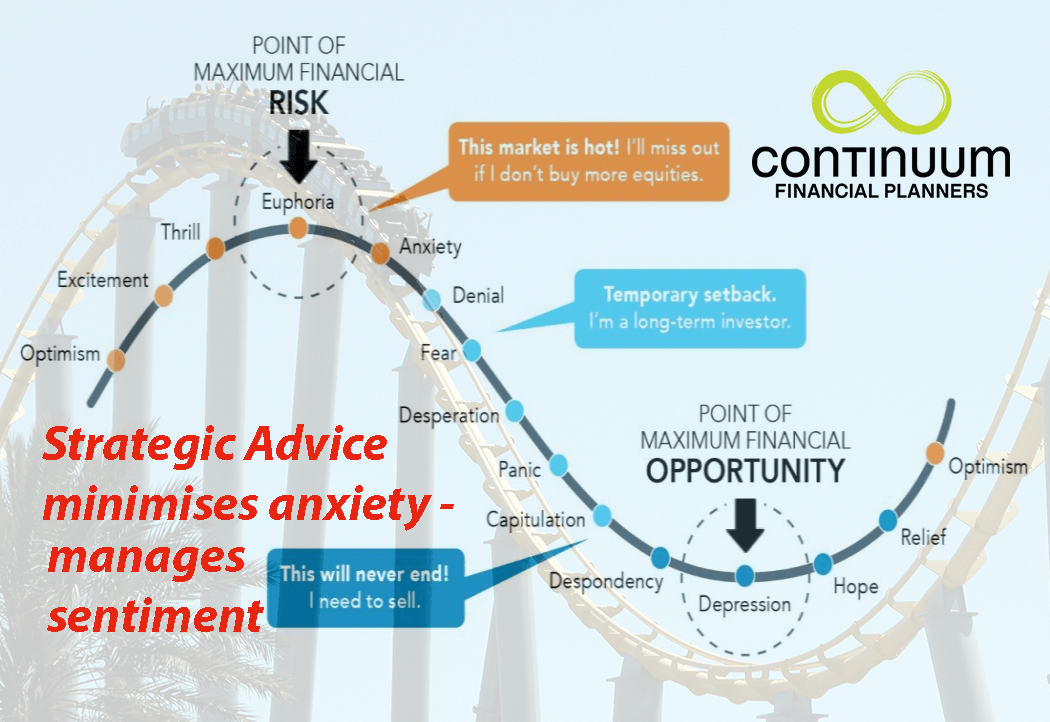

The Market and Economic Outlook 2015 The market and economic outlook 2015 was prepared to provide our investor clients with

Intergenerational Wealth Transfer – A Crucial Estate Planning Issue In the coming decades, we will witness one of the most

Tax refund wisdom enhances wealth management Tax refund wisdom is exercised when you use your refund effectively. You should also

The financial year end checklist 2013 contains tax-effective strategies that may be effective for you – depending on your personal

Your wealth management team should build around your financial planner, the trusted adviser and hub of your wealth management decision-making

Incremental wealth accumulation is a slow but sure way of building an investment portfolio to meet future financial needs. Small

What tax is payable on childrens investment income (minors)? As recipients of income in Australia, childrens investment income is taxed.

Level 1

2042 Logan Road

Upper Mt Gravatt QLD 4122

07 3421 3456

Paul Ashton & Associates – CPAs

2 Alice Street

Warwick QLD 4370

07 3421 3456