Dollar cost averaging proves that ‘Slowly but Surely may well Win the race’

Dollar cost averaging has proven itself effective in the continuum of market cycles. The strategy regularly demonstrates that investment success comes with patience: but what is it? – and why does it work?

What is it?

Dollar cost averaging (DCA) is a process of investing a similar amount at regular intervals into a single portfolio. An example of this is say, $100 per month into a bank passbook account. In this instance you will mainly benefit from ‘the magic of compounding interest’. When investing into other asset classes such as –

- shares or managed funds,

- fixed interest,

- property and

- other growth assets –

you will benefit from both the averaging of the purchase price – and the compounding of earnings.

DCA is a tried and well-tested financial wealth management strategy.

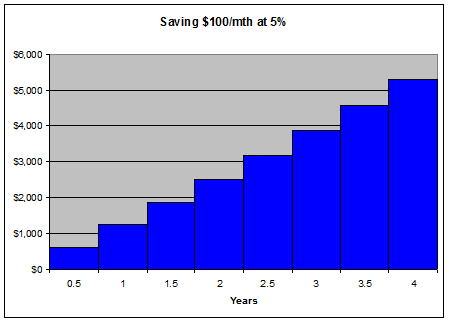

Getting back to the simple example above though –

- having run the savings program for a few years – say

- at $100 per month to a passbook account earning 5% per annum1 credited monthly –

we accumulate $5,000.

Now we feel confident to invest some of the saved money. (We may decide to keep a portion for a rainy day – or some opportunities!)

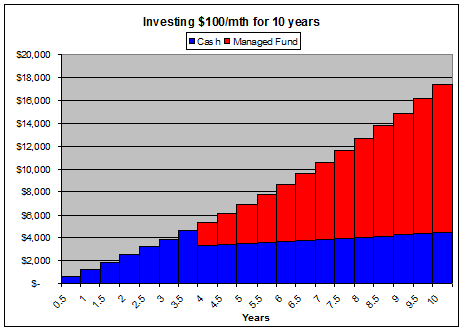

… and so we continue to ‘invest’ $100 per month – but now with a change of asset. Now we add a diversified, multi-manager managed fund account started with say $2,000 from the original account. (For purposes of the exercise we assume a Balanced Risk Profile and –

- anticipate a 30% tax effective income distribution of 4% p.a., paid quarterly; and

- capital growth at an annual average of 5% p.a.

(Note that negative growth of accumulated capital will occasionally be experienced.)

Ten years from starting out on this process, we have accumulated $17,380 and have hardly missed the $100 per month. The likelihood is that the income from which we invest, will increase throughout this period.

Why does it work?

Without running an expose on investment theory, the quick summary of the success of this story is that –

- we make the investments consistently over a range of market conditions, so that

- some of the funds are invested at a higher average cost,

- some are invested at average cost – and

- the majority are invested during average market conditions …

BUT the real secret of this success is the consistent investment of an affordable amount throughout a term regardless of other circumstances and situations – that is, we don’t run hot and cold with whether we will invest or not! [There is material available that will show that investors who try to time the market often miss critical days – or times of day – and in doing so, miss significant value. Dollar cost averaging works through all this and brings consistently improved outcomes for the patient investor.]

This strategy can be useful for a number of financial objectives (including some of those in our article ‘Planned investment utilising available resources‘; and think about your regular superannuation contributions).

Would you like to experience investment success?

You can experience investment success through a strategy as described above – and members of your family can also benefit even if at a lesser level of commitment. To do so, meet with one of our experienced financial planners. You are welcome also, to refer a family member or friend to have such a meeting. The Continuum Financial Planners team work to the mantra that –

‘we listen, we understand and we have solutions’

To make an appointment with one of our team –

- phone our office on 07 34213456; or

- at your convenience, use the linked Book A Meeting facility.

1 The current bank savings interest rate will depend on the type of account you select – and the market for cash rates at the relevant time. This figure has been selected as a longer-term average and for ease of understanding: the principle is the same regardless of the rate of interest.

(This article was originally posted by us in July 2010. It has occasionally been refreshed/ updated, most recently in February 2025.)